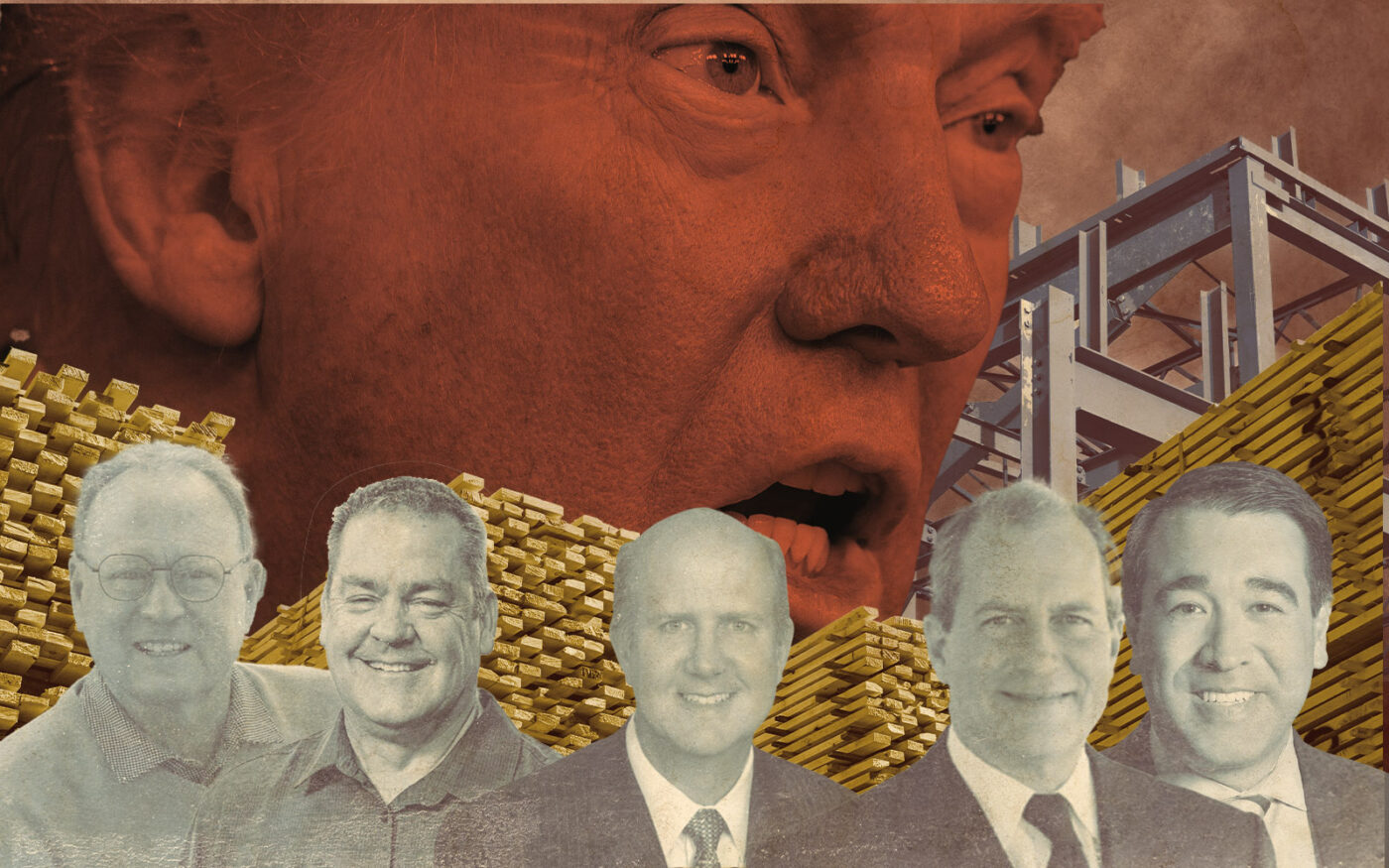

Tariffs on foreign goods imposed by President Donald Trump on Feb. 1 could send the price of lumber and steel in California through the roof.

California’s building industry has warned of pricing disruptions to construction materials should the Trump administration order the 25 percent tariffs proposed on Canada and Mexico, the Los Angeles Daily News reported.

Anaheim-based Ganahl Lumber, the oldest lumberyard in California, gets a fifth of its lumber from Canada. It’s also one of numerous companies concerned the pending tariffs could impact projects requiring lumber and steel, including offices, hospitals and homes.

“I think tariffs would potentially be a negative impact on our industry,” Pete Meichtry, Ganahl’s vice president of purchasing, told the newspaper.

Ganahl and other building executives say the tariffs would be passed along to consumers.

That could be a suckerpunch for Los Angeles County, where homeowners and businesses from Altadena to the Pacific Palisades are reeling from the cost of rebuilding after this month’s historic firestorms ripped through more than 16,000 homes, schools and businesses.

“Combine tariffs with the fires, and this will add substantial costs to our ability to rebuild,” Don Dunmoyer, president of the California Building Industry Association in Sacramento, told the Daily News.

In a worst-case scenario, Dunmoyer estimated the tariffs could add between $35,000 and $45,000 to the cost of building a new home.

While Trump’s move to impose tariffs would immediately raise the price of imported building materials, his administration argues the tariffs, also known as duties, would level the playing field by boosting U.S. production.

Turner Construction, the largest general contractor in the nation with more than $23 billion in construction contracts, began reviewing the potential tariffs before the November election.

A Turner executive in the Bay Area said that more than 350 procurement workers with the company, owned by German-based Hochtief AG, began testing ways to relieve the sticker shock on structural steel prices by considering alternatives around imported duties.

The firm developed a simulated building with an estimated $100 million price tag, with half of the project’s cost tied up in material such as structural steel. With between 30 percent and 40 percent of the $50 million in material costs sourced from overseas, the Turner team applied potential tariffs that ranged from 10 percent to 30 percent.

“That’s the sort of thing that a developer may look at and say, ‘Well, I can’t go forward with the project if the cost is going to be $101 million, or $103 million, instead of $100 million.’ ” Steve Rule, vice president and project director with Turner, told the Daily News.

Peter Tateishi, CEO of the California chapter of the Associated General Contractors in Sacramento, said the “tariff conversation is a real one” for member companies that build roads, bridges, hospitals, apartments and office buildings, as well as the reconstruction of Los Angeles.

“It definitely impacted us the last time tariffs went into effect, and it absolutely can impact us again in our ability to make those recovery dollars needed in crisis go further,” he told the newspaper.

“If we’re in a position where the cost of goods and materials is going up, it becomes harder to make sure that we can meet all the needs and demands of the rebuilding cycles.”

Read more