A Norwegian Bank has bought a stake in 40 logistics warehouses across Los Angeles County, Orange County and the Inland Empire.

Norges Bank Investment Management, a sovereign wealth fund for Norway’s government pensioners, paid $1.07 billion for a 45 percent stake in 48 warehouses from Southern California to New Jersey and Pennsylvania, the Commercial Observer reported.

The seller was the Canada Pension Plan Investment Board, which traded the minority stake in the portfolio controlled by Sydney-based Goodman Group.

Goodman will continue as asset manager for the portfolio known as the Goodman North American Partnership, which Norges valued at $3.23 billion, with $888 million of existing debt.

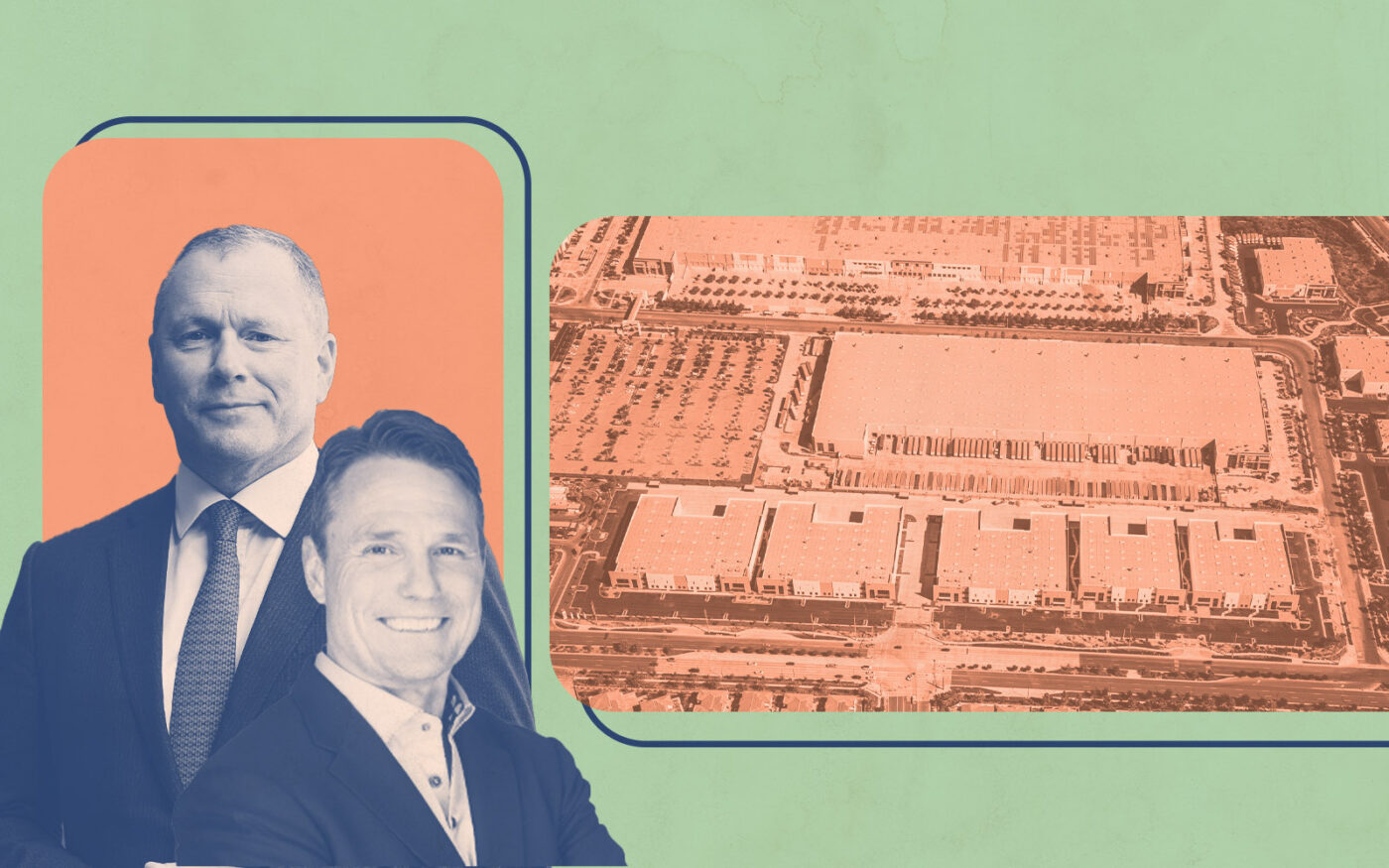

Of the 40 Southern California buildings, most are clustered into campuses in Los Angeles County, Orange County and the Inland Empire. The volume of warehouses, in square feet, was not disclosed.

Properties include the 3.2 million-square-foot Goodman Commerce Center Eastvale and Goodman Logistics Centers in Fontana, Santa Fe Springs, Compton, El Monte and Fullerton.

“The portfolio exemplifies high-quality buildings in excellent locations,” Edward Lerum, head of global logistics for Norges Bank, said in a statement. “We have long-term conviction in the investment, and we also see appealing growth potential, given the restrictions on new supply in these locations.”

The purchase comes less than a year after Los Angeles-based logistics giant Rexford Industrial Realty paid New York-based Blackstone $1 billion to buy 48 industrial properties across L.A. and Orange counties. The 3 million-square-foot portfolio was 98 percent leased at the time of sale.

Norges Bank Investment Management manages the Norwegian Government Pension Fund Global, known as the Norwegian Oil fund. It owns a stake in about 9,000 companies around the globe, making it the world’s largest single investor, while it owns hundreds of properties in some of the world’s leading cities, according to its website.

Read more