“I had so many difficult conversations with sellers in 2018 that I literally had to go to a voice doctor,” said Compass broker Brian Lewis, adding: “It was a tough year of real estate.”

The voice doctor suggested Lewis use a humidifier and drink less caffeine to keep his vocal cords from drying out as he worked on getting sellers to the right price. Drawing on his years as an actor, Lewis now does vocal warm-ups in the shower every morning and has switched over to herbal tea.

Lewis was one among the many Manhattan brokers for whom 2018 was a year of discounts and difficult conversations. Inventory was up, sales volume was down, listings sat on the market, and prices stayed stubbornly high.

And as the market shifted further in favor of buyers, it fell to brokers to deliver the bad news to sellers.

But landing listings — at least viable ones priced right — is the only way to make a sale.

This month, with that in mind, The Real Deal brings you its annual listings ranking, designed to determine which New York City brokerages have been marketing the greatest dollar volume of for-sale properties. It also provides a window into the batch of the next potential transactions.

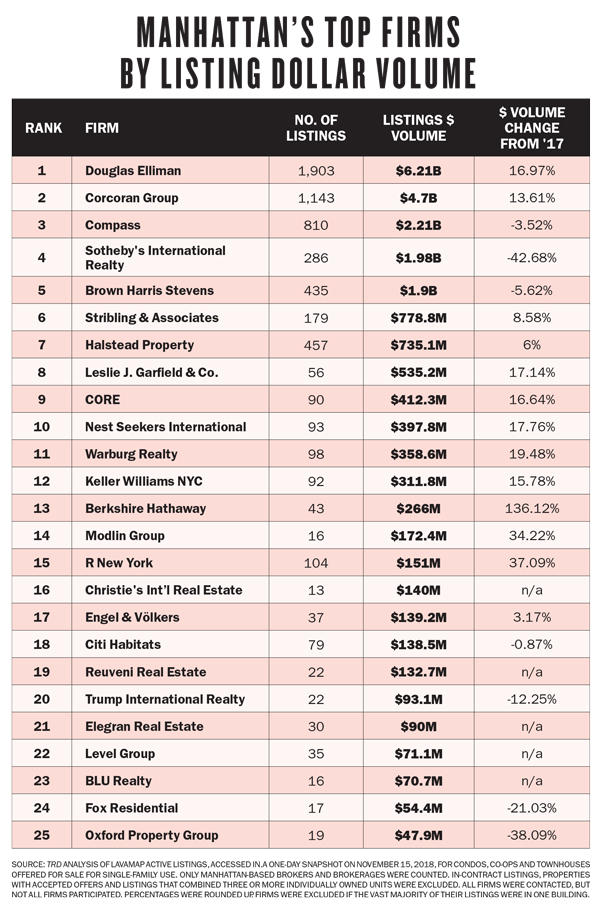

The one-day November snapshot found that, collectively, the top 12 brokerages had 5,642 listings valued at $20.53 billion. The top 25 firms, meanwhile, had a combined $22.1 billion in listings.

The listings were pulled by real estate data firm LavaMap and analyzed by TRD. Then they were shared with the firms, which were given an opportunity to provide any additional properties they were representing.

In this already data-driven market, sources said, brokers had to come prepared with more market and comp intel than ever to convince sellers to drop the charade of aspirational pricing.

Lewis said pulling comps varies based on the kind of property, but always starts on the micro level and moves to the macro. For a prewar co-op, for example, “You start in the same line, then the most recent sale in your line, then in your building, then in the apartment most similar in your building, then go down the block to similar buildings, then you go macro.”

In addition, he said, researching a home in a changing market is particularly challenging.

“I always have to ask myself: Is this before our little avalanche or after?” he said.

Real-time data has, indeed, become more important than ever for brokers negotiating listing prices, said Juliet Clapp, executive director of sales for Halstead Property’s West Side office, which has roughly 200 agents.

Closed sales data is “old information” and not enough to make a valid case to sellers about dropping their price, she said, noting that those stats are a reflection of where the market was months ago, when the units went into contract.

Agents need to provide sellers with up-to-the-minute information on the contracts being signed at similar properties now.

“You have to walk in so prepared,” Clapp said of agents, “You have to study the market. It’s almost like you’re studying for your MBA.”

Who’s marketing the most?

Once again, Elliman came out on top of this year’s listings ranking.

The firm had 1,903 listings valued at $6.21 billion. That was up from 1,187 listings valued at $5.31 billion in November 2017. And like last year, the Corcoran Group placed second. The brokerage had 1,143 listings with a total value of $4.7 billion — up from 871 listings valued at $4.13 billion last year.

The venture-backed firm Compass, the industry’s great disruptor, jumped two places to clock in at No. 3 with 810 listings, up by about 15 percent. But despite the increase in the number of listings, the overall value of Compass’ for-sale properties fell to $2.21 billion from $2.9 billion.

Rounding out the top five were Sotheby’s International Realty (with 286 listings valued at $1.98 billion) and Brown Harris Stevens (with 435 listings valued at $1.9 billion.)

The remainder of the top 10 included Stribling & Associates (with $778.8 million in listings); Halstead (with $735.1 million); Leslie J. Garfield & Co. (with $535.2 million); CORE (with $412.3 million); and Nest Seekers International (with $397.8 million).

The remainder of the top 10 included Stribling & Associates (with $778.8 million in listings); Halstead (with $735.1 million); Leslie J. Garfield & Co. (with $535.2 million); CORE (with $412.3 million); and Nest Seekers International (with $397.8 million).

With a few exceptions — such as Sotheby’s, Compass and BHS — most of the firms on the ranking saw their listing dollar volume rise since TRD’s last ranking.

Corcoran CEO Pam Liebman noted that because listings are “taking longer to sell,” they’re sitting on the market and increasing dollar volume across the board.

The overall jump in inventory is very much evident in the numbers.

According to a recent Elliman report, Manhattan had 6,092 active listings at the end of 2018 — up from 5,451 at the same time in 2017. That’s despite the fact that many developers have pulled new condo inventory off the market or are waiting to strategically release units so as not to flood the landscape.

And with 20,000 new apartments expected to hit the New York City market in 2019 — 6,342 of them in Manhattan — inventory is only expected to increase.

While brokerages have for the last year or two been saying that overpriced listings are not worth taking on, this new influx of product is further driving that point home.

“We want the listings that sell,” said Diane Ramirez, CEO of Halstead. “We’ll even pass on a high-end, or any price level, if the seller is still looking for those aspirational prices.”

Listed and unlisted

While listing a property publicly and blasting it out to the brokerage world (and press) can generate buzz, some of 2018’s biggest residential deals were unlisted.

In March, an unknown buyer paid $25.6 million for disgraced producer Harvey Weinstein’s Greenwich Village townhouse in an off-market deal.

That same month, an unlisted unit at One57 sold for $21.5 million. (It should be noted that TRD only included units that were publicly listed on this ranking, so these properties were not included in companies’ totals.)

While access to so-called whisper listings is usually tightly controlled by the brokerages that hold them, that market is starting to reach a wider group of players.

In July, TRD reported on RealAgentz.com, a website launched by former Keller Williams agent Parish Pradhan and his business partner Daniella Rinaldo.

Their goal is to provide a platform for off-market listings — which they call “future listings” — alongside properties on REBNY’s Residential Listing Service (RLS).

Although Pradhan is not a REBNY member, he said he adjusted his model to comply with REBNY rules, which state that listings have to be accessible to all of the group’s members. As of late last month, the nascent site had 74 listings.

Traditional firms are also thinking about how to use new technology to sell unlisted properties.

Traditional firms are also thinking about how to use new technology to sell unlisted properties.

Kathy Korte, president and CEO of Sotheby’s in New York City, said her company builds password-protected websites for some of its clients in the luxury market who aren’t ready to publicly list their properties.

In March, REBNY’s residential board of directors considered cracking down on whisper listings and drafted a proposal that would have banned members from accepting off-market listings. But it scrapped the plan after blowback from some of the city’s biggest residential firms.

The battleground for who controls the marketing of for-sale properties was on display last month when StreetEasy rolled out another program to monetize listings.

The art of the price chop

In this difficult environment, how did brokers get deals done?

Leslie J. Garfield’s Jed Garfield, whose firm specializes in luxury townhouses, worked with the owners of 63 East 82nd Street, a seven-bedroom townhouse on the “Gold Coast” between Madison and Park avenues, to find the right price.

It was originally listed in 2017 for $17.5 million. Garfield convinced the sellers to lower the price, and they eventually inked a deal for $13.3 million in February 2018.

“It was finally at a price that was basically below replacement cost,” he said. “You couldn’t renovate a house on that block for that price. So it really did represent value.”

And that price cut was just one of many. The share of sales in Manhattan with price cuts reached a high of 28 percent in 2018’s second quarter, according to StreetEasy.

Compass’ Lewis landed one of the biggest resale deals of 2018, representing the buyer of Unit 77 at One57, which sold for $42 million in cash in September to an anonymous buyer. Compass shared the listing with Elliman.

The four-bedroom apartment — which the unnamed seller originally bought for $52 million — was first listed for $49 million in 2017 and subsequently cut to $44 million. Lewis then convinced the seller to lower the price even further, a task he noted is far easier for the second broker on a listing than the first.

Meanwhile, last month TRD reported on the biggest price cut in New York City history: a penthouse at One Beacon Place owned by billionaire hedge fund mogul Steve Cohen.

After reducing the price a painful eight times, the unit has now been relisted at $45 million. Elliman is marketing the property.

While that discount came in 2019, it was par for the course in 2018, too. “If you weren’t stealing it, you weren’t buying it,” Garfield said.