In the last year, it’s been out of the frying pan of Covid-19 and into the fire of its aftermath for some of New York City’s largest general contractors.

The state’s new housing policy is a ray of hope, as are plans at the city level that favor real estate development, but it has been a trying year for the blue-collar side of real estate.

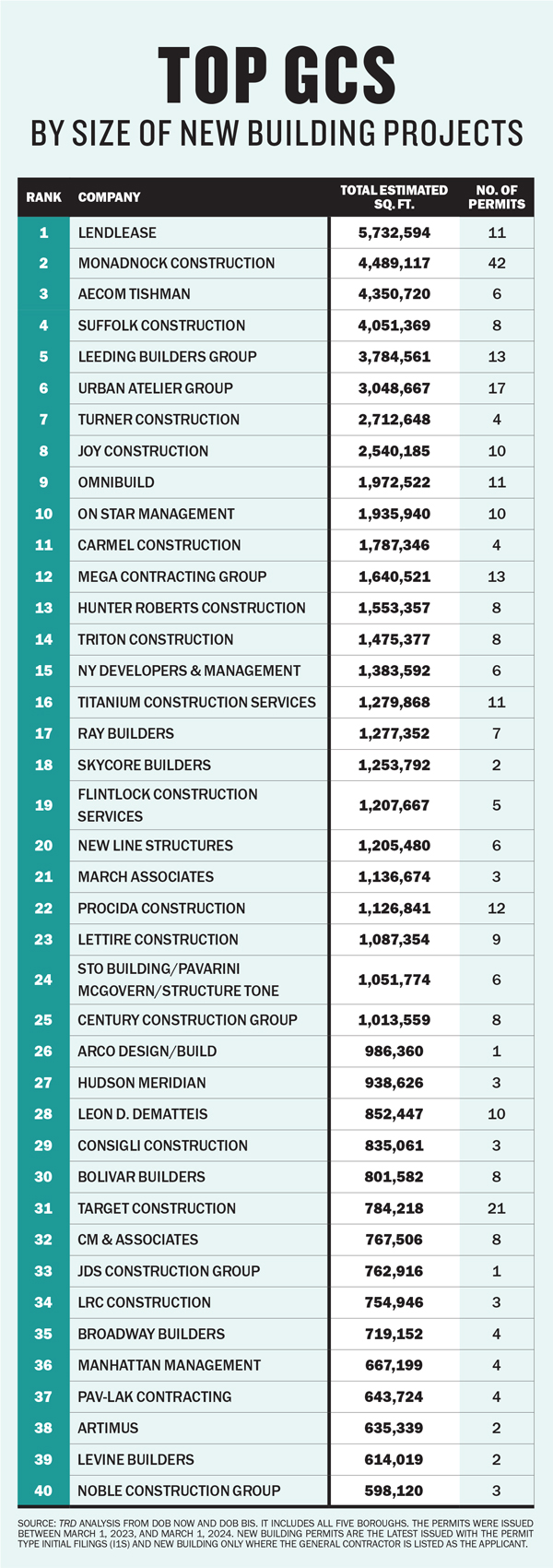

A familiar roster filled out this year’s ranking in The Real Deal’s general contractor rankings in the city, with megaprojects underway including the redevelopment of JFK Airport, the new Midtown headquarters for JPMorgan Chase and a film studio in Astoria, Queens, backed by Robert De Niro.

What comes next is a trickier question.

The future of office remains uncertain. While hybrid work habits have largely stuck, there’s a lack of demand for office, and builders have encountered obstacles on the supply side.

In 2023, the market for new multifamily projects was decimated by the expiry of 421a, a tax abatement considered essential for developers to build at required levels of affordability, and most new hotel construction remained frozen by a regulatory hurdle.

“The obstacle is that in some ways there is no bottom to the market,” Maurice Regan, founder and CEO of general contractor JT Magen, said by email. “Construction management companies like us, because of the backlog, got through Covid, but now we’re at the other side.”

Contractors hope the new housing agreement from Gov. Kathy Hochul and the legislature will enliven the market for multifamily construction and office-to-residential conversions. They also hope to make inroads on the high price of insurance, which they blame on overly litigious slip-and-fall cases.

There appears to be ample room for improvement.

Doing what works

Large projects like JPMorgan’s 2.5-million-square-foot headquarters, rising at 270 Park Avenue, and the $19 billion redevelopment of JFK have helped sustain many contractors for years. But the pipeline for new construction appears pinched.

In the last quarter of 2023, among the five largest new building applications were ones for a 28-unit apartment building in Rockaway Beach and a single-story commercial building on Staten Island.

Applications for new construction fell by 75 percent in Manhattan from the year prior, according to a report from REBNY. Developers filed one-quarter fewer new building applications in Brooklyn and Queens, and 50 percent fewer in the Bronx, compared to the third quarter of 2022.

Business should rebound thanks to action in Albany, but multifamily developers must meet deeper affordability requirements and pay workers higher wages on certain projects, so the margins could shrink.

“We expect to see a significant increase in activity during the second half of 2024,” said Mario Carone, a principal of the open-shop LBG, a subsidiary of construction giant AECOM.

LBG is working to finish Wildflower Studios, a 700,000-square-foot film production studio backed by De Niro in Astoria, and a 26-floor office building on Billionaires’ Row. Vornado’s Sunset Studios project at Pier 94, on Manhattan’s West Side, is among JT Magen’s active projects.

An office tenant build-out specialist, JT Magen has found constant clients in law firms and financial services. The industries have been among the biggest boosters of new office space, including One Vanderbilt and Hudson Yards, that came to market just before the pandemic.

However, there’s no getting around the challenges facing the office market. “There’s not a lot of confidence in taking more space,” Regan said, “and new construction for the most part has ground to a halt. There are some sporadic spots of sunlight, but the volume isn’t there.”

This has led his firm to explore other opportunities.

“There is a virtually unlimited amount of data center work available,” Regan said, a result of the burgeoning artificial intelligence industry, but in such specialized work, it “takes years to build up the staff and the experience.”

While virtually all construction of new free-market multifamily halted, the drop in construction activity was less of an issue for Joy Construction, which tends to build fully affordable developments, including one with more than 600 new units rising on 207th Street in Inwood.

Financed by tax-exempt bonds and low-income housing tax credits, many such projects have hummed along.

“Moving too far up the income range is something I try to avoid,” said Joy principal Eli Weiss, because fully affordable projects tend to have more government backing. “There is tremendous demand [for affordable housing], but it is never an easy business.”

Weiss praised the Adams administration for tackling overzealous zoning regulations through its City of Yes initiatives. “Looking back from Covid through 2023,” he said, “it’s better now.”

Supply chain salve

At the very least, contractors say that supply chains have improved, even though they remain slower and messier than before the pandemic.

“By the middle of 2023, it was fading as a topic,” Weiss said.

Contractors are now more likely to buy crucial materials from domestic sources and to use a greater variety of suppliers to hedge against another possible disruption, according to AECOM Tishman’s John Kovacs and Eric Reid.

The company is at work on a rare type of project in New York City: a new hotel.

Plans for Extell Development’s hospitality offering on West 48th Street, in the Diamond District, predated a special permit requirement passed by the City Council in late 2021.

Lead times for materials remain two to three times longer than before the pandemic, according to Regan of JT Magen, affecting construction costs and delivery times. The availability of electrical switchgears has been a particular pain point for some contractors.

Regan’s firm has created a division since the pandemic whose responsibility is to ensure the smoothest supply chain possible, including tracking shipments that go to its own suppliers.

“In the past, when a vendor had materials, generally it was the vendor’s responsibility,” Regan said. Not anymore. “It’s not ideal, but it has helped over the past 12 months.”

Under siege

Large general contractors rely on a sprawling network of subcontractors for the many specialized trades needed to construct any building.

Higher insurance costs have hit the subcontractors hardest, to the point where some risk going out of business entirely, a number of general contractors said.

“New York is very litigious and plaintiff-friendly,” agreed Joy’s Weiss. “Insurance costs have easily doubled in the last 10 years.”

“The cost of insurance now far exceeds 10 percent of total construction budgets,” LBG’s Carone said, including “general liability, workers’ compensation and excess liability for subcontractors, the general contractor and owner, plus builder’s risk insurance.”

“The main factor driving up insurance costs is fraudulent or exaggerated injury claims,” Carone added. “There is an entire ecosystem of doctors, attorneys and litigation-funding companies that coach workers through the motions to extort windfall tort settlements.”

The trade group Associated Builders and Contractors is pursuing legislation at the state level to make staging a construction site accident a felony, following a spate of what it says are suspicious injuries.

Carone says the proposed legislation also seeks to reform “third-party litigation lenders,” which make cash advances to plaintiffs in exchange for a portion of any legal recovery.

“It’s the demo subcontractors, the structural steel subcontractors, the concrete guys and the scaffolding companies that are often most at risk,” Regan said.

“A lot of smaller companies are suffering.”

Access the comprehensive data set supporting this ranking, including key contact information, by visiting therealdeal.com/data.