One day it was raining yuan on Los Angeles and the next it was gone. The promise of a gilded age of Chinese investment in L.A. real estate — sparked by deals like Dalian Wanda’s $420 million purchase of a Beverly Hills development site and Greenland’s massive $1 billion Downtown L.A. Metropolis project — has given way to a much harsher reality. One that features a whole lot less yuan.

Restrictions on China’s capital outflow, including a crackdown this March on what it deemed financial recklessness, and its ratcheted-up anti-graft campaigns, have torpedoed the country’s investment in U.S. real estate. Recently released numbers show the net result of those changes was a 55 percent year-over-year drop in Chinese investment in U.S. commercial real estate in 2017, with just $7.3 billion funneled in last year versus $16.2 billion in 2016, according to Cushman & Wakefield.

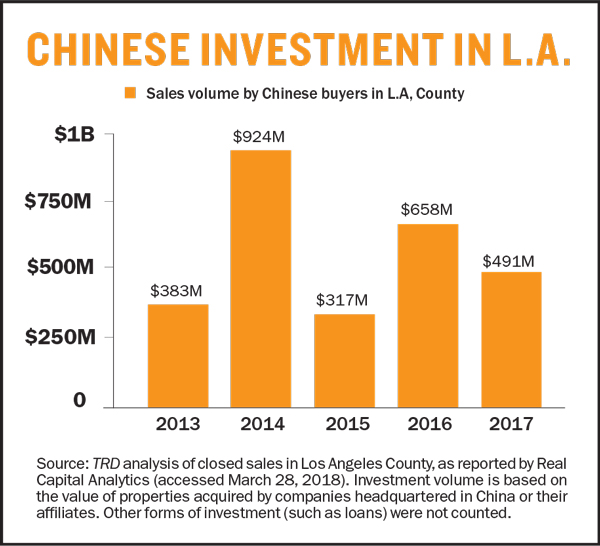

L.A. County saw a year-over-year drop of 25 percent, landing at just $491 million in 2017, according to The Real Deal’s analysis of closed sales as reported by Real Capital Analytics. That number is even more paltry when compared to 2014, when the county saw nearly $1 billion in Chinese commercial property investments.

Now the very same trophies Chinese firms made a splash investing in have been put up for sale. HNA put $16 billion in assets on the market, including two New York City office towers — one it had purchased for $2.21 billion and another it bought for $305 million. CEFC China Energy, too, recently put 100 properties up for sale that are valued collectively at $3.2 billion.

But there’s a silver lining: Industry insiders say China’s advance-and-retreat approach put assets in play that otherwise would not be, and presents a unique opportunity for developers who might otherwise have been priced out of the game.

Jonathan Woloshin of UBS Wealth Management said Chinese firms likely won’t get what they shelled out for properties purchased in the recent buying frenzy. “The Chinese were very aggressive buyers,” Woloshin said. “We will certainly see some lower values paid.”

Jim Butler, chairman of the Global Hospitality Group at law firm Jeffer Mangels Butler & Mitchell, said that while “big players have put properties on the market, it remains to be seen what this really means.” He added that “some people think this is a re-creation of what the Japanese did in the late ’80s,” referencing a time when Japanese investors put billions of dollars into the U.S. market, only for the properties to be liquidated for what he said was “pennies on the dollar.”

But that’s an unlikely outcome today, Butler said. Woloshin agreed, adding that he expects “there will be good bidding for them — maybe not at the prices that were paid, but I don’t see them being fire-sale.”

Gregory Karns, an attorney at Cox Castle & Nicholson who specializes in Asian investment, said it’s too early to say what will happen with the major properties being sold, but “they’re definitely going to sell.”

“The prices will come down,” Karns said. “It wasn’t like the Chinese were coming in second or third. They were the high bidders on most of these assets, which is why they acquired so many of them. With them dropping out, whoever was bidding second or third will be the new high bid.”

Greenland goes home

As one of the most visible Chinese firms locally, Greenland USA, the U.S. arm of Greenland Group, made headlines when it launched its vast Metropolis project, but now the firm is looking to unload pieces of it.

The company is looking for a buyer for one of its three residential towers at the project. Greenland purchased the parcel Metropolis is on in 2014 for $150 million.

CBRE’s Onno Zwaneveld is the listing agent on the tower, which is being marketed as an opportunity for a new developer to complete construction of the tower and then rent out units rather than selling them as condos, which is what Greenland had previously planned, per a CoStar report. Once completed, the tower will have 736 units across 56 stories. Zwaneveld declined to comment for this story.

In the fall, the Agency replaced Douglas Elliman on sales for units at Metropolis. A reason for the shakeup was not given. Roughly 80 percent of the first tower had been sold by the end of 2017, according to a managing partner at the Agency, Mike Leipart.

In the fall, the Agency replaced Douglas Elliman on sales for units at Metropolis. A reason for the shakeup was not given. Roughly 80 percent of the first tower had been sold by the end of 2017, according to a managing partner at the Agency, Mike Leipart.

Metropolis’ 350-key Hotel Indigo, operated by InterContinental Hotels Group, was also listed by Greenland, reportedly for $280 million, this year.

And last year, Greenland pulled out of a 1.9 million-square-foot mixed-use project proposed for the Red Line Metro station at North Hollywood. Trammell Crow Company is moving forward with the project. Greenland did not respond to requests for comment.

The announcements came after the Chinese government pushed back on overseas spending.

“You’re seeing what’s happening due to currency controls that went into effect in China about a year ago,” Karns said. “It has been a real reduction in the amount of Chinese capital coming into real estate here. That’s going to continue.”

Wanda winding down

Of the many projects Chinese companies have stepped away from, it was Dalian Wanda’s withdrawal from One Beverly Hills that left a crater-sized hole in L.A.’s landscape.

The Chinese investment group started looking for a buyer for the $1.2 billion luxury condo and hotel complex about a month after Athens Group left the project for undisclosed reasons. Wanda had paid $420 million for the plot in 2014, according to the Los Angeles Times.

The group is selling four other overseas properties as well, reportedly looking for one buyer to purchase all five projects, paying a cool $5 billion for the lot. The properties include the One Nine Elms in London and the Vista Tower in Chicago.

There has been some speculation that the One Beverly Hills project will be sold to a different Chinese company. Karns said that if any of the Chinese companies sell off assets to other Chinese companies, it would happen in China and “we’d only hear about it after it’s done.”

Hospitality hit hard

The hotel market seems to have suffered the most from Chinese divestment. There was a 90 percent decline in the dollar volume of hotel acquisitions in L.A. by Chinese companies in 2017, according to Cushman & Wakefield.

While there were a number of hotel transactions in L.A. in 2017, only one involved a Chinese entity — Han’s Holding Group, which purchased Downtown’s DoubleTree by Hilton for $115 million, according to Cushman & Wakefield data.

Anbang Insurance Group, which purchased Strategic Hotels & Resorts for $6.5 billion in 2016, significantly increased the numbers that year. Strategic Hotels includes the Loews Santa Monica Beach Hotel; the Montage Laguna Beach; the Ritz-Carlton, Laguna Niguel in Orange County; the Westin St. Francis in San Francisco; and the Four Seasons Washington, D.C.

In February, the China Insurance Regulatory Commission took over Anbang Insurance Group amid fraud allegations. It is said to be taking offers for a handful of Strategic Hotels properties. Anbang did not respond to requests for comment.

“These are all trophy hotels in incredible locations that usually don’t become available,” said Atlas Hospitality President Alan Reay. “Now the question is, will Anbang or the Chinese government sell these off as a package or individually?”

“These are all trophy hotels in incredible locations that usually don’t become available,” said Atlas Hospitality President Alan Reay. “Now the question is, will Anbang or the Chinese government sell these off as a package or individually?”

Anbang bought the properties from Blackstone for $500 million more than the asset management group paid for them roughly three months earlier. Reay said selling the hotels individually would earn more money but would take a lot more time. “Selling it as a package limits your buyer pool,” he said.

Woloshin said he would expect to see individual properties being sold rather than the entire portfolio, unless “a great price can be achieved by a buyer.”

Butler, however, said he doesn’t think Anbang’s hotel sales will draw the “feeding frenzy” some are anticipating.

“I don’t think this is going to be the kind of opportunistic investment opportunity that people are thinking,” he said.

Meanwhile, HNA Group is planning on selling $16 billion in assets during the first half of the year, according to Bloomberg. It reportedly has $90 billion worth of debt and is relying on employee investments. The firm is in talks to sell part of its investment in the Hilton spinoff Park Hotels & Resorts a year after becoming a shareholder. The stake is speculated to be worth about $1.2 billion. Hilton Worldwide Holdings said HNA started a sale of 63 million shares of its Hilton stock, according to Reuters.

Other properties put on the market by HNA Group include 245 Park Avenue, a Manhattan tower the group purchased for $2.1 billion last year; 850 Third Avenue, also in Manhattan; and 123 Mission Street in San Francisco.

Woloshin believes HNA Group will divest through “individual asset sales or a cluster in a given geography.” The company declined to comment for this story.

What to expect next

With so many assets up for grabs, the lack of closed sales indicates that “somebody is off on their pricing,” Karns said.

“My guess is that people who are seeing Greenland or Wanda selling think that they have to sell,” he said. “They are looking for a bargain. Maybe Greenland and Wanda will educate the market, [showing] that assets will not be sold at a bargain price, and we’ll see who the legitimate buyers are.”

Xinyi McKinny, co-author of Cushman & Wakefield’s China-US Inbound Investment Capital Watch report, said that the few big companies selling off assets do not accurately represent the bigger picture. “Everybody thinks all Chinese investors are selling their assets,” McKinny said. “That’s definitely not true. Besides those in the news, everybody else is doing okay.”

Butler agreed that Chinese investors aren’t entirely out of the picture. “Many have a long-term view,” he said, adding that Chinese companies that people have not yet heard of will likely be the bigger players moving forward.

“That doesn’t mean they aren’t big companies,” Butler said. “Some of these companies have built entire cities all over China.”

Woloshin said he would not be surprised if “Chinese investors pull their horns in for the time being.”

“They are sophisticated long-term investors. The game is not over for them, just maybe in the shorter term as they sort things out,” he said. “The reason money comes to the U.S. commercial real estate market is that we have among the most stable politics in the world, the best market and the best property laws in the world.”

McKinny pointed to the fact that though hotel sales to Chinese investors saw a sharp decrease in 2017, their purchases of suburban offices nationwide increased 136 percent and their retail volumes increased 29 percent.

She expects there to be smaller deals moving forward. Woloshin agreed that China would not be pushing the limits in terms of investment.

“The Chinese have been very vocal about having tighter capital controls, and the government has been very sensitive to the size of deals,” Woloshin said. “President Xi has been very vocal about making sure the country doesn’t get overextended. The message the government sent was maybe a couple companies got a little overextended and they wanted to get their house in order.”