When 601W Companies needed a break on its property taxes at Chicago’s Old Post Office, it turned to Nicholas Jordan.

The Worsek & Vihon attorney’s work turned out to be even more impactful than the landlord had hoped for the property, which has landed high-profile tenants such as Uber and was valued at about $850 million by Cook County Assessor Fritz Kaegi.

601W, which is managed by Mark Karasick, Michael Silberberg and Victor Gerstein, argued that the 2.3 million-square-foot building should really be taxed at a value of about $600 million, even after it had an $830 million loan issued against it in late 2021, when a lender appraised it at $1.2 billion. It was the third-largest loan ever on a Chicago office building.

The success of 601W’s appeal makes it easy to see why two property tax appeals law firms tied to Mike Madigan and Ed Burke, two long-standing Southwest Side politicians who are now facing separate indictments, sought the landlord’s business, according to Chicago Sun-Times reporting on federal investigations of the public officials.

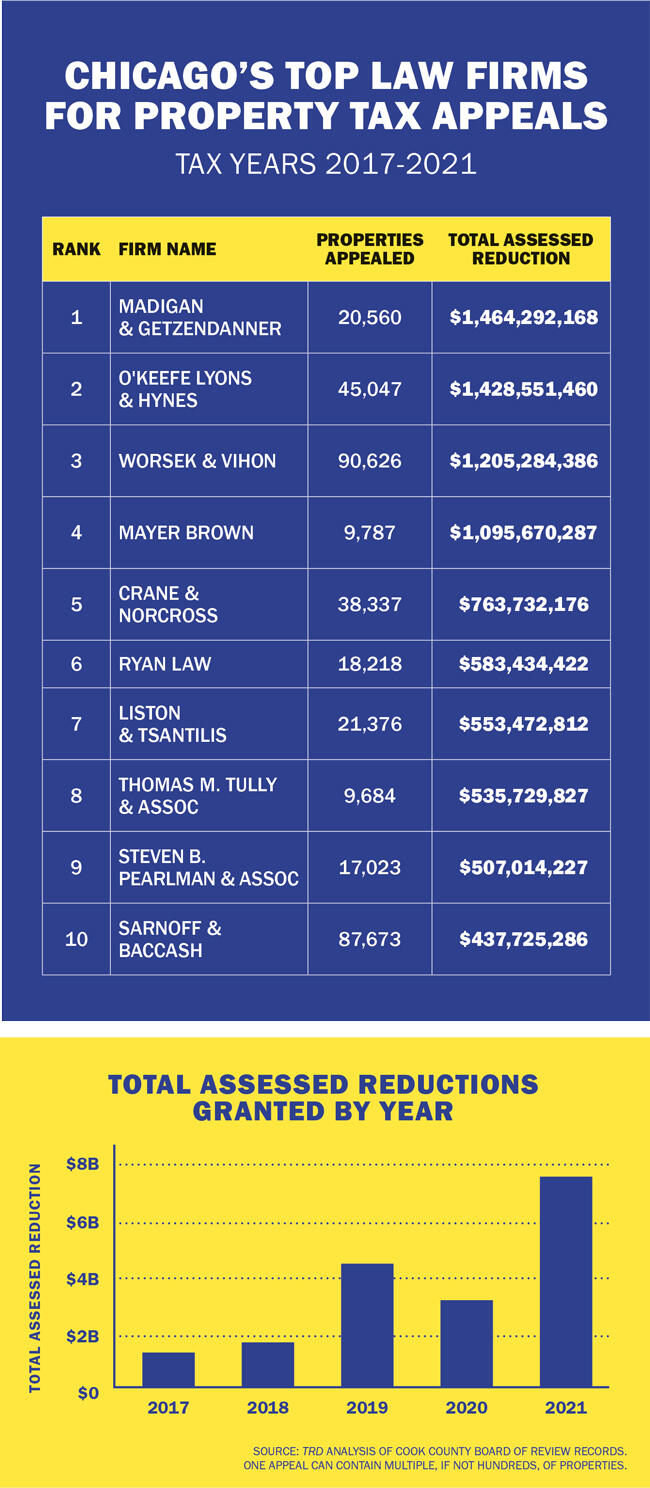

Chicago’s developers and landlords have long seized tax breaks by hiring powerful and often politically connected law firms that specialize in these appeals, and some top attorneys saved their clients twice as much money last year as in any other since at least 2017. Cumulatively, appeals reduced $7.5 billion in assessed value set by Kaegi, an analysis of Cook County Board of Review records by The Real Deal found. Reductions stemming from appeals granted over the five-year period from tax years 2017 to 2021 totaled $18.2 billion, the records show.

Though New York-based 601W never hired Madigan or Burke’s law firms for work on the Old Post Office, the firm it did use, Worsek & Vihon, notched the third-largest total cuts of assessed value of all law firms over the last five years of appeals. Its successful objection on the Old Post Office is ripping yet another rift between Kaegi and the Board of Review, the elected three-seat body that decides property tax appeal cases. It also led to the firing of a board staffer early in a newly elected commissioner’s term.

Mass appeals

As Worsek & Vihon wrenched a reduction of Kaegi’s Old Post Office valuation down to $600 million for taxing purposes, the savings in tax costs for 601W stood out amid last year’s historic success for property tax appeals attorneys in Chicago. As a group they foiled Kaegi’s attempt to raise the burden on commercial real estate owners.

The trend got Kaegi’s attention — and perhaps his goat. He told the Board of Review he’s making the rare move of reassessing the Old Post Office this year, accelerating the normal three-year cycle. Kaegi has promised to correct what he views as entrenched unfairness to owners of lower-priced properties, who he says bear more of a burden than they should due in part to the consistent success of large office, multifamily and industrial landlords in reducing their assessments through appeals.

The flap over the Old Post Office also led newly elected Board of Review Commissioner Samantha Steele — who tends to share Kaegi’s perspective and was stunned by the reduction given to 601W — to start the process of firing the staffer from her district office who agreed a cut was in order.

“I can’t have that in my office,” said Steele, who inherited the staffer after defeating incumbent commissioner Mike Cabonargi last year. Cabonargi voted in favor of the reduction for 601W before losing the election.

While Steele disagreed with the size of the reduction granted to the landlord, she’s also concerned with the precedent Kaegi could set by reassessing what they both view as egregious handouts to big landlords that end up getting funded by the rest of the property taxpayer pool.

“It becomes a Ping-Pong game, and the only people it benefits are the attorneys,” said Steele, who said her election campaign accepted no contributions from property tax appeals lawyers.

Those lawyers made out especially well protesting Kaegi’s valuations last year. Madigan & Getzendanner — co-founded by Mike Madigan, the longtime speaker of the Illinois House of Representatives, who resigned from office while facing corruption allegations in 2021 — cut $1.46 billion worth of assessments in Cook County between tax years 2017 to 2021, the most of any law firm.

Madigan’s firm came out just ahead of second-place O’Keefe Lyons & Hynes, which knocked tax values down by $1.43 billion in the same time frame. Worsek & Vihon, hired by 601W for the Old Post Office, came in third at $1.2 billion in reductions.

Many tax appeals firms generate revenue by taking a percentage of the savings they notch for clients. Others charge fixed fees.

Madigan & Getzendanner chopped $423 million in assessed value off commercial properties last year, by far the most of any year in the period, notching wins for landlords including Tishman Speyer at 227 West Monroe Street and KBS for Accenture Tower at 500 West Madison Street. The next-best year Madigan & Getzendanner had over the period was $139 million worth of commercial reductions in 2019.

The firm faced scrutiny for decades over Madigan’s public position, which critics warned could be misused to help funnel business to property tax appeals lawyers. The average annual reductions it achieved for clients during Kaegi’s tenure as assessor have been remarkably consistent with those during the years Kaegi’s predecessor, Joseph Berrios, held the office.

In the six-year period from 2011 to 2016, when Berrios was assessor, the firm removed $1.7 billion in assessed value, a ranking published by ProPublica Illinois and the Chicago Tribune found. The firm’s average of about $280 million in reductions per year for the period is the same mean it achieved to take the crown for the last five years.

In the six-year period from 2011 to 2016, when Berrios was assessor, the firm removed $1.7 billion in assessed value, a ranking published by ProPublica Illinois and the Chicago Tribune found. The firm’s average of about $280 million in reductions per year for the period is the same mean it achieved to take the crown for the last five years.

But there have been shakeups among the top firms during Kaegi’s tenure. While Crane & Norcross won back $1.8 billion in assessed value for its clients when it was the top firm from 2011 to 2016, or an average of $300 million a year, it won just $764 million in reductions in the last five years, an annual average of $153 million.

Still, business has been better than ever as the size of disputes has swelled. Four law firms won $1 billion or more in reductions from 2017 to 2021, whereas only two, Crane & Norcross and Madigan & Getzendanner, hit that mark for the six-year period analyzed by ProPublica and the Tribune. What’s more, the 11 priciest properties whose landlords filed appeals last year, including Blackstone’s Willis Tower and the newly built Bank of America Tower at 110 North Wacker Drive, all received reductions on their tax bills. The very top of the market enjoyed less consistent success on appeals in previous years, records show.

Winds of change

Kaegi has acknowledged that Cook County generates far more appeals than many other large jurisdictions, which he blamed on a history of faulty assessments during Berrios’ tenure.

“Our culture here in Cook County, because assessments have been inaccurate for so long and because there are so many industries and political incentives that rewarded driving appeals, [has] sort of taught people to feel like they need to appeal,” Kaegi said at a recent civic engagement event.

TRD contacted representatives for the top 10 firms that landed the largest appeals. All were given an opportunity to review the data for errors and comment. Many did not respond, and those remaining declined to comment, citing client confidentiality. Kaegi’s office declined to make him available for an interview for this story.

The Board of Review’s annual report in December criticized Kaegi for the size of the increases he tried to implement on commercial and industrial properties. Commercial complaints were up 12 percent compared to the last reassessment of the city in 2018, the board said, totaling more than 12,000 hearings requested.

“The unsupported substantial increases in commercial/industrial assessments by the assessor — particularly, during a global pandemic — ranged from 33 percent in Hyde Park township to 115 percent in West Chicago township,” read the report from Commissioner Larry Rogers Jr., who remains in office, and then-outgoing commissioners Cabonargi and Tammy Wendt.

Speaking to TRD in December, Kaegi said it wouldn’t make sense to implement more gradual increases to commercial property values simply to avoid confrontation with the Board of Review.

“Why should a false value that’s not in line with the market stay in place at the expense of all other people and businesses that try to make a living here in the county?” the assessor said at the time. “It’s a red herring.”