For agents out east, life was good a decade ago.

The residential market on Long Island’s East End had finally recovered from the 2008 financial crisis — the aftermath of which lingered for at least the following four years.

With Wall Street back on a steady footing, so was the residential market along the sandy shores of the Hamptons: Listings were plentiful, home sales were steady, and anyone wanting a decent rental for the Memorial Day- to-Labor Day season was on the hunt come January.

But the 10 years since have brought rockier waters.

Home prices have nearly doubled, propelled by a pandemic-era rush. In the luxury enclave already known for its pricey mansions, deals for properties both on and off the waterfront reached new heights.

“Everybody wanted [the Hamptons], and they were gonna pay for it,” said Enzo Morabito, the head of a top-producing team with Douglas Elliman. “They bought because ‘suppose we can’t go back to New York.’ Everybody was picking a lifestyle, and they did it rather quickly.”

The sales boom sapped listings to historically low levels. With nothing left on the market, transactions stalled and were stuck at a plateau as rising mortgage rates, economic uncertainty and political unrest deterred would-be sellers from parting with their abodes.

The Federal Reserve’s pledge to start cutting rates this year led to an uptick in listings, but the central bank has since walked back its promise and the market has stuck in a state of limbo. Hamptons agents have now contended with two years of sparse inventory.

The rising tides

When Nest Seekers International’s James Giugliano started selling real estate in 2014, the Hamptons was a buyer’s market. It was dominated by secondary homes, and sellers often listed their properties with the same sentiment: “If I get my number, I’ll move.”

“Homes would be on the market for two, three, sometimes four years. [Sellers] would slowly make reductions,” Giugliano said. “There was just so much inventory. I remember in Bridgehampton, between $5 million and $8 million, there must have been something like 30 homes for sale.”

But now that the frenzy has subsided, “you’ll be lucky to even see five,” he added.

He added that the lack of inventory extends especially to new construction. Land prices are through the roof, and homes that were built in the last 10 or 15 years don’t always qualify for a teardown.

“I’m a real estate surfer. Sometimes you go out on the ocean, and the waves just don’t come. But if you sit there long enough, they will.”

“In 2014, I was doing a couple land deals a year with my eyes closed,” Giugliano said. But now, “the land has drastically gone up. The teardown [cost] has drastically gone up. And the opportunities have drastically pulled back.”

Though homes in the Hamptons have been notoriously expensive for decades, the pandemic pushed prices to unprecedented levels.

“It was total insanity,” said Corcoran’s Susan Breitenbach, one of the top brokers in the Hamptons.

The influx of buyers consisted largely of New Yorkers concerned that a post-pandemic return to Manhattan would be impossible.

“‘I’ll bid $100,000 more than that person, just get me the house,’” she said of a typical client conversation.

The market has since softened, but prices have yet to come back down to earth. The average sale price in the Hamptons was up 89 percent last year compared to 2013, according to data from appraisal firm Miller Samuel. The largest jump was between 2019 and 2020, when prices increased by 27 percent.

“Covid was a complete accelerator,” said Saunders & Associates’ Mark Greenwald.

Subscribe to TRD Data to unlock this content

He added that back in 2018 and 2019, the market had begun to soften, but it froze completely in the early days of the pandemic.

“We forget too quickly what that was like,” Greenwald said. But the freeze period didn’t last long, and with uncertainty about the future of life in the city, “[the Hamptons] became a little bit, in the buyer’s mind, less discretionary.”

With pricing boundaries expanded by the pandemic, and few listings to keep up with demand, the high end of the Hamptons market rose even higher. The average and median sale prices for luxury homes — defined by Miller Samuel as the top 10 percent of the market — hit their highest levels of the last decade in the fourth quarter of 2023.

In that period, the average sale price was just under $20 million, and the median sale price was just under $13 million. The two metrics stayed elevated last quarter, coming in at roughly $14 million and $11 million, respectively.

“What people are building now is much bigger and better than what they used to build. There’s much more investment going into these houses,” Greenwald said. “That bids up the price.”

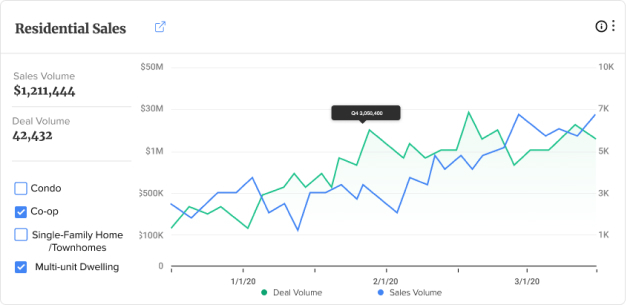

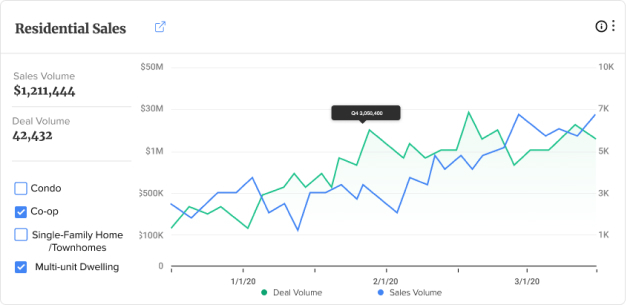

While prices have skyrocketed over the decade, listing inventory and transaction volume have declined. The number of sales was down 52 percent last year compared to 2013, while listing inventory decreased 36 percent in the same period.

In the luxury segment, the number of transactions has also declined, down 50 percent last year compared to 10 years earlier. But inventory at the high end of the market has expanded, with the number of listings last year more than double what it was in 2013.

Rental listing inventory is another story. For the last two summers, a glut of short-term stays has been languishing on the market.

A flood of investors had bought and rented properties chasing the sky-high prices seen during the pandemic. But in the following summers, those lofty rents didn’t line up. Demand for full-season rentals, particularly in the middle and low segments of the market, hasn’t reached pre-pandemic heights. Some people have instead opted for shorter stays or forgone the Hamptons altogether to catch up on international travel.

Subscribe to TRD Data to unlock this content

Moving the high-water mark

There’s a fresh breed of wealthy shoppers making waves in the market, said Hedgerow Exclusive Properties co-founder Preston Kaye.

Among the new group are tech executives and other entrepreneurs outside of the finance and private equity circles that typically feed the luxury enclave. They include Slack co-founder and former CEO Stewart Butterfield and Away co-founder Jen Rubio, who paid $32.2 million for David Walentas’ Southampton mansion in June 2022.

Clients have also changed when business happens, pushing the busy season beyond the usual May and September holiday bounds.

“We used to refer to the Tuesday after Labor Day as Tumbleweed Tuesday,” Kaye said.

But flexible work arrangements mean more are staying in the Hamptons year-round, extending their season through the fall or arriving earlier in the spring — which can be either a boon or a snag to brokers’ business.

With new money and changing interests, the residential scene has more sharks in the water than ever. A wave of brokerages seized on the area’s pandemic rush to expand east, including Adam Modlin’s Modlin Group, Serhant, Christie’s International Real Estate Group and The Agency.

The changing peaks and flow of business make it more difficult to forecast how the market may move out of its inventory cramp, but the cultural cachet means the residential guard old and new will be at attention for the foreseeable future.

“I’m a real estate surfer,” Morabito said. “Sometimes you go out on the ocean, and the waves just don’t come. But if you sit there long enough, they will.”