When News Corp and 21st Century Fox expanded their Midtown office footprints to a combined 1.2 million square feet in January 2017, it kicked off a hot streak for the Manhattan leasing market. And neither the market nor the brokerages that negotiated those blockbuster deals looked back last year.

For CBRE — which represented News Corp and Fox in those dual deals — and Cushman & Wakefield, which represented the owners of 1211 Sixth Avenue, the lease expansions (and extensions) were the first of many biggies in a year when mega transactions played an outsized role.

“I wouldn’t have predicted at this time last year that we would’ve had as strong a year in the market as we did,” said powerbroker Mary Ann Tighe, CEO of the tri-state region for CBRE.

This month, with that in mind, The Real Deal pored over hundreds of deals and ranked the top players in the Manhattan office leasing space — the biggest driver of fee revenues for the largest commercial brokerages.

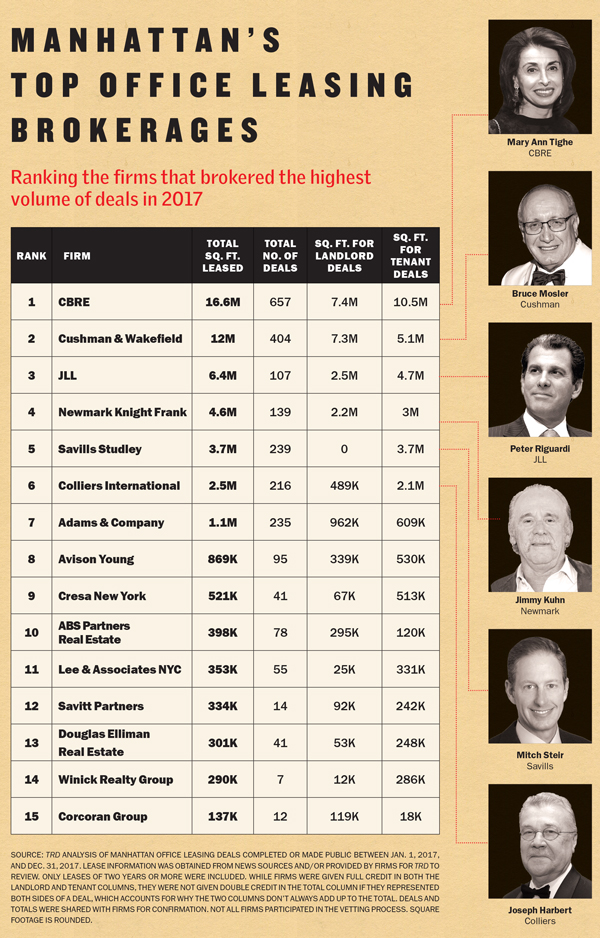

CBRE once again took the top spot, racking up about 16.6 million square feet worth of Manhattan deals in 2017 on both the tenant and landlord sides. That was up from 14.5 million square feet back in 2014, the last time TRD published this ranking.

Cushman, which leased 12 million square feet, clocked in at No. 2. It was followed by Chicago-based JLL (with about 6.4 million square feet), Newmark Knight Frank (fresh off its IPO with roughly 4.6 million square feet), tenant rep firm Savills Studley (with 3.7 million square feet) and Colliers International (with 2.5 million square feet). Rounding out the top 10 were Adams & Company, Avison Young, Cresa New York and ABS Partners Real Estate.

In all, Manhattan saw 36.8 million square feet of space leased up in 2017, including both new leases and renewals, according to CBRE. That was up 17 percent year over year — and the highest deal volume since 2014, which logged 38.8 million square feet. And 2017 was the second most active year since 2006 for new leases, with 28.5 million square feet of those deals inked.

That strong level of activity was thanks to an unusual number of big deals.

Activity for blocks of 50,000-plus square feet exceeded the average for the past five years, according to CBRE’s data. Deals greater than 250,000 square feet did extraordinarily well, too. Tenants inked 10 new mega leases for more than 250,000 square feet in 2017, double the number in 2016 and outperforming the five-year average by nearly 90 percent.

Activity for blocks of 50,000-plus square feet exceeded the average for the past five years, according to CBRE’s data. Deals greater than 250,000 square feet did extraordinarily well, too. Tenants inked 10 new mega leases for more than 250,000 square feet in 2017, double the number in 2016 and outperforming the five-year average by nearly 90 percent.

But it’s already clear that it’s going to be difficult to replicate 2017’s performance this year. Brookfield Property Partners’ chair, Ric Clark, said as much last month at a luncheon hosted by the Real Estate Board of New York, though he noted that tech companies are growing and financial services firms are expanding.

“I think it will be a good year, but I don’t know if we’ll be at the same levels as last year,” he said.

Moving the needle

The companies with the bandwidth to handle large transactions — think global giants —dominated in 2017.

For example, in addition to brokering the News Corp and Fox leases, CBRE also represented Bank of America on 700,000 square feet over three deals — two in Midtown and one in Lower Manhattan. And it’s the leasing agent on several buildings at both Hudson Yards and the World Trade Center.

“For us to move the needle, we have to do it with these larger-scale deals,” Tighe said, referring to CBRE’s annual leasing total.

That marks something of a shift from 2014, when even the big firms were focusing on nabbing smaller deals. But this year, deals of 50,000 square feet and under were actually down compared to long-term averages.

Either way, Tighe said, the sheer size of her firm gives it a competitive advantage.

“If four people come in to present to a [landlord or tenant], you’re going to have a very hard time actually parsing the differences of those firms. The harsh reality is that size matters in New York City,” she said. “How do you serve that market with under 200 brokers? I honestly don’t know.”

Out of the top 50 deals last year, CBRE worked on 31 of them — either on the tenant or landlord side. Cushman, meanwhile, was on 17, while JLL was on 16.

Cushman’s jump to the No. 2 spot on the ranking represented something of a shakeup that can be directly traced back to its merger with the commercial brokerage DTZ in September 2015. In 2014, Cushman ranked No. 4 while DTZ placed No. 7. But their combined firepower has clearly been effective.

Cushman’s Bruce Mosler — the agent on Brookfield’s mega Manhattan West development — said tenants looking for large blocks of space were eager to get deals done in 2017. That was even true for companies with substantial time left on their current office leases, he said.

“[Corporate] profitability drove optimism, and that directly resulted in take-up, especially at new developments,” Mosler explained. “That allowed the bigger users to look forward, and in looking forward make larger commitments that are further out.”

Large corporate tenants were, indeed, emboldened by a strong economy and encouraging employment gains. The Standard & Poor’s 500 index posted a total return of 22 percent year over year in 2017, according to Bloomberg. That was the best showing since 2013.

And many took advantage of the significant amount of new — and renovated — office space available.

Tenants inked 3.7 million square feet worth of deals last year in buildings constructed after 2010, according to Colliers. That was up significantly from 2.9 million square feet in 2016 and 1.8 million square feet in 2015.

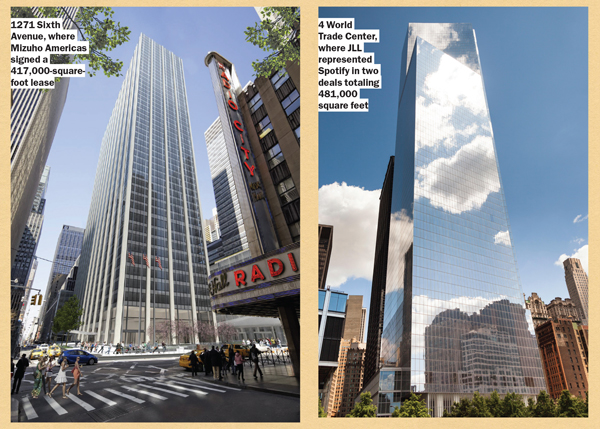

Tighe noted that in 2017, landlords who poured money into capital improvements were rewarded with big tenants signing leases, while those who didn’t renovate fell behind. She cited the Rockefeller Group, which is in the midst of a $600 million renovation of 1271 Sixth Avenue, the former Time-Life Building. The landlord landed Mizuho Americas.

Another reality of last year was less poaching. Unlike the investment sales and retail worlds of late, the poaching scene has been relatively tame in Manhattan office leasing.

Cushman, however, was one of the few firms that snapped up brokers from rivals.

In 2017, it lured industry veteran Patrick Murphy from CBRE and Eric Thomas, a former partner at Cresa.

Hey, beautiful

Finding and securing large office space is often a multi-year process. That means that 2017’s biggest leases are the result of work started earlier than last year.

And while relationships will always matter in real estate, with more tenants in the market and more new development inventory in the mix, that process has increasingly been starting with a so-called “beauty contest” in which a tenant or landlord issues a request for proposals. Those RFPs often ask brokers to submit their most competitive commission fees.

Cushman, for example, won the assignment to lease Aurora Capital Associates’ 40 Tenth Avenue building through a competitive process.

Cushman, for example, won the assignment to lease Aurora Capital Associates’ 40 Tenth Avenue building through a competitive process.

And HNA Group took pitches from the top firms last year to lease its 1.7-million-square-foot 245 Park Avenue, but that process has been put on hold as the Chinese firm looks to sell the building under pressure from its government. (Avison Young, one of the firms gunning for the job, claimed that it brokered 1.4 million square feet in 2017, but TRD was only able to confirm 869,000 square feet. The firm said it executed many confidential deals that TRD did not have access to.)

Still, while competitive beauty contests are on the rise, sources said most major landlords hand out assignments based on their relationships — unlike the tenant side, where more business is generally up for grabs.

That’s not to say that brokers are not getting repeat business based on longstanding relationships.

For example, Cushman’s Jonathan Serko represented the union 1199SEIU in July in a 180,000-square-foot lease at George Comfort & Sons’ 498 Seventh Avenue. Serko first represented the mega health care union in 2001, when he was on a team that negotiated a 38,000-square-foot lease for the fund.

Likewise, Cushman’s Michael Burgio represented longtime client New York-Presbyterian Hospital. Last year, Burgio represented the hospital in a 479,000-square-foot leasehold-condo deal at RXR Realty and Walton Street Capital’s 237 Park Avenue.

But many of last year’s top deals were thanks to brokers poaching new business.

JLL, for example, represented Spotify at 4 World Trade Center in two deals that totaled 481,000 square feet. Savills previously represented the music streaming service at RXR’s 620 Sixth Avenue. Savills declined to comment on the deal.

JLL also negotiated Amazon’s 365,000-square-foot deal at 5 Manhattan West. Cushman had represented Amazon in the past, but sources said it started looking for a new brokerage after a pair of Cushman brokers fought with each other over their split on a commission they earned from a previous deal with the e-commerce giant. A representative for Cushman declined to comment.

Stephen Siegel, CBRE’s chairman of global brokerage, said winning business often comes down to fees — even if firms don’t want to own up to offering discounts.

“Every firm does it, and every firm claims they don’t,” he said. “We all compete. The days of ‘here’s our commission schedule’ are long over.”

And make no mistake, leasing commissions are a huge portion of all of these commercial firms’ bottom lines.

At CBRE, for example, leasing accounted for $2 billion worth of fee revenues for its Americas region in 2017, according to the company’s financial disclosures. That was nearly 38 percent of its $5.43 billion in total fee revenues for the year — the largest single contributor.

Meanwhile, at JLL, leasing made up roughly 47 percent of $3.16 billion in fee revenues for the Americas region last year, and at Newmark it was nearly 39 percent of $1.59 billion in revenues.

For its part, JLL made news when it represented BlackRock in a monster 847,000-square-foot lease at 50 Hudson Yards. The firm was given credit for that deal on TRD’s ranking and by other public sources, but some told TRD it actually didn’t broker the deal and that BlackRock largely negotiated the deal directly with the Related Companies, the developer.

JLL, they said, acted as a consultant, most likely earning a flat fee that was significantly smaller than what it would have hauled in from a brokerage commission.

“Related’s very good at reaching out and contacting the C-suite of any firm that’s possible for Hudson Yards,” said a top broker at another firm. “They get access because they have big banking relationships. Between Steve Ross and Jeff Blau, they can get to most CEOs or the C-suite.”

Early bird gets the worm

With so much available space on the market last year, many said tenants had the upper hand in negotiations.

Concession packages started to pick up in late 2016, and in 2017 landlords were giving tenants an average of $89 per square foot in tenant-improvement allowances, according to CBRE. That was up 14 percent from the previous year.

Tenants seized on those sweeteners.

Mizuho Americas’ 417,000-square-foot lease at 1271 Sixth, signed in June, offers just one example. The 2.1 million-square-foot tower’s top-down renovation is one of the biggest in the city and has a goal of attracting tenants in the wake of Time’s departure to Lower Manhattan.

“We engaged the market at a very opportune time with an A+ credit tenant,” said Savills CEO Mitch Steir, who represented the Japanese bank’s local arm with colleagues Matthew Barlow, Steve Berliner and David Goldstein.

Steir noted that the landlord “had an entire building of nearly 2 million square feet to rent.” That, he said, gave the tenant a strong negotiating hand. “First movers should, and usually do, get rewarded,” he said.

At One Soho Square, Stellar Management is combining two buildings it bought in 2012 for $200 million into a hip office space. Early last year, the landlord leased 86,000 square feet to MAC Cosmetics. Then it closed out the year with a deal for another 107,000 square feet with Flatiron Health.

While startups have been driving the market for several years now, in 2017, financial service firms actually overtook technology and media companies in leasing activity, inking 8.8 million square feet, according to Cushman. So-called TAMI — tech, advertising, media and information — tenants inked 5.7 million square feet.

Newmark Executive Vice Chair Brian Waterman, who is heading up the team leasing One Soho, said that with so many tenants in the market looking to do deals, agency brokers have to tailor their pitches to tenants’ brands.

“What worked six months ago is not necessarily going to work today,” he said. “It really needs to be what’s going to happen in the future, not what happened yesterday.”

Repeat not likely

While 2017 was a blockbuster leasing year, that momentum has already lost steam.

Through the first two months of 2018, leasing activity stood at 5.5 million square feet, down 21.6 percent from the same time period last year, according to Colliers.

That’s partly due to a drop-off in those large deals.

By the end of February 2017, Manhattan had already nabbed six new leases or renewals above 250,000 square feet. But through the same time this year there were just two: Simon & Schuster’s 300,000-square-foot renewal at 1230 Sixth and JPMorgan Chase’s 440,000-square-foot lease at L&L Holding Company’s 390 Madison Avenue.

Still, the Trump administration’s tax overhaul — which has been blasted by many on the residential side of the market — is a boon for corporate America. And that could bolster confidence throughout the year.

Nonetheless, while the city continues to add new jobs, the rate of job growth has been slowing over the past two years. And with the city’s unemployment rate near 4 percent, the tight market could make it more difficult for corporations to add jobs at the rate that would justify the big moves seen last year.

In addition, Manhattan is expected to see more than 10 million square feet of new construction and renovated space hit the market this year, according to JLL.

So beating last year is going to be a tall task. As Cushman’s Mosler put it: “To repeat ’17 may be a challenge, given how extraordinarily outsized the requirements were.”