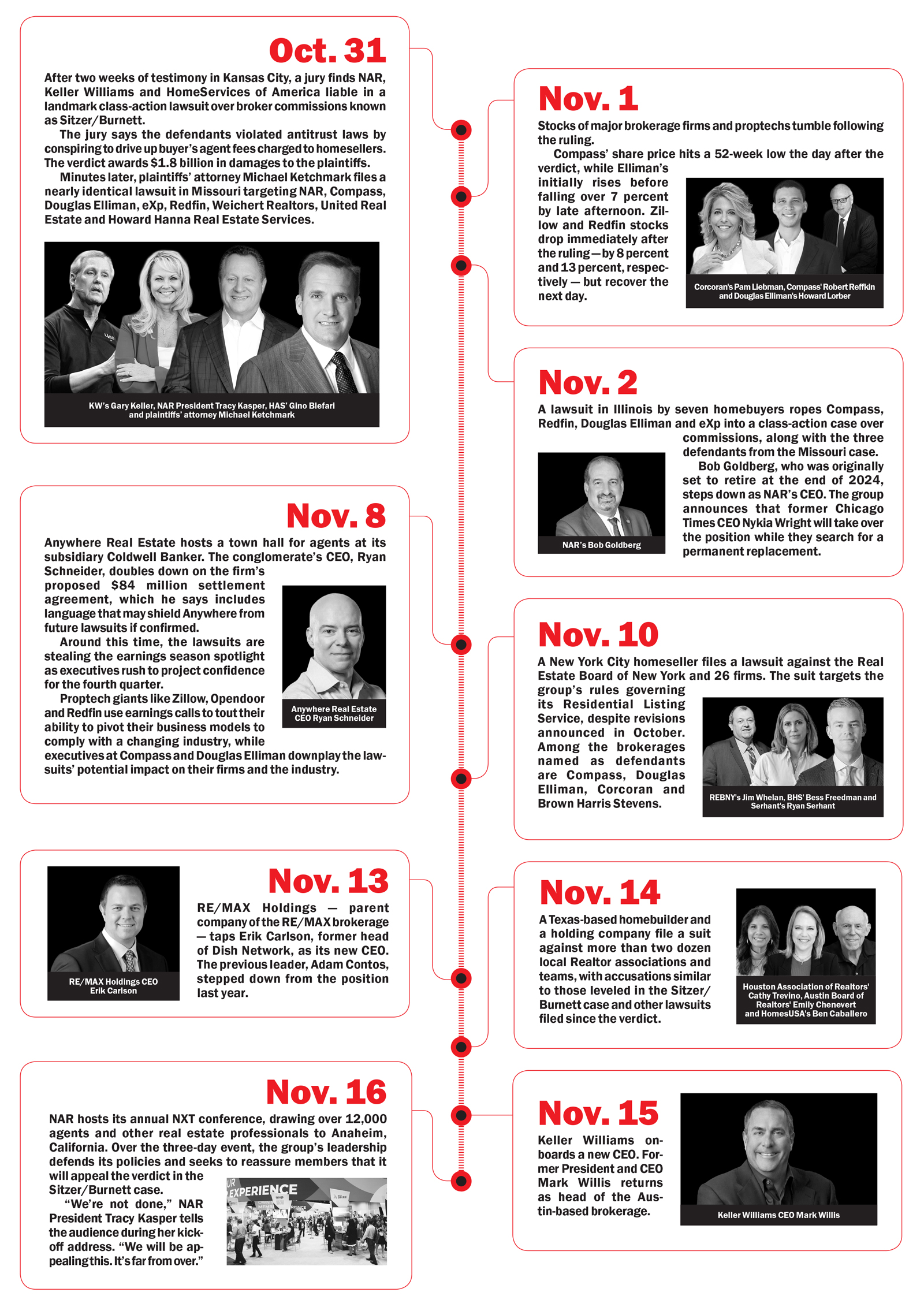

On Oct. 31, a Kansas City, Missouri jury rocked the industry when it found the National Association of Realtors and two brokerages liable in the landmark Sitzer/Burnett antitrust lawsuit over broker commissions.

The following month surfaced talking points, stock reactions and talk of industry technicalities that presented more questions than answers.

Several brokerage executives were tight-lipped in the days following the verdict, as news of copycat lawsuits dominated headlines. Separate — but nearly identical — lawsuits popped up in Chicago, New York and Texas, with plenty more sure to come.

The jury’s verdict landed in the middle of residential earnings season and NAR’s annual conference, where leadership jumped to steer the narrative and dispel misgivings. The 1.5 million-member trade group doubled down on its policies and vowed to continue fighting the onslaught of litigation.

“Just know that this is one chapter in a longer process,” NAR President Tracy Kasper said at the conference. “This is more about our consumer than it is about us, and we will fight for that.”

In addition to the usual cast of characters, the wave of litigation brought new players, including an antitrust lawyer who emerged as a disruptor for the old guard of residential real estate and fresh faces replacing some executives as shakeups hit the key parties.

As proptech giants seized the moment to tout their relevance amid an industry evolution, brokerage executives brushed off concerns about the verdict’s impact on the industry and the potential toll of new lawsuits filed against them.

“We believe these lawsuits lack merit, and we intend to challenge them,” Douglas Elliman Chair Howard Lorber said during the company’s third-quarter earnings call.

As the industry appears to absorb the aftershocks of the verdict, more developments are on the horizon.

The judge in the Sitzer/Burnett case will have to decide whether to uphold the jury’s verdict. The verdict’s confirmation could include a trebling of the damages under antitrust law to more than $5 billion.

“Just know that this is one chapter in a longer process.”

Plaintiffs’ attorney Michael Ketchmark could also request that the judge mandate policy changes in his decision. It’s unclear what those revisions might include, but the rule changes proposed by Anywhere and RE/MAX in their settlement agreements could be a road map for the plaintiffs.

Also at play is the Department of Justice’s probe into NAR and its practices, which could produce sweeping changes for the industry if the agency continues on its course. Ketchmark claimed he’s engaging in “significant and ongoing” discussions with department officials and think tanks related to the inquiry.

Some of the lawsuits have made reference to other countries’ commission structures, including those in Australia, the United Kingdom and Israel. But a shift to a foreign model could trigger a “race to the bottom,” with few exclusive listings, the end of the MLS and online listings and agent commissions as low as 1 percent, brokers told The Real Deal.

While some brokers cried disaster as the worst-case scenario, founders of proptech startups said the potential industry upset could be an opportunity for them to gain market share.

Though the lawsuits’ effect on commission structures is still up in the air, brokerages will likely take a financial hit as the cost of litigation continues to pile up.

Changes are already underway in Chicago, where some agents are starting to include commissions in buyers’ closing costs. Major brokerages in the area are also pushing for more frequent use of buyer agency agreements.

Two parties that can claim (relatively) scot-free status are Anywhere, the parent company of Corcoran, Coldwell Banker and Sotheby’s International, and RE/MAX. They settled shortly before the trial began.

The firms proposed deals for $84 million and $55 million, respectively, that would also exclude them from Moehrl, a lawsuit alleging they violated the Sherman Antitrust Act by colluding with the National Association of Realtors to inflate commissions.

Anywhere proposed rule changes around buyer and listing broker commissions, which the deal said would be implemented across its brands for at least five years. Overall, the firm agreed to three policy changes in line with an agreement NAR reached with the Department of Justice in 2020, though the DOJ has since vacated the settlement to pursue a larger investigation.

With heightened scrutiny, more litigation on the way and no confirmation on the settlement until 2024, residential observers have plenty to look out for. In the meantime, catch up on the moves so far.