Two Los Angeles Superior Court lawsuits, filed this month for different reasons, offer similar claims against Douglas Elliman and some of its executives, accusing the brokerage’s California businesses of engineering kickbacks for select agents and rule-bending to the benefit of the Altman Brothers Team.

The brokerage isn’t sitting quietly by and smacked back in a lawsuit of its own last week.

The in-fighting in L.A. court places Elliman’s California business under a microscope amid scrutiny of its national operations with the abrupt departure of CEO Howard Lorber.

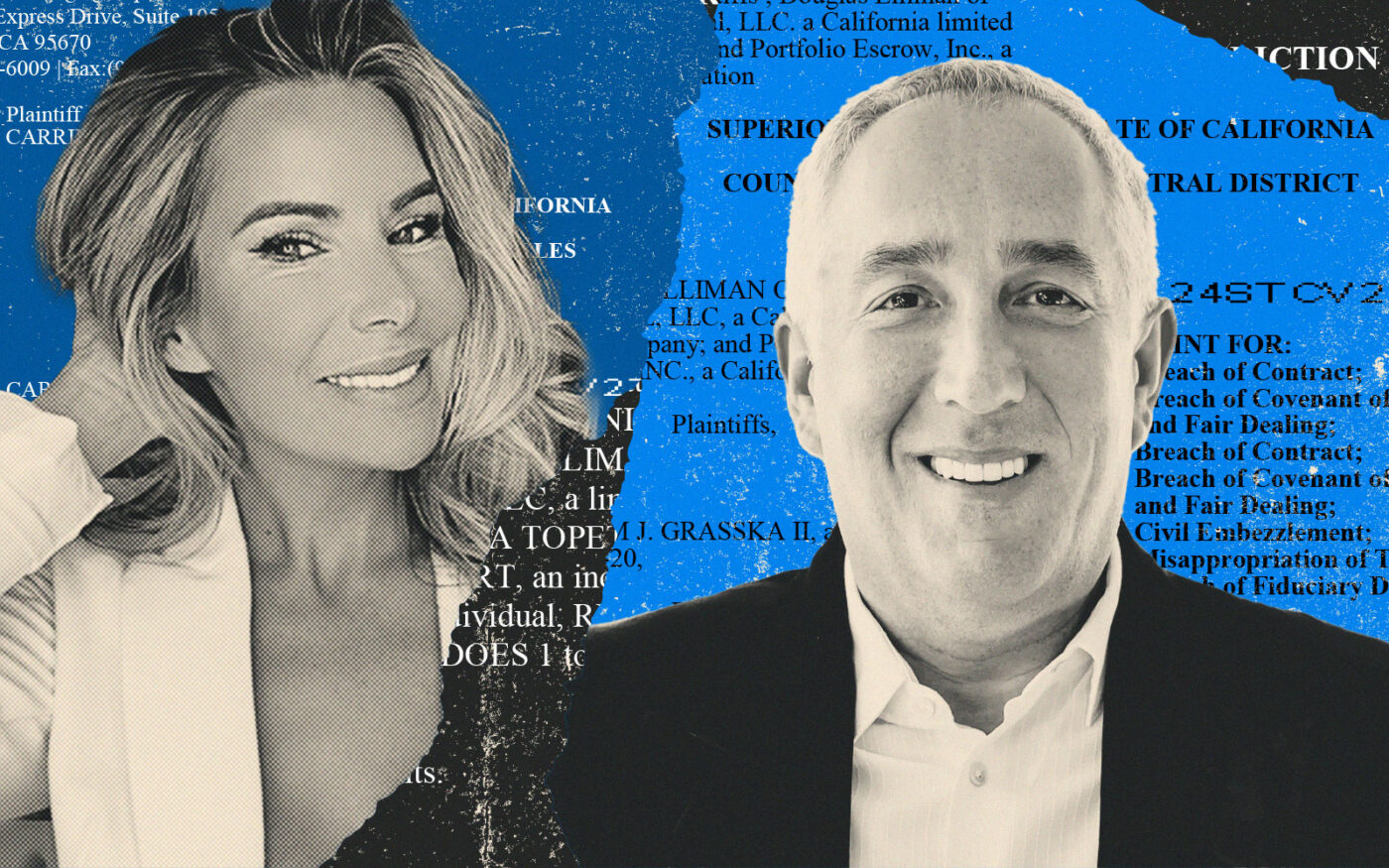

Former Newport Beach office Executive Manager of Sales Christina Carrillo and William Grasska, former president of Elliman’s Portfolio Escrow, describe in their respective lawsuits incidents of credits not being reported on closing statements leading to inflated commissions for some agents.

Carrillo, who resigned earlier this month, also accuses the Altman Brothers — helmed by brothers Josh Altman and Matt Altman — of soliciting clients from other agents’ and brokers’ active listings. The Altmans are not named as defendants in any of the litigation.

When Carrillo’s concerns about the Altmans were brought up to Western Region CEO of Brokerage Stephen Kotler, she claims she received pushback.

“Enough Christi. I have made millions from the Altman Brothers, so shut up. If other agents and brokers get fucked over, I don’t care, so be it,” Kotler said, according to the lawsuit.

Carrillo, who did not respond to requests for comment, is suing Elliman of California and Elliman of California Financial, along with Kotler for sexual harassment and retaliation, among other allegations.

The brokerage and Kotler declined to comment. Josh Altman did not respond to a request for comment.

Grasska alleges a similar rebuke from the company over allegations of managers at the brokerage’s Portfolio Escrow business being asked “to inflate a closing statement to allow the Altmans to earn more commissions,” the lawsuit said.

Grasska, who started Portfolio Escrow in 2009 and sold it a decade later to Elliman, did not respond to requests for comment.

The executive’s lawsuit is against Elliman’s California brokerage and financial subsidiaries, in addition to Kotler, escrow officer Melinda Topete, Western Region Chief Operating Officer of Brokerage William Begert and escrow officer Renee Mills. He’s suing for retaliation, breach of contract and defamation, among other accusations.

Topete and Mills did not respond to requests for comment.

Grasska’s suit includes broader allegations against his former escrow company, which he said in his lawsuit is currently under audit by the California Department of Financial Protection and Innovation.

A DFPI spokesman declined to comment on Grasska’s audit allegation.

Grasska alleges agents were incentivized with higher commissions and marketing spend increases to use Portfolio Escrow, without disclosure to customers.

Pushing back

Elliman views the situation differently, according to a lawsuit of its own filed last week in L.A. Superior Court. The firm claims that Grasska was under investigation for kickbacks, in addition to charging “expensive meals and lavish hotel stays” on his corporate credit card and creating a 1031 exchange company called Sienna Financial that violated his non-compete agreement with the firm.

Part of the investigation, the brokerage alleges, found that Grasska was working with one of Portfolio Escrow’s accountants to create fake invoices for services never provided.

“This scheme was designed to illegally obtain money belonging to Portfolio to pay off penalties assessed by the IRS” that Grasska needed to deal with a “personal transaction he carelessly ran through Portfolio,” the brokerage’s lawsuit said.

Added to that are accusations Grasska conspired with a “real estate broker that is now a star of a reality television show” to pay the broker kickbacks in exchange for business, Elliman alleges.

The firm is suing the escrow executive for breach of contract, civil embezzlement, fraud and negligence, among other complaints. It also hinted additional lawsuits “are being prepared against Bill Grasska’s co-conspirators,” while also stating in court documents the DFPI, California Department of Real Estate, Los Angeles Police Department and Internal Revenue Service have been notified.

UPDATE: A spokesperson for Douglas Elliman responded to the suits in the following statements sent to TRD on Nov. 1:

With respect to Grasska’s complaint and the Altman Brothers Team:

“Bill Grasska’s complaint is an attempt to deflect from his own egregious misconduct. In Douglas Elliman’s complaint against him, we clearly set forth our claims that Grasska engaged in fraud, embezzlement of company funds, and related misconduct. Moreover, the broker referenced in our complaint as being involved in Grasska’s fraudulent scheme involving kickbacks is not the Altman Brothers or anyone on their team, and has never been affiliated with Douglas Elliman.”

With respect to Carillo’s lawsuit:

“Douglas Elliman never received any complaints of sexual harassment or related misconduct involving Christina Carillo, nor was management aware of any such claims. Had any such complaints been received, those complaints would have been thoroughly investigated consistent with our policies and procedures, as has been the case with complaints made from time to time against others at the Company over the years. Douglas Elliman is committed to fostering a workplace environment that is safe, comfortable and free of sexual harassment.”

Angst at Elliman

The California drama plays out against the background of the executive shakeup at Elliman, set off last week by Lorber’s sudden departure. The company said Lorber’s exit was not due to any disagreement or violation with Elliman, but The Wall Street Journal reported days later the veteran executive was pushed out by the board of directors after a probe into the brokerage’s workplace culture and accusations of sexual assault by former Elliman brokers and brothers Tal and Oren Alexander.

Recently appointed chairman and CEO Michael Liebowitz announced more change within the ranks on Monday when staff and agents were informed of Scott Durkin’s exit from his role as CEO of the brokerage arm, to “pursue new opportunities,” according to the email announcement reviewed by The Real Deal. The company said in a filing with the Securities & Exchange Commission Durkin was terminated.

An attorney for Durkin, John Singer, told TRD this week Durkin “never at any time engaged in conduct justifying a termination, nor was he ever apprised that his employment was in peril.”

Read more