Last year threw residential real estate into chaos.

It started with economic headwinds and a dry inventory pipeline that slowed transactions. The second half of the year brought tepid earnings for top brokerages and a bombshell antitrust verdict that is poised to change the fundamentals of broker commission rules.

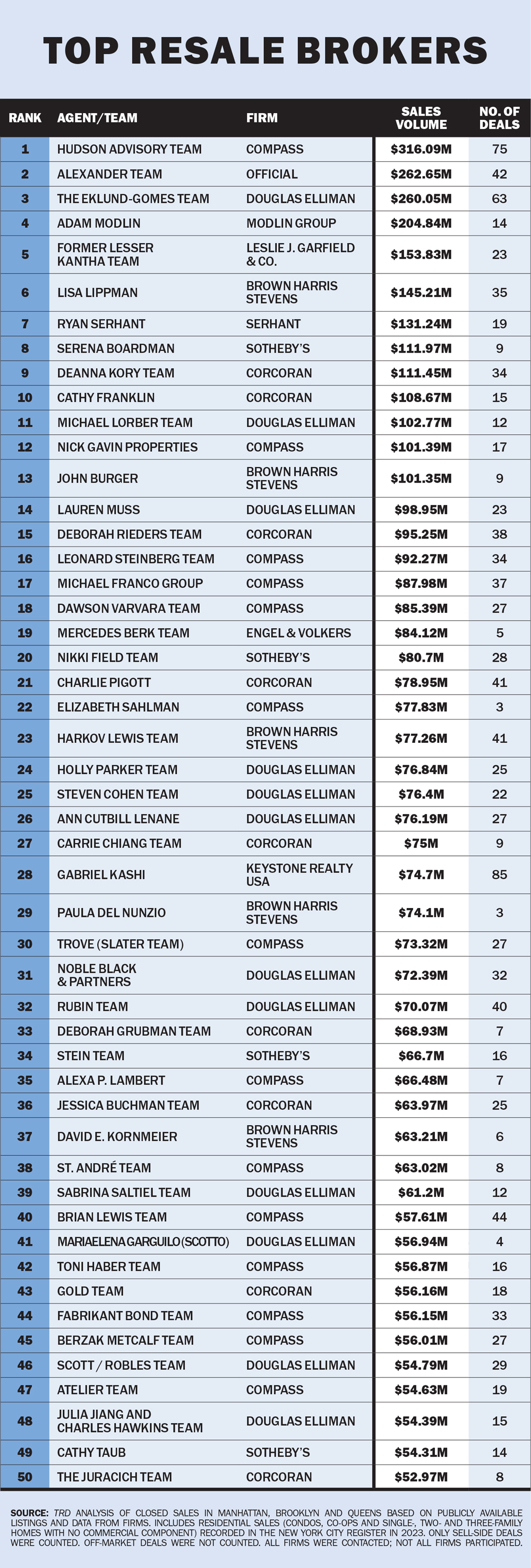

But New York City’s top brokers kept busy, and through millions of dollars of deals came more change: The Hudson Advisory Team at Compass claimed the top resale spot in The Real Deal’s ranking of the top resale brokers in Manhattan, Brooklyn and Queens in 2023, with $316 million in sales.

The group, which had finished in second place in each of the prior two years, unseated Douglas Elliman’s Eklund-Gomes team from the top spot in the ranking, which is based on publicly available closed sales in the three boroughs recorded between January and December 2023.

Co-founder Clayton Orrigo said the team’s “myopic” approach to real estate vaulted it to the most on-market, sell-side resale volume last year.

“The key to our business has been a deep focus on specialization,” said Orrigo. “We’ve doubled down on what we’re good at, and our goal is to just be the absolute best at a very specific craft.”

Orrigo and the Hudson Advisory Team’s other co-founder, Stephen Ferrara, specialize in a handful of prime Manhattan neighborhoods and push privacy, down to their office location — though that is expected to change this fall when they move into an office at 160 Leroy Street to house their 30 agents.

“If you look at the teams that do a billion-plus a year, they’re in multiple markets,” said Orrigo. “We do New York City, and we have a business in the Hamptons because it’s the same clients. We’re not expanding to Miami, we’re not expanding to L.A., we’re not expanding to Austin.”

It’s not the only shakeup at the top of the resale rankings as the market emerges from a difficult year of high interest rates and economic uncertainty. Tal and Oren Alexander’s Official finished in second place with $262.65 million in volume, knocking Eklund-Gomes to third with $260 million.

“I always like to think it doesn’t matter really what the market is doing,” said Tal Alexander. “If I’m going to be among the top of the list every year … we’re going to sell. It really doesn’t matter if the market is up, down, left or right.”

All three of the top teams said off-market deals were a growing trend last year, which they credited as a boost in the face of the market’s downturn.

“I want to be able to feel like people are calling me for what I call my intellectual property, and my intellectual property is all these data of off-market opportunities I have,” said Alexander. “If I’m going to be sharing these opportunities with certain brokers, I think it’s fair to say that I expect the same in return.”

Ryan Serhant tried to give the rankings another shakeup when he requested not to be included — an adjustment meant to highlight his transition to an executive role. The founder of the eponymous firm, which last year expanded to six East Coast markets, finished seventh in the rankings with $131.2 million in volume.

Townhouse deals landed Leslie J. Garfield’s Lesser Kantha Team in fifth place — up from No. 7 the previous year — with nearly $154 million in volume across 23 deals. Demand was high for turnkey townhomes, but the cost of renovation and the larger economic uncertainty kept some would-be sellers on the sidelines.

“Turnkey product is by far the biggest priority,” said Ravi Kantha, former head of the team alongside Matthew Lesser. “If you were a seller and you didn’t fit into that box, and you didn’t need to sell, my advice was just wait this out a little bit.”

Despite their rankings gains, the duo’s success in the market is up in the air after their split early this year. Kantha joined Serhant, along with three other Garfield agents and an administrative staffer.

At Sotheby’s International, the Nikki Field Team harnessed its pull with international buyers and the rise of branded residences in the city to rank 20th among resale brokers.

“Branded residences are the Ozempic of investments,” Field said. “It’s an easy delivery of your goals without any pain or strong challenges.”

Field’s team wrapped up the year with nearly $81 million in sales and a new international desk focused on clients from London, which joins its divisions in India, the Middle East, Asia and Canada.

New dev

New York City’s new development market wasn’t exempt from the macroeconomic headwinds, though activity largely returned to a pace on par with pre-pandemic levels.

“There was a lot of movement and a lot of absorption,” said Douglas Elliman’s Frances Katzen, whose team placed 21st among the top new development brokers with $90 million in closed sales. “We’ve now run dry in the context of what we’ve seen in Florida and in Texas, for example.”

A new strategy helped propel the Eklund-Gomes team to nearly $440 million in new development sales.

“We’re basically advising our clients to wait until the building is substantially complete and put several models into the building and have immediate closings,” said John Gomes. “That was a great success.”

Eklund-Gomes finished second in new development volume, behind Compass’ Alexa Lambert, who led the way with more than $870 million in sales. Lambert finished as the top agent in combined new development and resale volume with nearly $940 million in sales.

Cash buyers had the upper hand in negotiations with sponsors last year, according to Brown Harris Stevens’ Daniella Schlisser, who ranked 15th.

She closed the year with more than $125 million in volume across 18 deals, most of which were at SJP Properties and Mitsui Fudosan’s 200 Amsterdam Avenue. Most of the deals closed at the Upper West Side tower were not financed, according to Schlisser, but economic uncertainty did cause all-cash buyers to hesitate.

“[High interest rates and economic uncertainty] reflect the economy, and [buyers] don’t want to overpay,” Schlisser said, adding that as the year continued, many buyers grew accustomed to the higher-rate environment.

With a new development market tempered by turbulence, developers and their brokers leaned into concessions, according to Corcoran’s Kane Manera, whose sales included several units at 110 Charlton Street in Hudson Square.

Manera notched $151 million in sales volume across 23 deals, which earned him the No. 7 spot, up from 14th in 2022.

Looking at 2024, new development brokers cautioned that a shrinking pipeline of new projects and the typical uncertainty drummed up during an election year will likely have an effect on market activity.

“We’re looking down the barrel of little inventory,” Manera said. “Buyers should be capitalizing on opportunities now, because once the next wave of [new development] gets absorbed, it’s going to be a while until [product] of the same caliber comes on.”

Want to dig into the data behind this ranking? Check out the source on TRD Data now.