Two lawsuits filed in Los Angeles allege home insurers colluded to limit coverage in risky fire zones, forcing homeowners to use the more expensive state-sponsored insurance plan.

The complaints name State Farm and 24 other insurance carriers that together control 75 percent of California’s market of illegally working together in 2023 to abruptly drop or stop offering new policies in high-risk locations such as Pacific Palisades and Altadena. These areas were among those devastated by the January wildfires that destroyed nearly 17,000 structures and killed at least 30 people, according to a story from the Associated Press published by Los Angeles Daily News.

As a result of the insurance companies’ actions, hundreds of homeowners were forced onto the California FAIR Plan, the state’s insurer of last resort. This plan provides limited coverage — capped at $3 million — and comes with high premiums.

One of the lawsuits, filed by wildfire victims, claims this left homeowners severely underinsured and struggling to rebuild. The second lawsuit seeks broader representation, covering all policyholders pushed onto the FAIR Plan since January 2023.

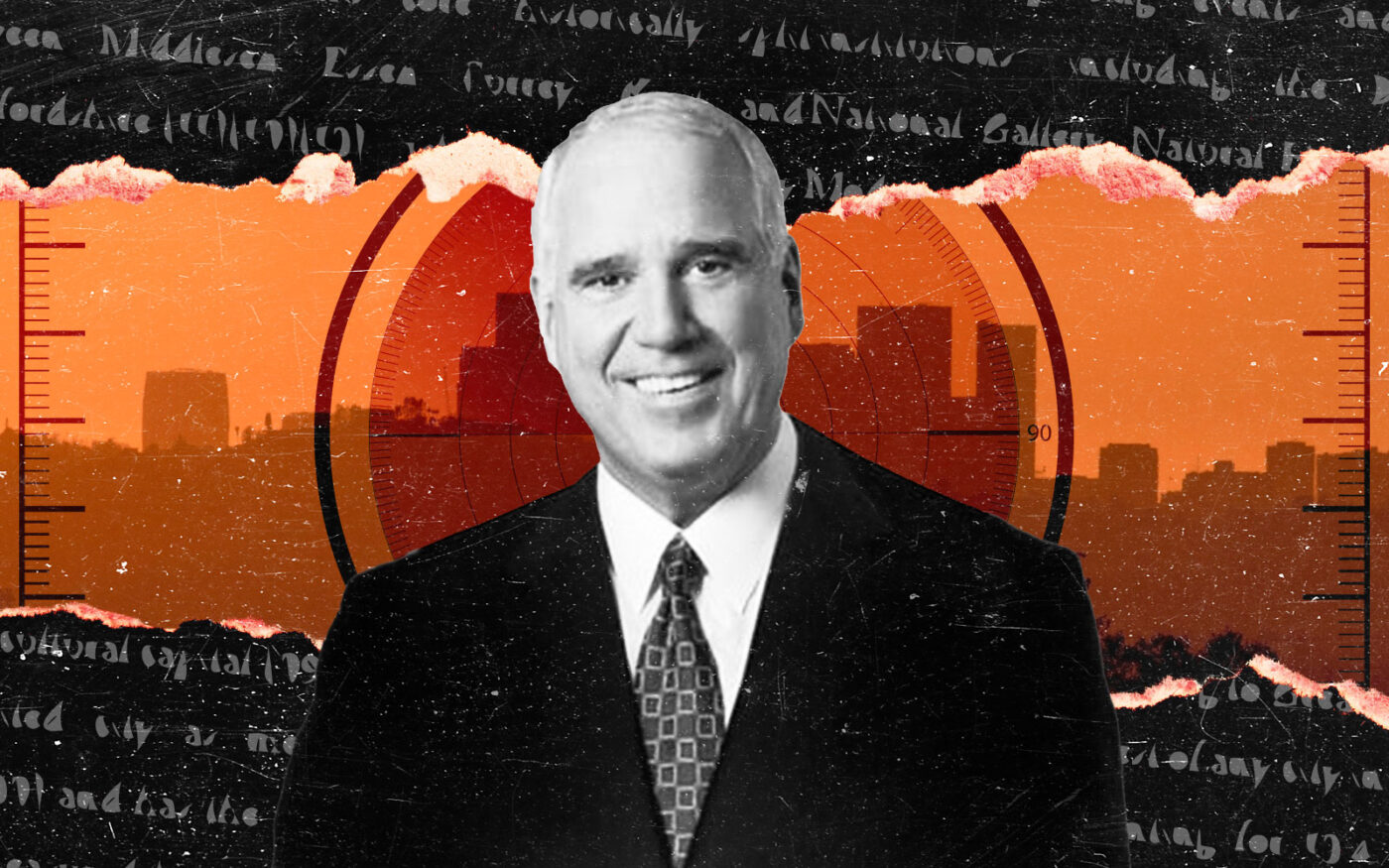

Attorney Michael Bidart, representing affected homeowners, said the companies profited from high premiums while denying people the comprehensive coverage they were willing to purchase.

The lawsuits come amid a broader insurance crisis in California, where providers are raising rates, reducing coverage, or exiting markets altogether due to the increasing frequency and intensity of wildfires.

While the California Department of Insurance is not involved in the lawsuits, it emphasized the need for a transparent system that protects consumers and reflects real risk.

The FAIR Plan, funded by all major insurers, was meant to be a temporary solution but now covers more than 555,000 policies — more than double the number from 2020. The lawsuits also allege that insurers pushed homeowners onto the FAIR Plan to reduce their own financial exposure, as the cost of supporting the plan can be partially passed on to consumers.

Regulators are working on new policies to balance industry sustainability and consumer protection, including allowing climate risk and reinsurance costs to influence premium pricing.

— Joel Russell

Read more