While the full extent of the damage caused by January’s wildfires in Los Angeles is still being assessed, properties tied to nearly $1 billion in commercial real estate loans may have been impacted.

As of Jan. 30, 76 loans with a combined balance of $985.2 million were within Altadena and the Pacific Palisades zip codes where fires damaged properties, Bisnow reported, citing figures from Trepp.

The list of exposed properties includes 45 loans for apartment buildings.

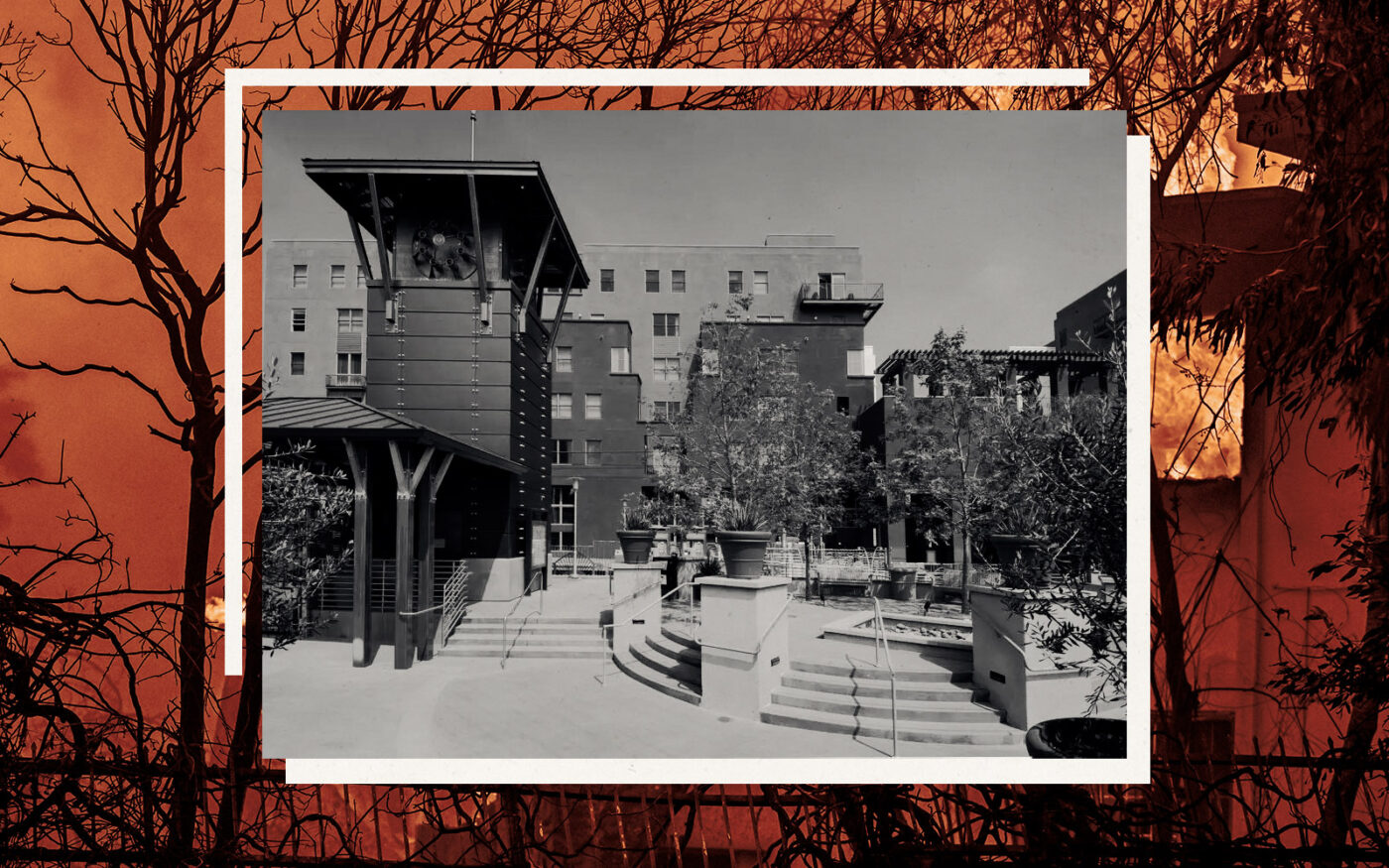

Some of the largest loans on the list, such as the $93 million loan linked to Avalon at Del Mar Station, a transit-oriented development at the Del Mar A Line light rail station in Pasadena, were safe from the fires.

Avalon at Del Mar is near Old Town Pasadena’s shops and restaurants.

Multifamily properties that aren’t damaged are positioned to benefit from higher occupancy, as the effort to rebuild the properties that were lost is expected to take years, according to Bisnow.

Fourteen self-storage loans and 11 office loans are tied to exposed properties.

A Pasadena business park on Bradley Street has a loan balance of about $32 million. Two of its buildings appear on a map of inspected properties as “affected” by the Eaton fire, a classification used for structures with less than minor damage.

No loans are delinquent, according to Trepp. But 28.7 percent of the loans, totaling $283 million, are on watchlists.

Read more