Chicago’s developers kept general contractors busy last year, feeding the city’s top construction firms twice the work they did in 2021 even as the office sector floundered.

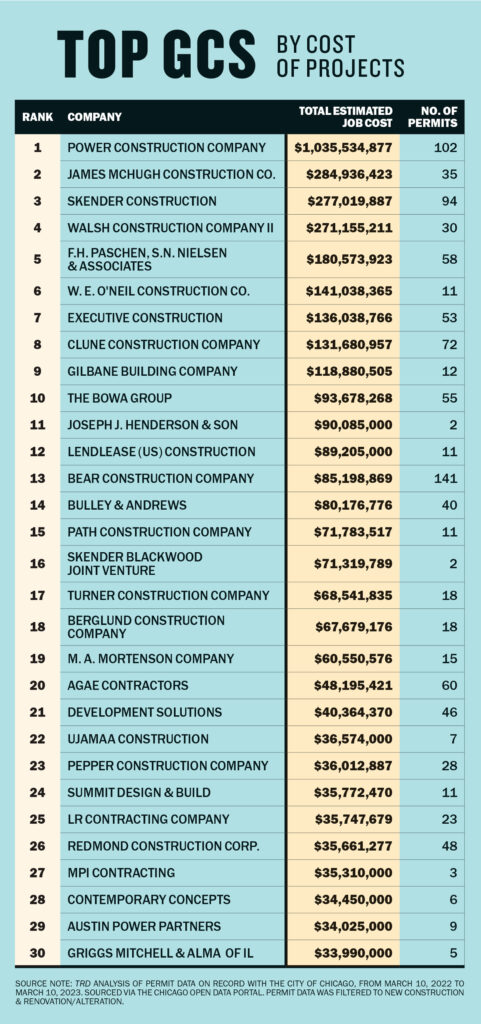

Combined, the city’s top five contractors booked more than $2 billion in work from March 10, 2022, to March 10, 2023, a huge jump compared to The Real Deal’s 2021 ranking, when the top five failed to meet the $1 billion threshold.

Power Construction, a Chicago-based fixture at the top of the city’s contractor market, led the charge by securing more than half of the project volume among the top five contractors with $1 billion worth of work last year, according to an analysis by TRD of reported costs on applications for city building permits submitted within the analyzed time frame. Power ranked second last year.

For Skender CEO Justin Brown, whose firm recorded more than $277 million of work during the period, it’s a question of whether pandemic-induced challenges, such as supply chain issues, have improved.

“For us, the supply chain is more predictable, it’s just a lot longer now with global and pent-up demand,” Brown said. “We haven’t figured out if it’s gotten better or if we’ve gotten better at adapting to it.”

Chicago’s overall construction market is projected to grow by 1.5 percent this year, with infrastructure and healthcare work expanding their market shares as the residential and commercial markets slip, according to the research arm of the construction consultancy Cumming.

“What we’ve been seeing in the industry is that a lot of general contractors do have healthy backlogs and there seems to be several reasons for that, but there are concerns in the commercial market that they’re going to see a slowdown due to higher interest rates and general uncertainty,” said Michael Cwienkala, president of the Chicagoland Associated General Contractors trade group.

‘Still kind of a ghost town’

While work on office buildings lagged, contractors relied on the diversity of their portfolios to keep project volume up.

“When you’re walking around downtown, it’s still kind of a ghost town, so the activity on the tenant side was down,” said Vince Gutekanst, who leads eighth-ranked Clune Construction’s Midwest region.

Commercial projects’ market share sank by more than 6 percent in 2022, a smaller drop than 2021’s 11 percent, according to Cumming. Meanwhile, residential work increased by nearly 7 percent, though that sector is expected to lose ground over the next two years.

Multifamily development accounted for seven of the 10 most expensive projects permitted during the time period analyzed by TRD. Near the top of the list were the Trammell Crow Company’s $140 million, 386-unit, 34-story Fulton Market high-rise at 1114 West Carroll Avenue and the $135 million, 411-unit apartment project from JDL Development, which will rise to 27 stories at 868 North Wells Street in River North. Power is the general contractor for both.

Close behind was the $108 million Cassidy on Canal, a 33-story residential tower at 350 North Canal Street in the Fulton River District, where McHugh is the general contractor for the developer, a joint venture of The Habitat Company and Diversified Real Estate Capital. Power and McHugh did not respond to requests for comment.

Still, the $162 million project for Chicago’s first multistory warehouse took the top spot for the priciest project permitted during the time frame. Walsh Construction is the general contractor for developer Logistics Property Co.; the 1.2-million-square-foot facility will be located near Goose Island at the intersection of Division Street and Elston Avenue.

Just one office project cracked the top 10 — Sterling Bay’s $121 million high-rise underway at 360 North Green Street, with Power as the contractor. It’s a shift from 2020, when the two most expensive projects contractors pulled permits for were office skyscrapers: the $476 million BMO Harris Bank tower near Union Station and the $360 million Wolf Point South tower.

The priciest permits also included one infrastructure project, an $85 million modification to the Eugene Sawyer Water Purification Plant on the South Side for which Joseph J. Henderson & Son, Inc. is the general contractor.

Infrastructure’s share of Chicago’s construction market increased by almost 7 percent in 2022 and is projected to continue growing over the next two years, according to Cumming.

“The industry as a whole has been kind of picked up by public money that’s been spent as part of [President Joe Biden’s $1 trillion] infrastructure bill and further public investments as the commercial and even multifamily markets seem to be slowing,” Cwienkala said.

Proceed with caution

Some contractors observed a perfect storm of factors slowing the commercial market, including interest rates and the risk of a recession. It’s harder for developers to secure loans from financial institutions when inflation continues to rise at above-average rates, Brown said.

“A lot of people are going to be cautious moving forward, understandably so,” he said. “People are just being a lot more choosy where they place money.”

We haven’t figured out if it’s gotten better or if we’ve gotten better at adapting to it.

Gutekanst agreed, saying “it was a grind” to secure work for office tenants.

“For us and I think a lot of contractors, it was a bit of a unique year. We were fortunate enough that we weathered the storm pretty well, and quite honestly, I think we weathered it a little bit better than others,” he said.

Karrie Kratz, head of the Chicago office for ninth-ranked Gilbane Building Company, observed a similar shift in what made up most of the firm’s work.

“It has been kind of the most exciting piece of what we’re seeing in the marketplace right now, a lot of positive momentum on the complex manufacturing side of the industrial space taking the place of some spec-type of development,” Kratz said.

Contractors have also noticed another source of hesitancy among clients and developers — Windy City politics. With Mayor-elect Brandon Johnson taking office next month, those doing business in Chicago are watching closely to see how the real estate industry — much of which opposed Johnson’s campaign — will fare under the new administration.

“We’re challenged enough trying to get people back to work with the hybrid environment, then you couple crime and transportation issues,” Gutenkanst said. “It’s almost like coming to a boiling point of the perfect storm impacting the commercial real estate business.”