San Francisco’s largest residential brokerages fended off last year’s interest-rate-induced chill on deals, and many are at last expecting to wave goodbye to the bottom.

Though the numbers in The Real Deal’s ranking of San Francisco’s top residential brokerages showed how slow dealmaking can be when you’re at the low point, with 15 brokerages in the top 20 seeing sales volume and deal counts fall in comparison to last year’s list, some local leaders now view the market as glass half full.

“The good news is it’s much better than last year,” Jeffrey Gibson, who runs Sotheby’s International Realty’s San Francisco office, said.

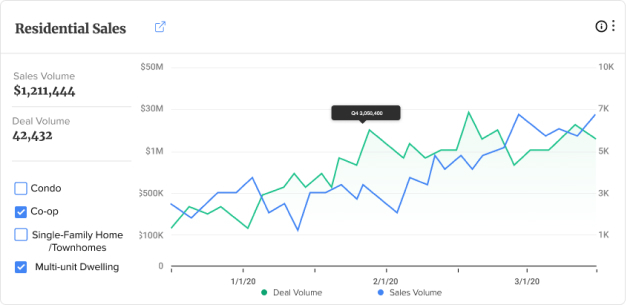

The rankings are based on information for buy- and sell-side deals reported on the San Francisco MLS between May 2023 and May 2024, so the bright spots that agents and executives currently see aren’t included. The data also does not include off-market listings and properties priced below $200,000.

Compass once again led the pack, with $5 billion in volume and 2,711 deals. That’s down from last year’s $5.8 billion in volume across 3,214 deals, thanks to the market slowdown. Still, Compass’ business is about triple that of its closest competitor, Sotheby’s International Realty, which ranked second. Vanguard, the largest independent in the Bay Area, followed in third.

The market conditions have led to a game of musical chairs among agents, though the shuffle has meant recruiting stayed flat for Corcoran Icon Properties, according to Steve Belluomini, the brokerage’s president. Icon Properties slipped one spot, to No. 5, with transaction volume of $579.7 million and 386 transactions.

“I have noticed a bit of migration,” Belluomini said.

The market is split between agents who are more self-sufficient and don’t require much support from a brokerage and those who want a higher level of support that they can pass along to clients, he added.

Subscribe to TRD Data to unlock this content

He said he does see new talent come into the market, presenting an opportunity for the brokerage to grow.

As for buyers, they are starting to expect a new normal for interest rates, which is helping prop up inventory, said Coldwell Banker Realty’s Jennifer Lind, the brokerage’s Western regional president. Coldwell came in fourth on this year’s ranking, with 450 transactions totaling $674.4 million. Workers returning to offices and business openings are driving downtown activity and could offer an early read on where the rest of the market will go, she said.

While waiting on a market comeback, interest rate cut and Aug. 17 implementation of the NAR settlement rules, Lind is advising agents to be diligent and opportunistic.

“I think there’s a transparency factor that’s playing out this year that we’re really leaning into,” Lind said. “I keep telling my team it’s a level-up moment for our industry, so we’re really embracing it.”

While the picture has improved, some acknowledged that deal flow is nowhere near as robust as it had been pre-pandemic or during the pandemic.

“It’s not a rocket ship, but the trades are happening more quickly,” Gibson said, adding that listings are spending less time on the market than a year ago. “Buyers and sellers are finding equilibrium on price, and so more deals are happening.”

So far, the market’s biggest deal this year came in May when the Presidio Heights home of venture capitalist and Hotwire co-founder Karl Peterson sold for $24 million, with Compass’ Steve Mavromihalis as listing agent. It knocked an April off-market deal for $23.8 million in Pacific Heights from the top spot for the year; BCRE’s Davide Pio was the listing agent and Sotheby’s International Realty’s Neill Bassi was the buyer’s agent for that property, at 2350 Broadway.

Neither sale signaled a major change for the market, according to Vanguard Properties President Frank Nolan.

“It’s been a slow climb out of [the bottom],” he said of the past year. “This year’s been better than last year, but it hasn’t been spectacular, nor were we expecting it to be spectacular. It’s in line with expectations.”

External forces

Even with inventories rising, some buyers and sellers are waiting out market uncertainties.

Nolan said he’s heard of some sellers — not clients of his — who have placed their properties on the market ahead of the election. However, he wouldn’t call what he’s seen a trend.

“I think the consumer’s more concerned about rates than they are the election,” he added.

Locally, it’s the mayoral election that could hold greater implications for the residential business, Gibson said. Incumbent London Breed is looking to snag a second term but will have to compete with more than a dozen hopefuls, some of whom promise to do a better job than her at tackling public safety, homelessness and downtown revitalization.

Politics aside, the outlook for 2025 is looking up, some say.

Entitled projects of all shapes and sizes, frozen for several years, could pick up, according to Nolan, who sees a development bounce likely to begin in the next year and a half.

“We’re now starting to see curiosity in that arena,” he said. High sale prices at single-family homes and condominiums are behind the renewed interest in development, he said.

Interest rates are likely to remain the sticking point.

“It’s still a seller’s market,” Belluomini said. “There’s a big pool of buyers and a lot are waiting for interest rates to go down. What they don’t understand is if they all jump off the fence at the same time, it’s even more of a seller’s market.”

Access the complete ranking, including key contact information, by visiting therealdeal.com/data.