My minivan is stuck in traffic in Lakewood.

I’m on a tour of the New Jersey boomtown with one of its own. Our car passes hitchhiking Haredim going to and from Beth Medrash Govoha, where 9,000 young men study Talmud. Once we’re out of the yeshiva gridlock, we accelerate, avoiding other minivans, as we make sporadic stops, turn down cul-de-sacs and pause at retail centers.

Not everyone’s steering is as deft as my guide’s, and at one point, the driver of a pick-up truck with road rage gets out and yells at a student behind the wheel of a sedan.

The guide points to the hot spots: Tottini, a children’s clothing store, the Hat Box, for the prevailing black fedoras, and the restaurant recently vacated by Seared, an upscale steakhouse that went viral when a customer’s receipt totaled $7,000.

“Ultimately Hashem decided this wasn’t a restaurant for a town of Torah,” an anonymous business owner in a kosher food blog noted.

This is small-town America, New Jersey Orthodox Jewish style. Family and faith are the fuel for growth in the township, where population doubled between 2000 and 2020 to about 135,000. The problems of success — gridlock, housing costs and fights about new development — animate public conversation and town hall meetings.

But families have to pay bills and put food on the table, and Lakewood’s primary industries, nursing homes and real estate, have underwritten that expansion. The township’s residents run title companies, brokerages and businesses in every obscure niche of commercial real estate, often servicing partners from nearby Orthodox communities. For a while, swaths of New York City deals in the $10-to-$50-million range seemed to touch Lakewood: Some piece of the loan or the closing document would come from a Lakewood address, even if the marquee names and companies didn’t seem connected.

Yet the business has brought a darker reality, too. In recent months, Lakewood investors Aron Puretz and his son, Eli, have each pleaded guilty to one count of conspiracy to commit wire fraud; both got prison sentences. Fannie Mae put Lakewood-based title insurers Riverside Abstract and Madison Title on its blacklist. A sprawling investigation by the Department of Justice and the Federal Housing and Finance Agency into commercial mortgage fraud has touched the core of Lakewood.

On Jan. 8, a week before I visited, panic struck the town. A nursing home executive had filed a lawsuit against Mark Nussbaum, a real estate attorney many in the community used. The plaintiff was seeking to collect $15 million in escrow money. Some of the alleged missing funds were linked to Borough Park real estate investor Mendel Steiner, who owned at least 4,000 units nationally.

A day after the lawsuit was filed, Steiner shot himself. He was 33 years old. Though Steiner was from Brooklyn, his death unnerved Lakewood in a way not even the federal investigations and recent crackdowns had.

I’m here to understand the place at the center of the federal prosecutors’ investigation into suspect real estate transactions, but almost no one wanted to discuss these topics, least of all with me, a guy from a news outlet they worry is airing the insular community’s dirty laundry or worse, ruining people’s lives.

Some in Lakewood blame lenders involved in the suspect transactions. Prosecutors are choosing the guy with a yarmulke rather than the banker with a Manhattan office, they say.

“You give a couple dollars to BMG … and people will be literally licking your toes. It doesn’t matter what you did. The facts are you go to BMG and all that is around is money, money, money.”

Eli Puretz, who is staring down a sentence of two years in federal prison, thinks it’s more complicated. After my car tour, I meet him at a kosher restaurant overlooking a golf course.

Puretz, who lives in Lakewood’s neighboring suburb Jackson, was part of a transaction involving an office complex in Troy, Michigan. His crime is that the deal relied on an illegal flip, which meant JPMorgan lent him and his partners $45 million, more than the actual sale price. At his sentencing, New Jersey District Court Judge Robert Kirsch told the younger Puretz he was a “novice swimming in a shark’s pool.” At the time the deal started, he was 24 years old.

Now 29, he still looks the novice, young with a boyish face. He is upbeat but reflective. His sentence starts in July.

Puretz and I order the same appetizer: smoked brisket flatbreads with garnishes of apple jam, spinach, pickled onions and garlic aioli. Only a few Lakewood machers are inside the modern, dimly lit space with us, and another table of older women behind us is celebrating a birthday.

It would be easy for Puretz to blame others. His co-conspirators were his father and the embattled Boruch “Barry” Drillman, and both had deeper knowledge of real estate than he did. Letters supporting Eli Puretz at his sentencing described Aron Puretz, who got five years, as “cold, rigid and dictatorial,” though Aron’s attorney has disputed this characterization.

“I don’t think we would be looking at Mr. Puretz if it weren’t for his father,” Judge Kirsch said at his sentencing in early January. (The book of Ezekiel disagrees: “A child shall not share the burden of a parent’s guilt.”)

But Puretz’s story cuts deeper than a broken family.

A hustle culture predominated in the insular community; other young people seemed to find instant success. The pandemic made things worse, with low interest rates and easy money from federal programs burning holes in the pockets of the town’s 20-somethings, who were willing to take risks and learn on the go.

“The community today is definitely taking all of this as a wake-up call,” Puretz says, relocating the aioli to the side of his plate. “It’s going to be a tough journey, there is no question about it.”

The scandal is rippling through the town, not just the businesses and families but also the faith.

“Even though the rabbis may have been pushing this aside for quite a while, they’re waking up to it,” Puretz added. “They don’t have a choice.”

Chosen suburb

In the late 1800s, Lakewood pitched itself to New Yorkers as a winter retreat.

The rural enclave about 70 miles south of New York City boasted that it had warmer winters than other New England cities. A son of railroad magnate Jay Gould built his version of the Biltmore Mansion, a Georgian-style estate with tennis and squash courts, a pool and three bowling alleys. It’s tucked between tall pines and is now part of a private college, Georgian Court University.

Across the street is Beth Medrash Govoha, or BMG. The Orthodox yeshiva, founded by Rabbi Aharon Kotler in 1943 with 13 students, is now the largest in North America and the center of life in Lakewood.

The place is a hodge-podge collection of architecture. Students in white button-downs and black velvet yarmulkes scramble from building to building to dissect portions of the Torah in study groups known as chaburos.

The campus’s newest building feels like a spiritual center combined with a medical office. Etched into the portico in Hebrew and English is the last name of a key donor: Meridian Capital’s Ralph Herzka, who donated the building in honor of his parents.

Young men, many with families, come to Lakewood from throughout the U.S. for the equivalent of a master’s degree in intensive Torah education. When they stay, Lakewood swells.

“BMG has been the primary driver of Lakewood’s recent growth, and of the revitalization of the local economy,” BMG wrote in a filing about whether New Jersey had used public funds for private religious schools.

In the 1990s and 2000s, Lakewood developed a reputation as an affordable Orthodox suburb compared to Brooklyn, Monsey or Long Island’s Five Towns, with cheaper land and cost of living.

By 2009, about a quarter of all families in Lakewood were headed by BMG alumni, yeshiva leaders claimed.

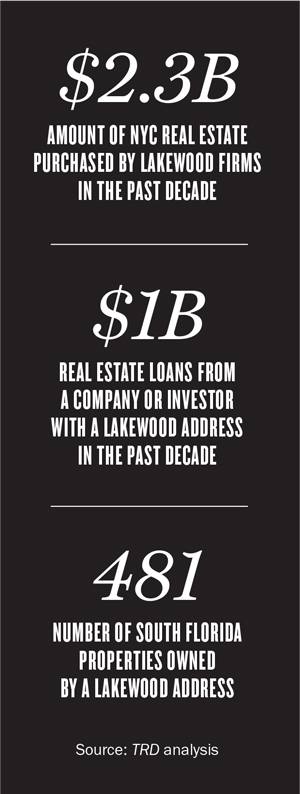

The deals were accelerating at a similar pace as the population. Lakewood firms purchased $2.3 billion in New York City real estate across 540 deals over the past 10 years, an analysis by The Real Deal found. At least $1 billion worth of loans came from a company or person with a Lakewood address. In a TRD analysis of South Florida, another 481 properties have an owner with a Lakewood mailing address.

Property in Lakewood was also growing more valuable. Successful residents put up bigger and bigger homes with modern designs. Aron Puretz’s house spanned 8,000 square feet with 11 bedrooms and 13 bathrooms. Investor Shaya Prager, known for his use of an ownership structure involving ground leases to take out loans worth more the value of his real estate purchases, has a house just under 6,000 square feet valued at close to $3 million.

Young and hungry

Eli Puretz moved to Lakewood as a teenager from New York City, where his grandfather was referred to as Staten Island’s Jewish Donald Trump.

He struggled with school, getting expelled from a yeshiva upstate before graduating from another. He moved to Lakewood and took up the local trade.

This — yeshiva, then a business endeavor — is the typical path of a young man here.

Many idolize the business bigwigs associated with BMG: Prager of Opal Holdings, nursing home executive Louis (Lazer) Scheiner and David Lichtenstein of Lightstone Group are among the notables, in addition to Herzka.

But the graduates don’t have much in the way of formal business education, and so they have to pursue careers with low barriers to entry, Puretz believes. Nursing homes and real estate fit the bill.

“It’s definitely been a machine that’s been on this vicious cycle, and I think that people just look at my story as well as similar stories and just think that it could have been them,” he said.

Puretz worked for his family business then set off on his own to look for a deal. Some graduates make cold calls for top commercial brokers, and others become syndicators who collect money from dozens. Still others join the army of eager young debt brokers for Meridian Capital or Eastern Union or sign on at title firms such as Madison and Riverside to set up lenders and buyers with insurance underwriters.

All embraced a similar culture of grinding 24/6 (and resting on the seventh day). Eastern Union’s Ira Zlotowitz gained the reputation as the master of the cold call. Riverside Abstract’s unofficial motto was “Do whatever it takes.” Meridian’s: “Eat, Sleep, Close. Repeat.”

Everyone remembers who gave them their break.

“I give tremendous loyalty and I expect it back,” Herzka said at an industry event.

This cycle of hard work and dues-paying has become Lakewood’s specialty: big groups of little guys making enormous deals happen.

“If you submit false financials about the property you’re purchasing or refinancing, you’ve likely committed bank fraud. The only reason I say likely is because I am a criminal defense attorney and I would never implicate my clients.”

There was a heimish, or friendly, way of doing business with other community businesses.

Riverside famously offered “soft deposits,” or short-term loans, giving investors the ability to put down the initial deposit needed to close on an acquisition. This launched a few careers in Lakewood, sources said.

This hard-driving ethos pushed Lakewood-based title firm Madison Title to rank fifth on TRD’s 2018 list of New York’s largest title insurance companies with $2.3 billion in transaction volume. Riverside Abstract ranked 10th with $1.56 billion in volume.

“Our clients are young, aggressive, they’re traveling, working hard, hustling,” Riverside Abstract’s co-founder Shaul Greenwald said in a 2021 interview.

Otherworldly wealth

It’s hard to pinpoint when exactly things changed in Lakewood.

The relationship between studying Torah and making money had been fraught from the beginning. Kotler, founder of the Lakewood yeshiva, wanted to escape the assimilationist Jewish ambition, the kind that had Jewish parents pushing children to be doctors or lawyers, and set future generations on paths of observance “without concern for livelihood,” as David Landes put it in a 2013 Tablet article.

But money and culture seep in, especially when you’re in the real estate business in New Jersey. Over the last 15 years, a balance between observance and material success emerged in Kotler’s town. Often the worlds collided.

In 2012, BMG held a ceremony to honor Kotler’s legacy at BMG, which 15,000 attended. The festivities included a groundbreaking and naming of the Herzka building. Billionaire industrialist and junk bond king Ira Rennert arrived in Lakewood by helicopter for a Torah scroll dedication, one publication reported.

BMG went into real estate as well. Its industry arm spearheaded a $15 million investment with public grants to construct the Cedarbridge Corporate Park, a sprawling corporate park of 1 million square feet of buildings that inject Miami-inspired design into a suburban office complex. The project was expected to bring in $35 million for the yeshiva’s endowment, its leaders claimed.

“This is not a private development by private people making money,” Jack Mueller, chief executive officer of Cedarbridge Development Urban Renewal Corporation, told the Asbury Park Press in 2019. “It is going for higher education and a great cause.”

Meanwhile, the town’s marquee companies were hosting parties that resembled those thrown by Manhattan power players.

In 2015, Riverside, the title company, had a blowout holiday bash in Chelsea with more than 1,000 attendees. A buffet had sashimi and a carving station and stretched over a city block, one blogger claimed.

New sushi restaurants and modern steakhouses started opening in the Lakewood area. Last year, a Tesla Cybertruck appeared in town, wrapped in red, white and blue. Someone had donated it to an emergency response organization in Lakewood.

For many, nicer homes, fancier clothing, better restaurants and high-priced Passover trips fit easily into an American dream life coupled with Jewish law.

But others noticed that affluence had altered the town, especially among a younger generation who had never known anything simpler.

“Because of their surroundings, [people] are living so fast-paced, and the luxuries are moving so fast — and so extreme — and they’re seeing the trajectory of people going from zero to 100 so fast, that they’re kind of like clouding their judgment,” Eli Puretz said, citing his own experience. Young Lakewood residents feel like they have to make it big, fast, not by the time they’re 50 but before 30.

“It is a really true phenomenon in the frum community and in Lakewood … the obsession with wealth from the top down,” one anonymous person said in a voice message to Halacha Headlines, a podcast with Lightstone’s David Lichtenstein, after it featured Puretz in November.

“You give a couple dollars to BMG … and people will be literally licking your toes. It doesn’t matter what you did. The facts are you go to BMG and all that is around is money, money, money.”

A survey of legal and agency actions against Lakewood-connected operators suggests the quest for instant wealth got out of hand.

To the outside world, the first cracks in Lakewood’s real estate universe emerged in late 2023 when Freddie Mac placed Meridian Capital Group under investigation over allegations some brokers falsified financials. Meridian has since been taken off the list, though with some sharp caveats.

Next, the 36-year-old Drillman pleaded guilty to wire fraud. Then Madison Title and Riverside got put on Fannie’s blacklist. The Puretz duo and their co-conspirators pleaded guilty in succession starting a few months later. The year finished when Fannie paused doing deals with Lakewood-based Sevenstone Capital and Eastern Union. (Eastern Union claims it was “dragged into this by the actions of others no longer employed by Eastern Union and we fully expect this to get cleared up.”) None of these firms have been charged with any wrongdoing by the DOJ.

The basic playbook was that the less you could put down on a deal, the more you could make on it, and Lakewood investors relied on others in that endless number of title companies, brokerages and businesses in every obscure niche of commercial real estate to put together projects. As interest rates shot up in 2022, some in the community who had put savings in with these machers saw their deals collapse.

In certain deals, lenders, like JPMorgan in the Troy Technology Park, were simply defrauded, resulting in a $20 million loss. In others, such as the Dutch Village and Pleasantview owned by Mendel Steiner, some say lenders all but wrote blank checks. Bank of Montreal provided a $160 million refinancing to Steiner for a rental portfolio the Kushners sold for $70 million in 2021, and while BMO claims Steiner misled them about the actual purchase price, according to an article in the Baltimore Banner, the loan raises questions about the due diligence of the check signers, who seemed to believe that Steiner could have more than doubled the value in less than three years at a time when interest rates increased.

“While much attention has been given to fraud committed by brokers and buyers, the real scandal lies in those financial institutions that, at best, turned a blind eye and, at worst, actively encouraged these practices,” Joseph Kahn of VisonRe, a real estate services company, said. “Some lender actions that have come to light recently are reminiscent of the opioid crisis, where drug manufacturers may not have forced anyone to partake, but they certainly provided every opportunity and incentive to abuse the ‘drug’ of easy money. This lust for fees was no different than in any other area of finance.”

Community members also debate what went wrong and who is to blame.

Some had started wondering about the mysteriously fast success of some of the younger real estate guys, like Steiner, Prager, and a 35-year old, Moshe Silber, from Suffern, New York, who worked with Lakewood dealmakers.

Silber lived in particularly splashy fashion. He claimed to have a real estate portfolio of $1.3 billion, along with a private jet. His jewelry and cars were valued at $2 million, according to a personal financial statement obtained by TRD.

Sometimes the talk was conspiratorial.

One anonymous blog post comment read: “BD [Boruch Drillman] is a mosser. BD is a mosser. BD is a mosser. BD caused Riverside to close and caused Madison to lay off hundreds of employees feeding their families” (mosser is Hebrew for a Jewish person who informs on other Jews).

“The anonymous commentators are liars with axes to grind — and smeared Barry anonymously because they don’t want to be sued for defamation,” Drillman’s lawyer, Jeffrey Lichtman, said. “Barry has accepted full responsibility for his conduct and will face the consequences, without any disingenuous spin or apology tour.”

In Lakewood, the lavish spending extends to charity.

On the day of my visit, the community’s brighter side was apparent. I saw signs for charities everywhere, and they followed me in banner ads on local news site the Lakewood Scoop. Tomchei Shabbos provides Kosher meals for anyone on Shabbos and Yom Tov. Chai Lifeline, a charity for people impacted by illness, trauma or loss, hosts a bike race called Bike4Chai that raises $70 million annually.

“There’s probably no other community in the world that has this amount of charity and organizations and nonprofits,” Puretz said.

A matter of life and death

Eli Puretz is the first to admit he made a mistake, a really big one.

When he found the Michigan deal, he sought to broker it but eventually players more seasoned than himself led the way, Puretz said in the podcast interview.

“I would say that the consequences that I’m dealing with are definitely a mix of my mistakes together with a mix of the community that’s been allowing it,” Puretz tells me as lunch winds down, late in the afternoon. “There were many people along the way or around me that could have stopped and taken stock and corrected some of that and seeing me being so new and so fresh and green that instead allowed it to continue or maybe even encouraged it.”

But, he adds, “I would stop short of saying that the community as a whole let me down.”

Judge Kirsch, who sentenced Eli Puretz, noticed the contradictions. He admired the charity work in Lakewood, he said, but found it odd that the insular community did not jump in when it saw a young Puretz “floundering.”

“There’s probably no other community in the world that has this amount of charity and organizations and nonprofits.”

“Dirty laundry is not shared,” he says. “What happens in one family’s household is that family’s business.”

“People are caught for white collar crimes all the time but when it hits home, it’s the guy that you see at your sister’s wedding or the guy that you are going to be on the same table with in synagogue the next morning praying,” Puretz reflects.

“It’s like, okay, we got to make sure we’re on the right path.”

Though some say Lakewood is unfairly targeted, that a few bad apples did bad deals, there are signs of a correction. Recent articles in Jewish magazines and Lakewood websites have delved into the problem of iffy deals and lack of financial education in the yeshiva system.

In November, famed defense attorney Benjamin Brafman offered advice to the Lakewood community. At another event, Aron Puretz’s lawyer, Steven Yurowitz, led a talk at Tiferes Bais Yaakov, in a local high school auditorium.

“If you submit false financials about the property you’re purchasing or refinancing, you’ve likely committed bank fraud,” Yurowitz said. “The only reason I say likely is because I am a criminal defense attorney and I would never implicate my clients.”

Another piece of advice: “Don’t think just because you write it in Hebrew the government isn’t going to figure it out.”

It is too late for Mendel Steiner, the Borough Park-based investor who died by suicide in a hotel room in Manhattan. Details about what preceded his death are still emerging, but they show someone who took on significant debt and amassed a massive rental portfolio in just a few years. Steiner had 62 apartment properties consisting of more than 4,482 units, according to a 2023 Fitch report that put his net worth at $200 million and liquidity at $29 million.

At a livestream of his funeral, a packed room of men in black hats, his wife and children gathered in a room in Borough Park. The eulogy was mostly in Yiddish, but I could hear a refrain of “tzadik,” which means the righteous one in Hebrew.

Steiner sought to become a top philanthropist in Borough Park’s Hasidic community. He was honored by the rebbe of the Chernobyl sect, according to an Israeli news article.

But he was also known for his parties and a lavish lifestyle, according to community sources. A video sent around the community shows Steiner handing out $100 bills to tip a car service driver.

Meanwhile, Steiner had a pending foreclosure in at least three properties in South Florida, for which he took on a high interest loan. Loan documents in New York show he personally guaranteed others.

Puretz did not discuss Steiner openly. But he had begun to see the problems about staying quiet about all this excess, demands for instant wealth and operating in gray areas.

“At the end of the day, if we don’t speak up now, trust me, it will only get worse,” he says.

Puretz will have another chance. In two years, he’ll be free of his bad deal, ready for redemption at age 31.

Puretz touches the mezuzah on the door on the way out of the restaurant. In the parking lot, he wishes me a safe trip back to Brooklyn. He is going home to his family — two kids and his wife, who is due with a baby in May, which is the reason his sentence starts in the summer.

I watched Puretz get into his Range Rover and head back into the busy Lakewood world.