For Houston’s top residential brokers, 2023 saw a great divide. Top performers stood out more than ever in a year largely defined by residential decline.

The backdrop was interest rate hikes and ballooning construction costs, culprits in a slowdown that started in 2022. Indeed, the metro market has now notched 19 straight months of declining home sales, according to the Houston Association of Realtors.

But it’s been a robust period for top brokers thanks to the luxury market and its cash buyers, who are insulated from rate hikes.

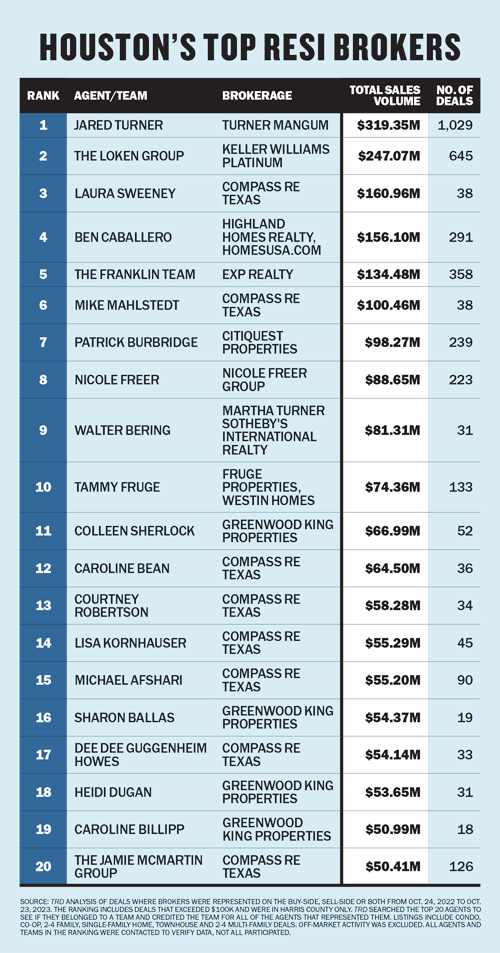

The top 20 brokers in Houston’s Harris County accounted for $2 billion worth of deals during the 12 months ending in mid-September, according to The Real Deal’s analysis of on-market deals.

The top 10 brokers logged $1.5 billion, or three-quarters of the total. That’s up 36 percent compared to a year ago, when TRD’s list was limited to 10.

Compass’ Laura Sweeney, who ranked third on the list, called it a seller’s market, saying she has seen multiple offers and quick sales.

Sweeney closed five of the 10 priciest residential deals in Greater Houston, typically under dual agency, or working as both the buying and listing agent. Those deals alone combined for nearly 42 percent of Sweeney’s sales volume, or about $67 million.

But not all the top agents got there via big-ticket deals. Jared Turner of Turner Mangum took the top spot in both number of transactions and sales volume. He jumped from ninth place last year to first, with 1,029 deals totaling over $319 million.

Keller Williams Platinum’s Loken Group took second place on our list, with $247 million closed across 645 transactions.

Ben Caballero of HomesUSA.com and eXp Realty’s Franklin Team rounded out the top five with $156 million and $134.5 million in sales volume, respectively.

Volume is a popular game in Houston. In fact, Caballero, a Dallas-based broker, holds the Guinness World Record for most homes sold through an MLS by an individual seller-side real estate agent in a single year. He completed over 6,400 home sales in 2020. While his presence extends across Dallas, Austin and San Antonio, the former homebuilder made a healthy showing in Houston, with 291 local deals. His website, HomesUSA, serves as a resource for more than 60 builders who pay a flat fee to Caballero as the listing agent for each home sold.

A topsy-turvy market

This year has been largely business as usual for Compass’ Sweeney — with some added benefits.

Consistently ranked among the city’s top brokers, she closed an equal number of deals year-over-year but saw a big increase in dollar volume. Turner and the Loken Group also saw increased dollar volume.

Meanwhile, Greenwood King’s Colleen Sherlock and Compass’ Mike Mahlstedt, ranked 11th and 6th, saw decreased sales volume compared to last year — an experience more in line with the typical Houston broker.

“It’s been the toughest year in my 30 years in real estate outside of Covid,” said Greenwood King’s Heidi Dugan, ranked 18th. “There’s just so much uncertainty.”

Since Compass hit the scene, Dugan said, many agents have started operating in groups, albeit discreetly, avoiding the “team” label.

“It is specifically to bolster numbers. Some top agents have seven or eight people under them,” she said. “All individual agents have sold less this year than last; I have seen the numbers. Maybe they are just posturing for the media — but that is a fact.”

Patrick Burbridge of CitiQuest Properties sees the year as more of a mixed bag. He also saw a decrease in sales volume and brokered deals, falling from fifth on the previous ranking, with $126 million in sales volume, to seventh with $98 million. But the year played out better than he had anticipated.

“2023 for us was expected to be a not-so-great year, because of the downturn we saw in the second half of 2022. But interestingly, we’ve had a great first half,” he said. “Unfortunately, when interest rates bumped above 7 percent in late August, things slowed down drastically.”

Another thing the top brokers can’t agree on is 2024. While some see a foundation for one of the best post-pandemic years to date, others see signs of uncertainty continuing to influence the market. The uncertainty surrounding the election year and war abroad have brokers leery about how the year will unfold.

Burbridge and Caballero cited the historic trend of downturns during election years, as well as depressed consumer interest that was already evident more than a month into the Israel-Gaza escalation.

Martha Turner Sotheby’s Walter Bering, who ranked ninth, remained largely optimistic about the coming year and offered a word of insight for brokers still trying to make sense of 2023.

“The market has not changed,” he said. “People are still getting married, having babies, having job changes, divorces and other life events. Life events are not dictated by interest rates.”