Unfavorable conditions burdened general contractors over the past two years, though Chicago’s top firms have learned to adapt.

“If you’re in the construction business, you don’t have the luxury to sit on the sidelines. You have to seize the opportunities that are available to you,” said Damian Eallonardo, an executive with W.E. O’Neil Construction and board member of the Chicago Association of General Contractors.

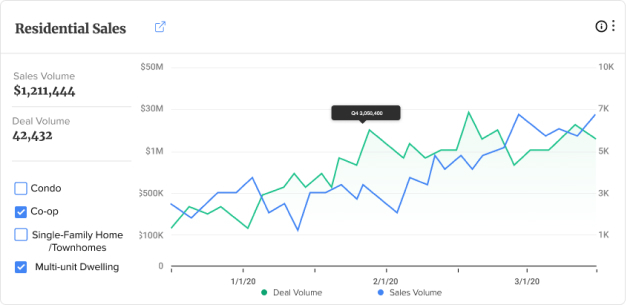

Battling high interest rates, construction costs and a lagging development pipeline, Chicago’s top contractors saw a major dip in work volume in the city in 2023. But the city appeared to stage a comeback in 2024.

Of the city’s top 20 contractors, 17 brought in $100 million or more in new work in Chicago in 2024, according to permitting data analyzed by TRD. That marks a major jump from 2023, when just five firms crossed the $100 million threshold. (The initial construction estimates for projects are often lower than their final finished cost.)

Resilient revenue

Some of the year’s biggest permits point to promising spots of growth in a market that has otherwise been strained by a lagging pipeline and stalled megaprojects.

“The number of opportunities that we have had the chance to compete for is up year-over-year by a substantial amount,” Eallonardo said.

In Streeterville, Related Midwest broke ground on an apartment tower on a long-abandoned development site. After the 150-story Chicago Spire project proposed for the same property failed, a gaping hole on the site sat undisturbed for 15 years, highlighting the difficulty of restarting a similar development in its place.

LR Contracting Company, developer Related’s in-house firm, scored a $259 million permit for the first phase of the project which includes a 72-story, 635-unit apartment tower. The tower is the first of two planned for the site and will cost more than $500 million when complete.

“The number of opportunities that we have had the chance to compete for is up year-over-year by a substantial amount.”

Meanwhile, an overhaul of Chicago’s O’Hare International Airport that was announced in 2018 but threatened by inflation-related cost increases, got back on track. The city reached a deal with airlines on a new phasing plan for the project that helps address cost changes. W.E. O’Neil scored a $250 million permit for continued work on significant renovations and expansions to Terminal 3. Clark Construction Group is serving as the construction manager.

“At O’Hare or Midway [airport], that’s where there is lots of economic activity in Chicago,” Eallonardo said.

Other projects that have proven more resilient to economic headwinds include life sciences and higher education-related developments.

Turner Construction Company was issued a permit for the ground-up construction of a cancer care facility at The University of Chicago. Foundation work began in 2023 and the $263 million vertical construction phase kicked off this year.

Branching out

Even with an uptick in activity, Chicago’s development pipeline remained sluggish due to unfavorable financing options, which has forced contractors to broaden their scope to find new work.

Sometimes that meant identifying growing pockets that are ripe for development opportunities.

“There seems to be a big push in West Woodlawn,” said Andy Schcolnik, president of the Southside Builders Association. “There’s been a tremendous amount of new housing being built there.”

In other instances, contractors may need to pursue the most in-demand development sectors, even if it’s outside their realm of expertise.

“In our core sectors, we are seeing the most activity with aviation and multifamily but we have to follow our client,” Eallonardo said.

For his firm, W.E. O’Neil, this meant that in addition to working on the O’Hare expansion, it also pursued projects with existing clients in other states including Oklahoma and Michigan. Likewise, it leaned into high-end retail development, despite it being a smaller share of W.E. O’Neil’s work.

Subscribe to TRD Data to unlock this content

In April, Mayor Brandon Johnson announced a slew of 100 policy changes aimed at improving the city’s cumbersome permitting process. Proposed changes included eliminating minimum parking requirements for new developments, allowing conversion of ground-floor commercial spaces to residential, and possibly combining the Community Development Commission with the Chicago Plan Commission.

But so far, it’s unclear if the changes have made a substantial impact on permitting timelines.

“My experience with the permit process is not good,” Schcolnik said. “There must be a way that this could be streamlined somehow without them leaving a whole bunch of things unstudied or a lack of due diligence.”

Chicago has boasted strong rent growth over the past two years, bolstered by the city’s sizable job market and low supply of new inventory. But even as the multifamily market draws interest, investors can struggle to make new projects pencil out.

“The cost of construction is probably outpacing rent growth,” Eallonardo said. “Its cheaper to buy an old building and fix it up.”

Though not reflected in Chicago permitting data, many local contractors supplement the city’s lagging pipeline by seeking out work in other cities where barriers to building new are lower, he added.

Bracing for the unknown

When construction costs shot up during the pandemic, contractors felt the pain. Costs have not returned to prepandemic levels but appear to have leveled off since 2023.

Research from Minneapolis-based development firm Mortenson found that construction costs nationally remained flat through the third quarter of 2024. Costs in Chicago were slightly lower than the national average, according to its data.

Still, as the new year and new presidency take shape, contractors will have to be ready to adapt again.

President Trump announced Feb. 12 a plan to tax foreign steel and aluminum imports by 25 percent, potentially sending construction material costs up again. He also instituted additional 10 percent tariffs on Chinese goods and almost put a 25 percent tariff on goods from Mexico and Canada, before pulling back at the last second following agreements with the country’s neighbors. He’s promised reciprocal tariffs in the near future, ostensibly designed to equalize what the president deems to be trade imbalances.

How the impact from tariffs shakes out will remain a hotly debated issue. It will be advantageous for contractors to stay ahead of the curve, and keep tabs on trade negotiations between the U.S. and its trade partners and monitor and react to supply price fluctuations.

However, like years prior, Schcolnik suggests builders will continue to build: “I will continue to move ahead until it’s loud and clear that I gotta slow down and stop building right now.”

Access the comprehensive data set supporting this ranking here. TRD Data puts the power of real data in your hands.