Condo and multifamily development in South Florida is still booming, but signs of a market correction are appearing, as some builders are abandoning planned projects and listing their sites for sale.

In the past three months, nearly two dozen development sites across Miami-Dade County have hit the market, as small and mid-tier builders trim their project pipelines. In some cases, developers are pulling back because of high interest rates, lenders’ tightening terms and rising construction costs, experts say. About a quarter of the listed development sites have full zoning and building permitting approvals, based on an analysis by The Real Deal. The remainder have at least obtained site plan approvals.

Builders are hoping to cash out early after realizing that their projected returns on investment have been severely diminished by rising development costs.

“[Market conditions] are forcing certain developers to reconsider projects and monetize a site that they have spent preparing for two, three years,” said Alex Karakhanian, who leads Miami-based Lndmrk Development. “There’s an opportunity for sites that are shovel-ready to command a much more substantial premium than three, four years ago.”

Finding equity investors may also be more of a challenge.

Rising development costs mean planned projects have a higher cap rate, increasing the risks for equity investors, said Devlin Marinoff of Dwntwn Realty Advisors. “If you bought a development site two, three years ago, you would underwrite it with an exit cap rate at around 5 percent,” Marinoff said. “Now the costs are much higher, so your exit cap rate is at 6 to 7 percent. As a result, the equity you put into building a project disappears. That’s a market correction.”

Because of this, developers with a full plate of projects are seeking to unload some sites. Miami-based commercial broker Fabio Faerman is listing properties for development in Miami Beach, Miami, Homestead and Fort Lauderdale.

“In some cases, the sellers don’t have the money to build a project,” Faerman said. “In other cases, the equity investors have pulled out. And some are not moving forward because construction costs keep rising.”

Shovel-ready dev sites

In January, a development site in Miami’s Edgewater hit the market with a sweetener for prospective buyers who want to avoid the hassle of dealing with the city’s cumbersome zoning and permitting bureaucracy.

“The only available shovel-ready development site in Edgewater,” the offering memorandum boasted. “The property will be delivered with city of Miami approved plans, pending only the payment of impact fees.”

With listings for development sites surging since December, a property with full entitlements can be more attractive for out-of-town builders seeking to break into the booming Miami market, said Arthur Porosoff, whose brokerage is marketing the shovel-ready parcel at 459 Northeast 25th Street.

“We can’t wait another six months to execute. It’s like going to the casino. Sometimes you take chips off the table.”

Brickell-based Habitus Capital, the seller Porosoff is representing, bought the Edgewater development site for $1.9 million in 2022. Less than two years later, after securing city approvals for a 61-unit short-term rental condominium to replace two existing small apartment buildings with five units, Habitus is asking $5.1 million for it. The developer is tied up with five other projects in Miami, according to Porosoff.

“Shovel-ready is the name of the game,” Porosoff said. “You have buyers who don’t want to deal with the brain damage of navigating the city’s zoning and permitting departments. To have a shovel-ready project these days is very valuable.”

Indeed, sellers pitch buyers on the amount of time they will save by acquiring a shovel-ready development site, resulting in shortened construction timelines that are not at the mercy of volatile interest rates and market conditions two or three years from now, experts say.

“There is more of a premium for having a site that is fully approved with construction drawings than selling vacant land that doesn’t have anything,” said Colliers’ Virgilio Fernandez. “I have a ton of [listed] sites that have approved site plans, but only a few that are basically shovel-ready except for the impact fees.”

Last year, Fernandez co-led a Colliers team that sold a development site in Hialeah with “a complete set of entitlements from the city” to build a 151-unit apartment project up to eight stories, according to an offering memorandum. The site sold in August for $7.5 million after being listed for four months.

The seller, an entity led by Francisco Espinosa in Miami, paid $4.4 million for the property in 2021 and spent almost two years obtaining approvals from the city of Hialeah, Fernandez said.

“We had three bids, and we were going to sell to an arms-length, third-party buyer,” Fernandez said. “But one of the partners had the right of first refusal. He executed it and bought out his other partners.”

At Coral Gables-based Avenue 4, having shovel-ready development sites for sale is part of the business model, said principal Tony Pardo. “Sometimes we entitle stuff, then sell it,” Pardo said. “But we also build some. It all depends.”

Avenue 4 recently hired Porosoff to market a property at 6881 Indian Creek Drive in Miami Beach that’s fully approved for development of a quintet of four-story townhomes. The planned project would replace an existing two-story apartment building with 30 units that Avenue 4 bought for $4.5 million in 2017. Pardo said the site is hitting the market without a price, and declined to comment about the dollar amount that Avenue 4 would consider a good offer.

His firm currently has six other projects in various stages of development, he said, including a pair of apartment buildings with a combined 79 units in Miami’s Allapattah neighborhood that have design approvals but don’t have building permits. Avenue 4 “has too much on our plate,” so he and his partner, Fausto Callava, decided to sell the Miami Beach site.

Avenue 4 should have started the townhome project a year ago, but getting the building permits took longer than he and his partner expected, Pardo said. “We can’t wait another six months to execute,” he said. “It’s like going to the casino. Sometimes you take chips off the table.”

Buyer pool

Pardo expects the Miami Beach site will draw interest from developers based in the Northeast. “There are so many New Yorkers moving to that area,” he said. “That’s my sense as to where the end buyers will be from: New York.”

Other development site buyers hail from the Midwest, California and South America, experts say.

“I just sold a shovel-ready project in Little Havana to a Chicago developer,” said Porosoff, Pardo’s listing agent. “These guys don’t want to wait two years in a city where they have no experience and will have to hire lawyers and expeditors. It’s tough to get a site shovel-ready.”

But while they’re willing to pay a premium, the buyer pool for shovel-ready development sites is a finicky bunch, Colliers’ Fernandez said. “These groups have cash to deploy,” he said. “They are very selective and meticulous. A site has to check off every box on their list.”

William Ticona, CEO of Grupo T&C, a development firm based in Lima, Peru, took his time evaluating shovel-ready sites in Edgewater for his planned second project in Miami. “We were looking for several months,” Ticona said. “We saw a few shovel-ready sites, but we really didn’t like them.”

Reconfiguring the approved plans of those sites would have been the same as starting from zero, Ticona said.

“And some of the prices were too high,” he added. “There are many sellers who are land banking. And they are not in a hurry to sell.”

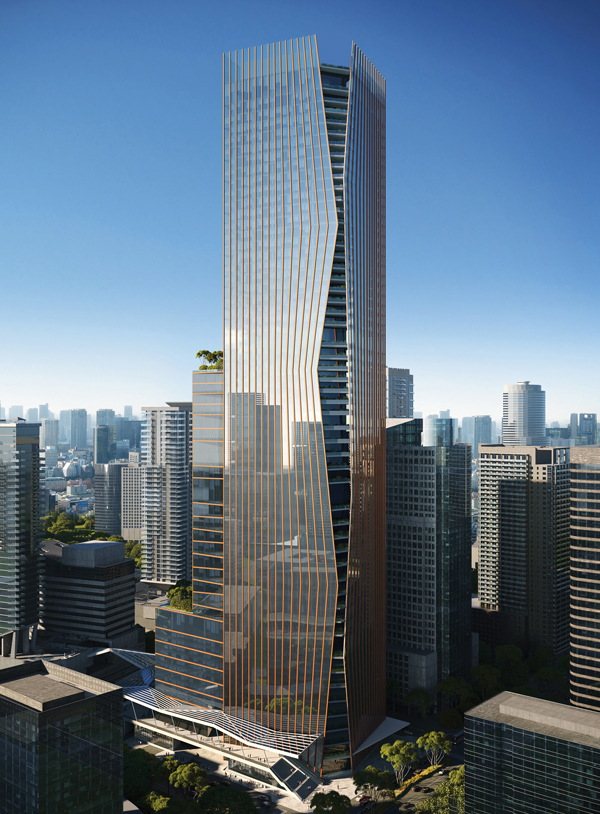

Instead, Ticona found a company that wanted a quick sale of an Edgewater development site that has zoning approval for a 60-story condominium or multifamily project. Last month, Grupo T&C paid $19.2 million for three lots at 423 Northeast 27th Street, 426 Northeast 28th Street and 434 Northeast 28th Street.

The seller, PR Group Florida, a subsidiary of Paris-based developer Groupe City, offloaded the 0.8-acre assemblage because the parent firm had abandoned a plan to expand into the Miami market. The subsidiary had submitted a site plan application for a 55-story condominium with 128 units. Grupo T&C is still going to build a condominium on the site but has not finalized the details, Ticona said.

“We needed patience to find the perfect site at the right price,” Ticona said. “We found a seller that had to do a deal quickly, so we ended up with more favorable terms.”