The California Municipal Finance Authority is claiming default on The Preserve at Woodland Hills, a 50-unit assisted living complex in Woodland Hills, The Real Deal has learned.

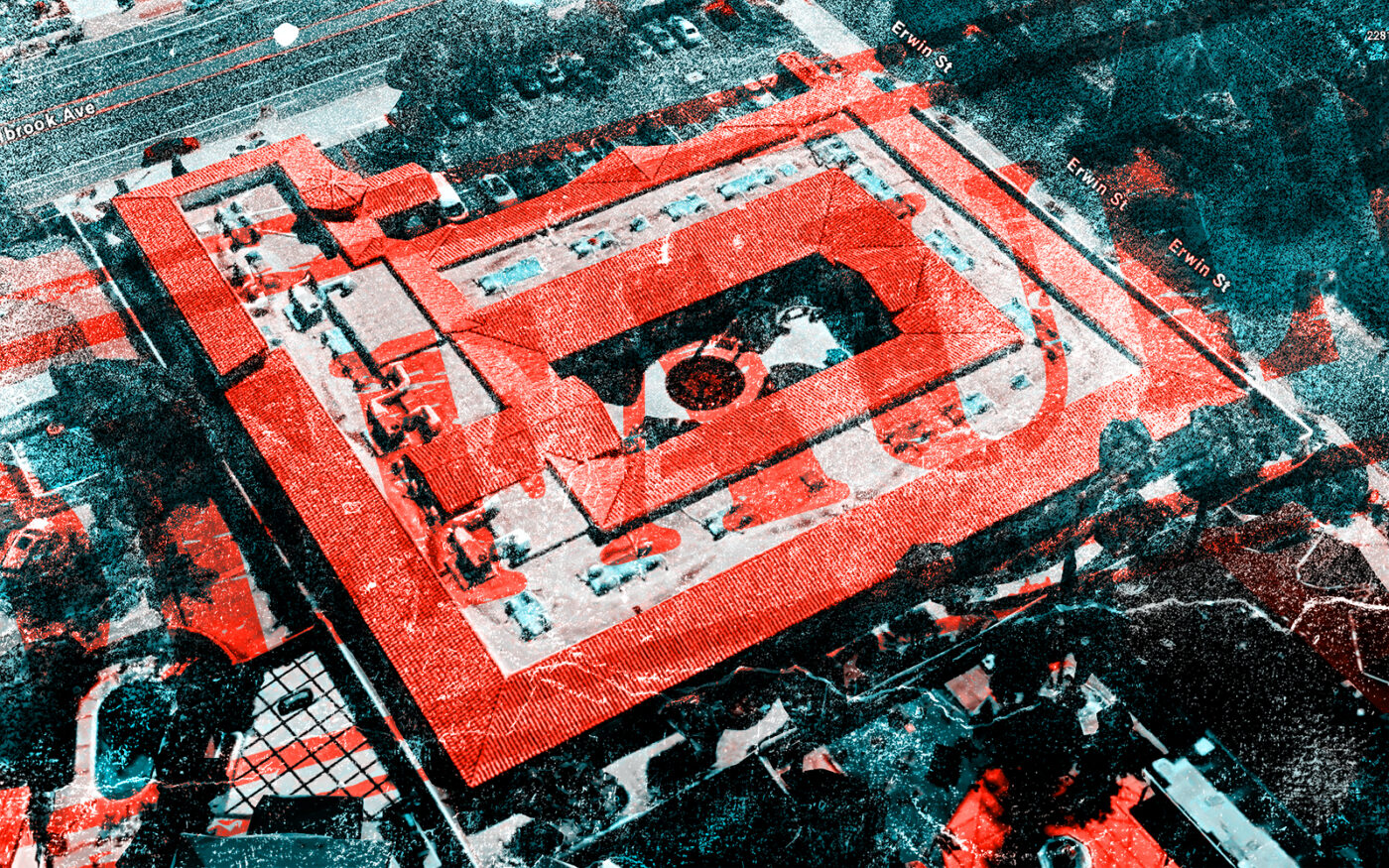

The agency filed a default notice on the 33,300-square-foot property, located at 6221 Fallbrook Avenue, on Jan. 21, property records show. The owner of the asset, an entity tied to Utah firm Welbrook Senior Living, allegedly fell behind on nearly $1.7 million in unpaid bills.

Welbrook completed the property in 2019, with $13 million in improvements, city records show. The facility, which caters to residents 62 years old and up, sits on a 1.5-acre site and has room rates starting at $4,180 per month.

CMFA, which was formed under state law to help communities and charities raise funds through bonds, provided $14 million in financing for the project in November 2018. The funding package came in the form of taxable revenue bonds.

The agency recently provided $107 million in construction financing for a planned 300-unit affordable housing project. The funds allowed a partnership between Jemcor Development and Pacific Housing to buy a 1.1-acre lot in Downtown San Jose. A large chunk of the financing for the project — $75 million — came in the form of tax-exempt bonds. CMFA also recently provided $68 in bonds for Terracina at Whitney Ranch, a 288-unit housing development in Rocklin.

The default comes as the senior living sector grapples with financial difficulties that date back to the start of the Covid-19 pandemic.

Bloomberg said in a story last year that $3.5 billion in senior living municipal debt is due to mature this year. Lisa Wasburn, the chief credit officer at Municipal Market Analytics, told the publication that the maturities may contribute to an “uptick in impairments or defaults.”

CMFA did not respond to a request for comment.

Read more