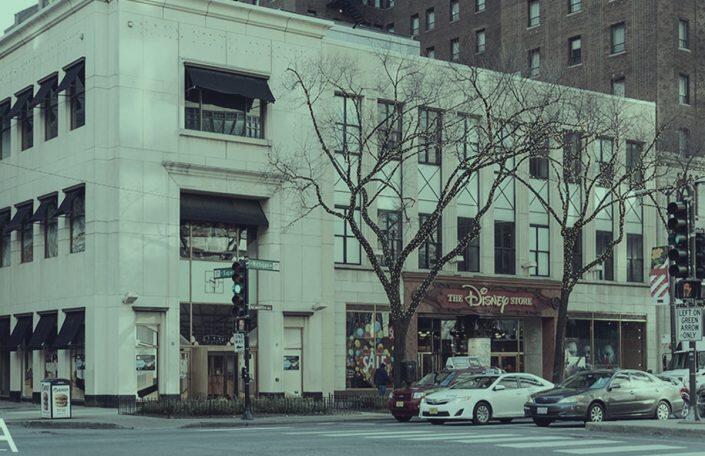

Directly across the street from Neiman Marcus and close to a Saks Fifth Avenue and Tiffany, 717 N. Michigan Avenue occupies a prime corner on the Magnificent Mile.

It now also stands completely unoccupied.

All 62,000 square feet are empty after the last remaining tenant, the Disney Store, flew off, vacating its 7,000 square feet.

Landlord Acadia Realty Trust paid $104 million for the four-story building in December 2016, investing in an iconic corridor that had already seen retail departures amid a changing landscape. With Disney’s exit last month, the property joins more than a dozen empty storefronts along the stretch.

Now, the New York-based real estate investment trust must pivot, and it will likely divide the four-story building into smaller chunks to accommodate additional tenants, COO Christopher Conlon said.

Other landlords are doing the same along the Mag Mile. As other department stores and flagship centers cut space or exit entirely, landlords are looking to reinvent a district by repositioning their properties. That retail shift hasn’t been sudden: When Acadia acquired 717 N. Michigan Avenue, three years had already passed since Saks Men’s Store had exited its 36,000 square feet at the property.

Conlon maintains that Michigan Avenue will remain a “dominant shopping corridor for the entire Midwest and certainly for Chicago but not with conventional retail.” Some of it will be converted to alternative uses that he called “quasi retail” or entertainment-type venues.

That change is already in the works, as entertainment concepts and experiential venues are considering potential sites there to ink deals at the vacant spaces, Crain’s previously reported.

At Acadia Realty’s 717 N. Michigan, the Disney Store just exited, leaving the building vacant. (Acadia)

The Disney Store was the sole tenant remaining at Acadia’s retail corner. It had been there since 1999, but it was operating on short-term leases. In March, Disney said it planned to shutter dozens of brick-and-mortar stores nationwide. Its announcement to close the Mag Mile location by Sept. 1 came just days before, and it coincided with Target’s news that it would add more than 100 Disney shops to its stores across the country.

Despite 717 N. Michigan’s years of near-vacancy, Conlon said he anticipated announcing new tenants by the beginning of next year. He did not provide details.

Acadia, he said, was “very, very pleased with the current level of interest we’re seeing” from prospective tenants. He said, “Michigan Avenue has its challenges, but for real well-located real estate, those challenges are less. And we have that.”

But the issues include a North Michigan Avenue vacancy rate now at 26 percent, Crain’s reported, citing Cushman & Wakefield. Recent closures include Forever 21, Tommy Bahama and Uniqlo. Earlier this year, the Gap and Macy’s announced they would shutter their locations at Brookfield’s Water Tower Place.

The amount of empty store space along that stretch far surpasses Chicago’s overall retail vacancy rate, which was expected to hover at just under 7 percent for the year, according to Marcus & Millichap.

That increases the urgency for a Mag Mile retail recalibration, which comes amid Chicago’s staggered recovery. The tourism and hospitality industries are still struggling but fighting their way back. The hotel occupancy rate across the city was at 60 percent, according to a recent report from data firm STR. That figure was still below the national average of 68 percent, but it’s far above the 25 percent from August 2020.

And although the Chicago area housing market has enjoyed months of strong sales and the downtown apartment market has bounced back from its losses last year, office vacancies abound. Trendy Fulton Market — home to Google’s Midwest headquarters, stylish restaurants and sleek hotels — now leads the city with a 28.6 percent office vacancy rate, NAI Hiffman reported. And developers are still pumping out projects; the district has 924,000 square feet of spec office space under construction, the report noted.

That jumble all makes for something of a moving target that retailers and landlords are struggling to hit. Acadia has said it acquired 717 N. Michigan Avenue with the intention of redeveloping it, and a rendering of a redesign concept remains on its property website. But those plans have yet to materialize.

“There are several corridors around the country where multi-level flagship retail is no longer, and those spaces may need to be reoriented,” Conlon said, referring also to New York, Washington, D.C. and Boston. “We’re very open-minded to that all around the country.”