Los Angeles’ industrial market isn’t as hot as it once was because of people pulling back from shopping.

At the end of the second quarter, 3.7 percent of all industrial space was available, marking a 14.5-year high, according to a report from Newmark.

“Vacancy will rise for the foreseeable future,” Newmark said in its report. Rents for L.A. warehouses are deterring tenants from moving into the region or expanding in L.A. More warehouses are getting built, bumping up vacancy.

More tenants are also looking to get out of their space — sublet availability ticked up 11.6 percent over the first quarter, with almost 10 million square feet on the market.

Rents for the most premium warehouse space have been dropping, according to the report.

Asking rents for Class A industrial are down 20 percent from October 2022, Newmark said.

But tenants are still paying significantly more than they were pre-pandemic, when consumers pivoted to shopping more online and tenants leased warehouses to store goods. Between early 2021 and late 2022, average asking rents for Class A industrial soared 113 percent, according to Newmark.

“U.S. retail sales are healthy but remain below their 20-year average,” Newmark said in describing overall market economics. “‘Decent’ but ‘not great’ sales have implications for local industrial leasing conditions.”

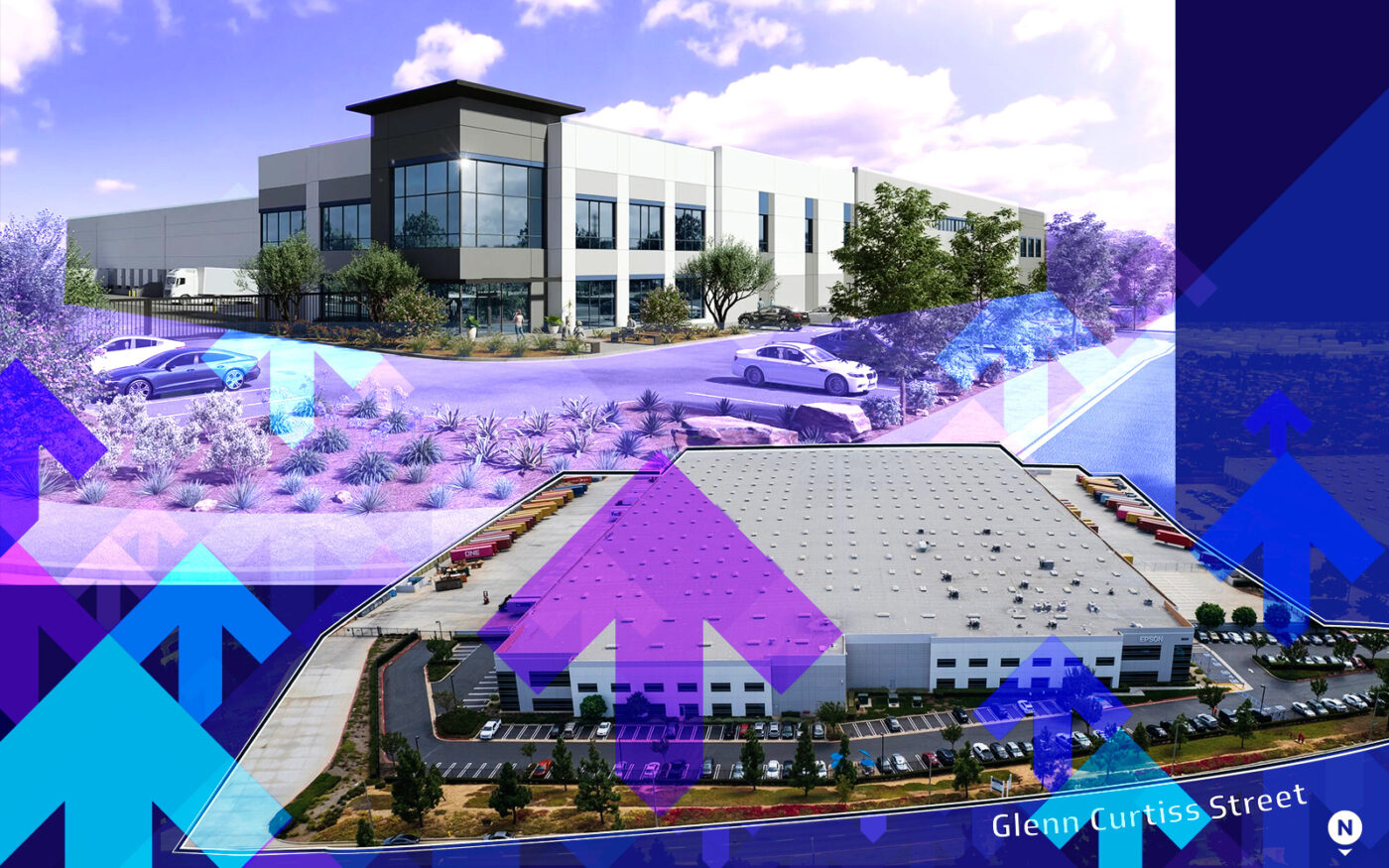

The largest lease signed in the second quarter was KW Logistics’ 339,000-square-foot deal for 1650 Glenn Curtiss Street in Carson. The next three largest were also in the South Bay.

In Central L.A., Reformation, a fashion brand who counts 70 percent of its customer base as under 35, signed a 185,000-square-foot deal at 5801 South 2nd Street, a building owned by Bridge Industrial.

Read more