In the four years since The Real Deal last ranked New York’s top property management firms, the industry that keeps the peace between residents and building owners has been through the wringer.

From pandemic-related lockdowns, which emptied some buildings and triggered a transition to remote technology, to soaring rents and increasingly stringent regulations, city firms acknowledge that the past few years have demanded flexibility and a fastidious eye.

But the industry’s leaders haven’t let that environment stifle growth.

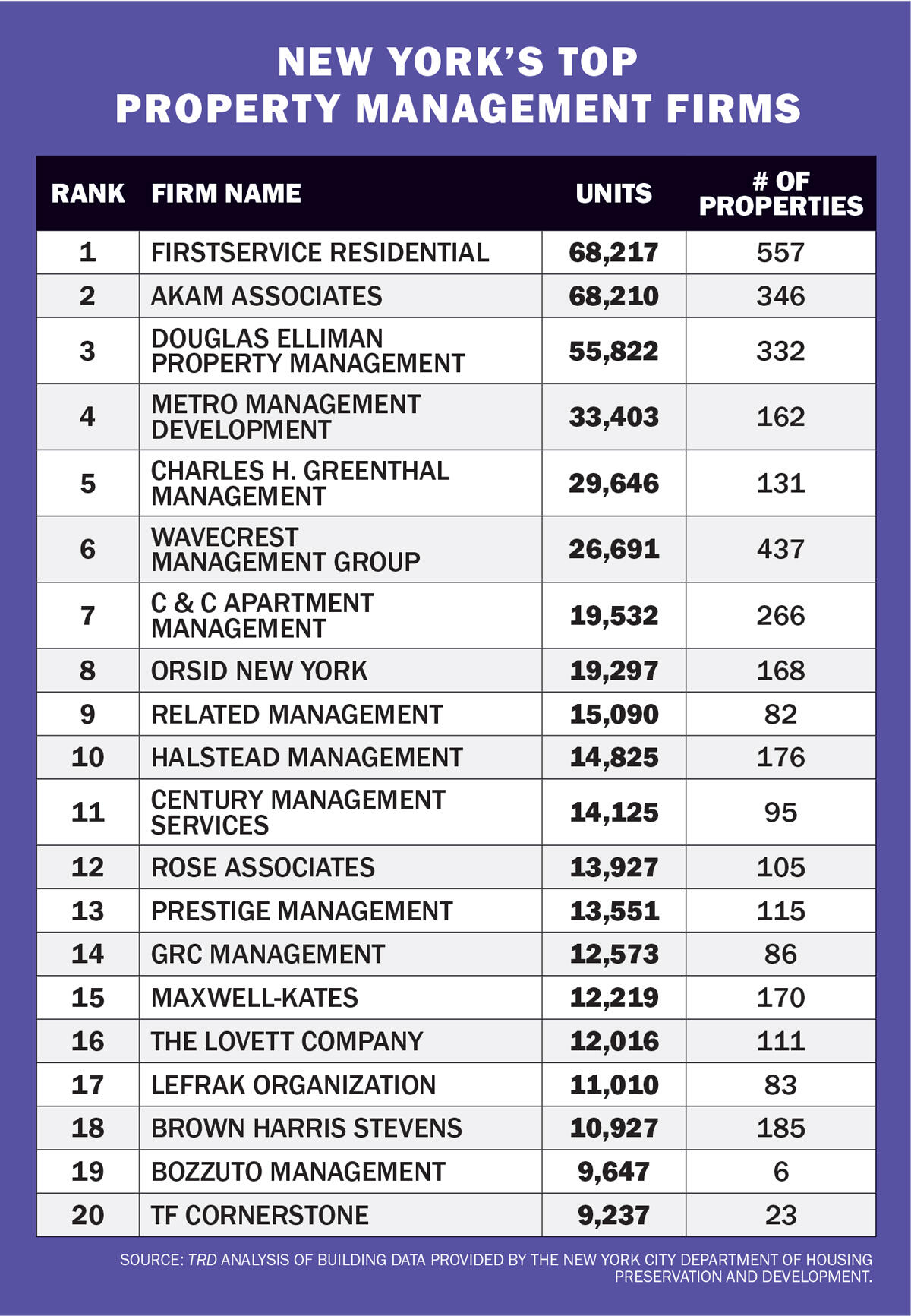

To rank the city’s top property managers based on the number of units under management, TRD analyzed building data provided by the city’s Department of Housing Preservation and Development from all five boroughs. Competition was intense: The difference between first and second place this year could be counted on two hands.

FirstService Residential shed its second-place standing in 2018 to nab the top spot in 2022, with 68,217 units citywide, a 28 percent gain over the firm’s citywide holdings four years ago.

AKAM Associates took second place with 68,210 units.

“What! We’re seven away from number one?” Michael Rogoff, president of AKAM Living Services President, exclaimed. “Can we get a recount?”

To make sure, TRD’s data team verified its numbers with the in-house counts from the top 20 teams and reviewed discrepancies to produce final figures.

Apples and oranges

Both of the top companies have roots in Florida, but their growth strategies couldn’t be further apart.

FirstService, which specializes in luxury condos and co-op buildings, including some of New York’s new supertalls, leans heavily into acquisitions.

Last year, FirstService acquired Midboro Management, adding 15,000 units to its New York portfolio. In the past few years, the firm has also picked up Tudor Realty Services, which placed 11th in TRD’s 2018 ranking with 7,082 units in Manhattan alone.

FirstService makes it a point to nab projects in their infancy, connecting with developers before preliminary renderings or design drawings are on the table, Marc Kotler, its head of New York development, told the New York Real Estate Journal this year.

The firm has gotten in on the ground floor of a couple of hotel-to-condo conversions of late, including the 99-unit One11 Residences tacked onto the Thompson Central Park at 111 West 56th Street.

AKAM, by contrast, largely steers clear of new developers. Rogoff said his team has worked with a few that are doing “really great projects,” but noted that some developers have less-than-desirable reputations, which can lead to issues for the property manager once a residential board takes over.

“I would say 99 percent of our business comes over from other management companies,” Rogoff said. “It would be highly inappropriate for me to mention them by name. But I’ll tell you: They’re the top ones on the list.”

Tough crowd

Scan the online reviews for FirstService or Douglas Elliman Property Management, which took third place on the list with about 12,000 fewer units than AKAM, and there’s a fair showing of negative feedback.

FirstService has two out of five stars on Yelp; Douglas Elliman carries 1.5. Reviews for both firms cite unresponsiveness, unaddressed maintenance and a lack of professionalism.

To be fair, residents who are happy with their property management are less likely to seek out the company online and leave a review.

AKAM isn’t ranked much higher: It boasts just 2.5 stars. A recent review from a woman living at Skyline Tower, a Long Island City high-rise the firm manages, gripes about disorganization, delays and inaccessible amenities.

“Pool? Nonexistent. So why charge us high maintenance fees if you can’t deliver on your promises?” reviewer Janet W. wrote.

But property managers say the past few years — contending with ultra-low demand and plummeting rents as New Yorkers fled the city, then unprecedented price growth when they returned en masse — have been a struggle, even for the most established companies.

“It’s been a wild ride really ever since Covid,” Rogoff said. “It’s reshaped our industry.”

“It’s been a wild ride really ever since Covid,” Rogoff said. “It’s reshaped our industry.”

AKAM cited the early innings of the pandemic, when tenants demanded “immediate concessions,” as the most difficult to navigate.

But as rents notched records throughout 2022, Rogoff said collecting payments from AKAM’s tenants, who mostly occupy higher-end buildings, hasn’t been an issue.

“I get it, people don’t love paying higher rent. I don’t either,” he said. “But people seem to accept that that’s kind of where the market is right now.”

Tech takeover

The switch to remote operations during lockdown — particularly for property management firms that pride themselves on having boots on the ground — proved a challenging adjustment. But some were already in the throes of that transition when the pandemic hit.

Wavecrest, which placed sixth with 26,691 units, had begun migrating to a portal that allowed residents to communicate with the building’s management team. AKAM also said it was in the process of incorporating digital technologies; Covid just hastened that process.

Now the tech has become essential to day-to-day operations.

AKAM now uses an array of property management software: BuildingLink to track packages, BoardPackager to handle sales and lease applications, SiteCompli to manage maintenance and violations in real time, AvidXchange for payables and Yardi for accounting.

Though most companies are more than willing to embed tech into their business, they decry the rise of full-suite virtual property managers, such as RentRedi or Moxo. For now, few fear that artificial intelligence can render traditional firms obsolete.

“There is no substitute for a human being visiting a site,” said Joseph Camerata, Wavecrest’s president.

Regulation hell

The much bigger pain point for property managers is a web of regulations, which they claim grows denser and more difficult to navigate each year.

The first deadline for compliance with Local Law 97’s emissions standards is swiftly approaching. The 2024 cap, which applies to the city’s largest buildings, will only affect 3,000 properties, but landlords and management firms expecting to be affected by the 2030 deadline are already budgeting for retrofits: boiler replacements, envelope makeovers and lighting overhauls.

Then there are the new requirements for city garages, which, as of 2022, must be inspected once every six years. Local Law 152, passed in 2016, requires gas line inspections every four years. And the long-established Local Law 11 demands facade inspections every five for buildings taller than six stories.

This year, a deadly fire in a Bronx apartment building resurrected a push to require sprinklers in all multifamily properties. Mayor Eric Adams in March said he would work with the City Council to pass legislation to prevent another tragedy. As of June, though, Gothamist reported that no progress had been made on a bill.

Property management firms admit that complying with an ever-evolving smorgasbord of rules and keeping violations to a minimum can be an undertaking. Larger firms with the means to do so have expanded their compliance teams to keep up.

But the outlook for the smaller firms that have characterized the industry for years may not be as robust. Between rampant mergers, market pressures and a labyrinth of rules, acquisition-adverse AKAM doesn’t know how much longer some of those teams will last.

“I just don’t see, on a small scale, how you can truly do a good job with all the compliance because I see what it takes and it’s just becoming more and more tough,” Rogoff said.