The high streets are flying higher than ever in the City of Angels, with top-tier retailers setting up shop in the city’s swanky shopping districts like Rodeo Drive and Abbot Kinney.

The high streets are flying higher than ever in the City of Angels, with top-tier retailers setting up shop in the city’s swanky shopping districts like Rodeo Drive and Abbot Kinney.

Yet while demand from global luxury brands has been propelling rents and investment sales along the famous shopping streets, many affluent Americans say that this year, they’re planning to curtail their spending amid the uncertain economic outlook.

Americans earning at least $150,000 annually said they planned to spend around $16,000 on luxury goods in the coming year, a 20 percent decline over the previous year, according to a 2016 annual report from the Luxury Institute.

The good news for brick-and-mortar stores and for those in retail real estate is that a rising share of affluent consumers — 54 percent, up from 49 percent a year earlier — said they preferred to make major purchases in shops, the report said.

Luxury retailers looking to make the most of this trend by expanding their presence to compete for sales among these increasingly cautious consumers will help keep demand high in Los Angeles’ deluxe shopping enclaves, market watchers say.

In December 2015, Chanel paid a record-breaking $13,217 a square foot to buy the store it had been leasing at 400 North Rodeo Drove for $152 million — that is, until a July 2016 deal. Then LVMH Moët Hennessy Louis Vuitton paid $122 million for a smaller storefront at 420 North Rodeo Drive occupied by the company’s Bijan brand. At $19,405 per square foot, the LVMH deal set a new California record for the highest price paid per square foot. The global conglomerate’s U.S. sales had climbed 7 percent during the first half of 2016.

Jay Luchs, an executive vice president at Newmark Grubb Knight Frank who has handled many Rodeo Drive transactions, said deals like these to buy rather than lease prime locations on Rodeo Drive indicate that the retailers are there to stay. “It wasn’t like that when I started in 2003,” he said.

Rodeo Drive is the second-most expensive retail district in North America, after Fifth Avenue in New York. Retail space rents for $800 per square foot a year — comfortably ahead of the $685 for San Francisco’s Union Square, the third-most-expensive market — but well behind the $3,000 a year charged by landlords on the prime section of Fifth Avenue, according to Cushman & Wakefield’s 2016 Main Streets Across the World report.

Rodeo Drive’s local competition includes up-and-comer Melrose Avenue in West Hollywood and trendy Abbot Kinney Boulevard in Venice.

Melrose Avenue — the West Hollywood thoroughfare that begins at the corner of La Cienega Boulevard, passes the big blue Pacific Design Center and ends around Robertson Boulevard — has rents ranging from $144 to $240 per square foot a year. “The feel of that street is more charming than anything we have in L.A.,” Luchs said. “It’s like a European street.”

Abbot Kinney Boulevard is the only serious regional contender for Rodeo’s retail crown. Shoppers from far and wide make expeditions to stroll along the popular Venice high street.

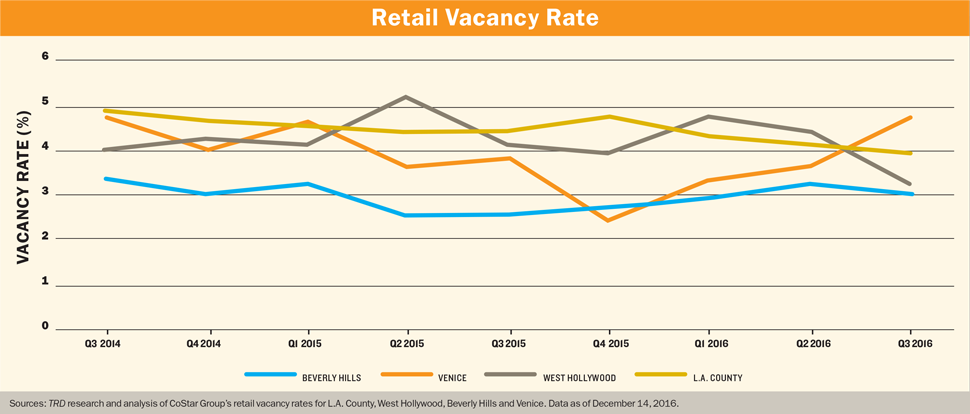

Retail space is tightening countywide, with a vacancy rate of 3.9 percent in the third quarter of 2016, down from 4.8 percent two years earlier.

In the City of Beverly Hills, the already low vacancy rate edged down very slightly to 3 percent from 3.3 percent in the same two-year period. In West Hollywood, it narrowed to 3.2 percent, down from 4 percent. After a brief decline in Venice, it returned to 4.7 percent.

Even with few available spaces, landlords are inking new deals. Here is a block-by-block guide to some notable deals.