Sometimes the original pricing just doesn’t cut it. Amid a continuing oversupply of inventory and shrinking buyer pool, Miami’s luxury home sellers are issuing increasingly substantial price reductions to move their properties, The Real Deal’s research shows.

“I think what you are seeing is that the game has changed, and not many brokers are strong enough to tell — or don’t have the confidence to tell — a seller where they need to be on pricing [at the beginning],” said Oren Alexander, a Miami Beach broker with Douglas Elliman, explaining the perception that agents are often misjudging the market with original listing prices.

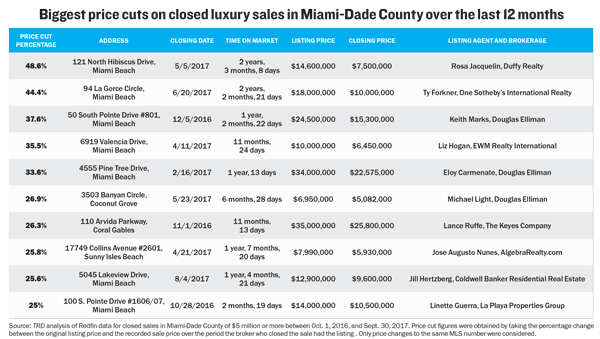

To conduct the analysis of homes that sold with the biggest price cuts, TRD looked at only publicly listed properties priced at $5 million or more with closed sales in the last 12 months. Additionally, when calculating the price cut percentage, TRD used the price as first listed by the broker who ultimately closed the deal.

Closing at $7.5 million in May 2017, 121 North Hibiscus Drive in Miami Beach saw the biggest chop — 48.6 percent — since it was initially listed with broker Rosa Jacquelin of Duffy Realty for $14.6 million in January 2015.

However, such a huge price cut is not the norm, despite the shift in the market. Current sales in excess of $1 million are going for an average of 19 percent below their asking prices across the board, according to Ron Shuffield, the CEO of EWM Realty International.

Sellers should “look at the months of supply and set a price no more than about 5 percent above where they think it will ultimately sell,” Shuffield advised.

The increasing glut of luxury inventory isn’t helping sellers get their hoped-for sale prices. There was a staggering 53-month supply of luxury condos on the market in the third quarter, according to the latest Douglas Elliman report on the Miami coastal mainland. That’s up from a nearly 40-month supply at the same time last year. The median luxury condo sales price was down 5.4 percent from the third quarter of 2016, to $691,500.

The increasing glut of luxury inventory isn’t helping sellers get their hoped-for sale prices. There was a staggering 53-month supply of luxury condos on the market in the third quarter, according to the latest Douglas Elliman report on the Miami coastal mainland. That’s up from a nearly 40-month supply at the same time last year. The median luxury condo sales price was down 5.4 percent from the third quarter of 2016, to $691,500.

And yet there’s even more inventory to come. Peter Zalewski, founder of Cranespotters.com, has started offering what he calls “condo correction tours,” during which he takes prospective buyers through downtown Miami, pointing out all of the inventory that hasn’t yet hit the market. Zalewski said that as the Miami condo market continues to soften, investors are signing up for his tours with the eventual goal of buying as prices continue to drop.

“We’ve had almost 150 buildings delivered in coastal area, and we have another 100 buildings under construction,” said Zalewski. “So really, what you are seeing is all of the early effort of the beginning of this cycle from 2011 starting to come to fruition, while at the same time you are seeing sellers start to realize the jig is up.”

As he guides his charges through the condo canyons surrounding Brickell Avenue, Zalewski points out the fallout from Miami’s last real estate crash in 2009 and 2010. Buildings like 1050 and 1060 Brickell Avenue, Wind at 350 South Miami Avenue and Brickell on the River South Tower at 31 Southeast 5th Street, where Zalewski said units that cost $300 per square foot to build eventually sold for $200 per square foot or lower. Those units were snapped up by investors, many from Brazil and elsewhere in Latin America, buoyed by high currency rates at the time in booming commodity-driven economies.

Ron Shuffield

But now those economies have cooled and those currencies have dropped, said Zalewski, who likens the current state of the Miami real estate market to a rocky plane ride. “I like to look at a real estate cycle as typically seven to 10 years — it’s like a flight; at some point you run into turbulence, so we are at that point now,” said Zalewski.

Indeed, the scales have, for several quarters, been tipping in a not-so-promising direction.

“We like to have 12 to 18 months of inventory for a balanced market in the over-$1 million market,” said Shuffield. He said there’s a real need now for price reductions just to attract buyers “who are on the sidelines.”

After all, there are plenty of potential homebuyers who are eager for stock at more affordable price points. South Florida can be “a tale of two markets, the over-$1 million market and the under-$1 million market,” Shuffield said.

Four out of 10 houses and seven out of 10 condos in Miami-Dade sell for under $300,000, Shuffield said, citing data from the Miami Association of Realtors. There’s currently only a 2.2-month supply of homes under $300,000 and a five-month supply of homes under $500,000,

he said.

Owners of luxury property obviously aren’t going to drop their prices anywhere in that vicinity, so with such abundant supply, what does it take to sell high-end homes in Miami-Dade? Patience and proper pricing, said Nancy Batchelor, a leading broker with EWM in Miami Beach. The days of aspirational pricing are long gone, she said.

“There’s prestige in being an agent with a trophy property, but you’re not doing anybody a favor by overpricing it,” said Batchelor, who added that buyers are getting more sophisticated. “Often the buyers know the comps better than the agents out there; no matter how much money people have, they want to feel they are getting value.”

There’s no shame in implementing a price cut, particularly since that doesn’t always mean the seller is taking a loss. Alexander of Douglas Elliman conducted the buyer-side negotiation for the sale of 4555 Pine Tree Drive in Miami Beach, which was originally listed at $34 million. It eventually sold for $22.6 million, but Alexander claimed the 33.6 percent price cut wasn’t worrisome, saying that no house on Pine Tree had ever sold for more than $20 million. The broker did concede that it took six months of negotiations to “get the buyer to the deal.”

Time is crucial for landing a luxury sale these days, said Ty Forkner, a broker at One Sotheby’s International Realty in Miami Beach. Forkner handled the sale of rapper Lil Wayne’s 15,000-square-foot, nine-bedroom manse at 94 La Gorce Circle, which had the second-largest price cut in the TRD ranking, at 44.4 percent. Forkner said the house was listed in early 2015, “when we were still at the tail end of a very good seller’s market.”

He originally priced the house at $18 million at the recommendation of another broker, who claimed to have a buyer willing to pay close to that price. Forkner expected it to sell for about $16 million.

With the double whammy of a rooftop skate park that covered much of the structure and a seller whose privacy requirements necessitated restricted advertising and did not allow for open-house showings or any showings while he was on the property, Forkner said patience was required. It took two years to sell the property at a price of $10 million — lower than the $11.8 million Lil Wayne paid for it.

Forkner underscored the difficulty of selling luxury these days, particularly in Miami Beach. “It’s just supply. There are brand new megamansions everywhere, you have them all over the place — on the Venetian (Causeway), every other house there was a teardown, so you have a lot more supply,” he said.