The State of California has hit Shangri-La Industries with a sweeping lawsuit, after the developer defaulted on loans tied to seven motels slated for conversion into housing for the homeless under a state program.

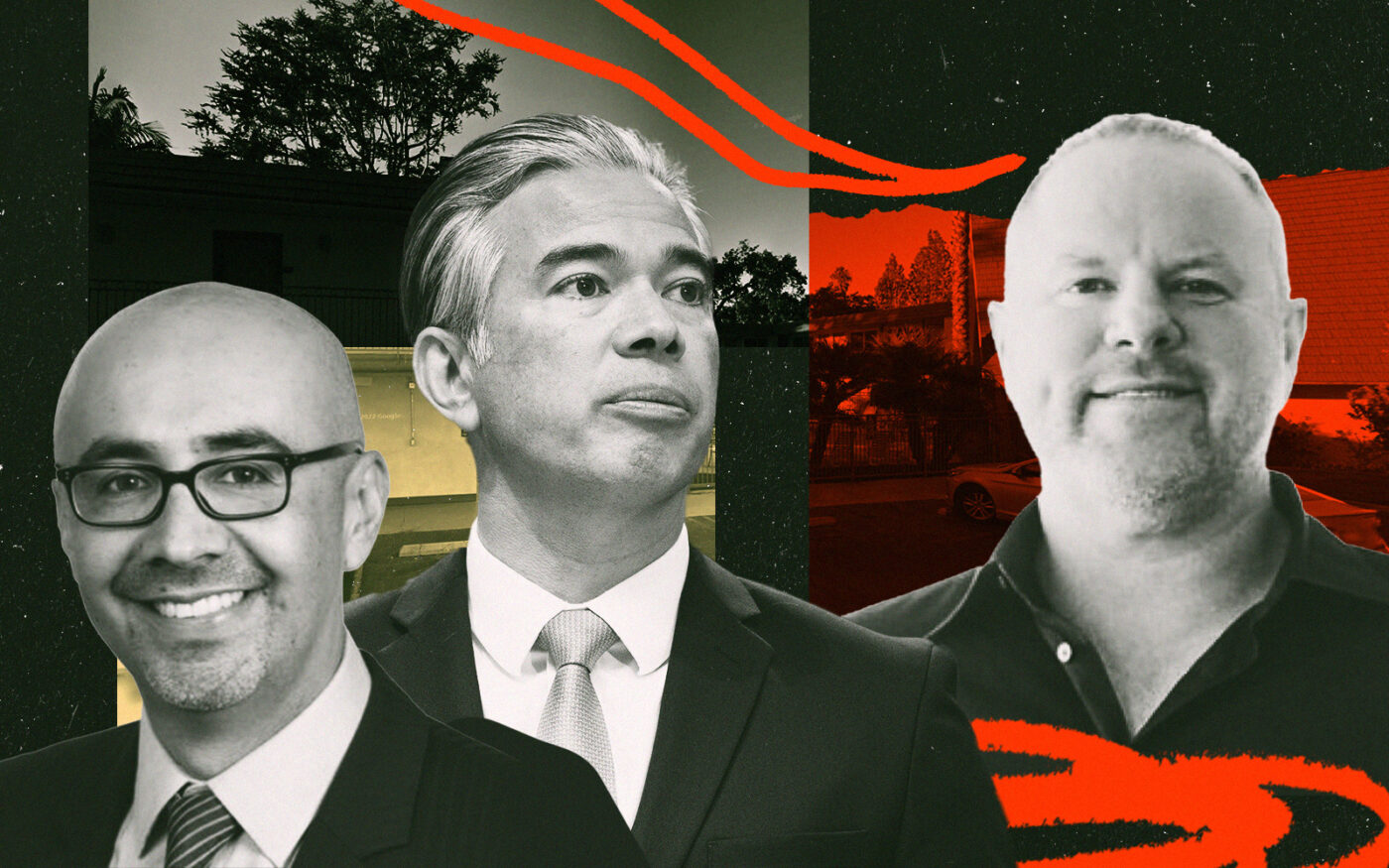

State Attorney General Rob Bonta filed the suit in L.A. Superior Court on Monday afternoon, claiming the developer breached contracts to convert motels into housing for the homelessness and alleging Shangri-La committed fraud, according to the complaint.

“The state is taking legal action as Shangri-La has misrepresented multiple financial considerations and has yet to cure a number of breached contractual obligations to the state and the Homekey program,” a representative for the California Department of Housing and Community Development said in a statement.

Shangri-La defaulted on the loans tied to seven properties over the last six months, and owed about $41 million under the delinquent debt, as of Dec. 1, TRD reported.

After TRD’s report, the state opened an investigation into Shangri-La Industries and found Shangri-La had violated its operating agreements tied to six Homekey properties — two in Salinas and others in San Bernardino, Redlands, King City and Thousand Oaks.

All seven are now “at risk of imminent foreclosure,” the complaint states.

Shangri-La, run by Andy Meyers, scored at least $121 million in grants from the Homekey program from 2020 through 2022, according to state data, about 3 percent of the total funds handed out by the state to date.

In its 321-page complaint, which also named Thousand Oaks, Salinas, Redlands, San Bernardino and King City, along with Shangri-La’s lenders as defendants, the state attorney general alleged the developer “failed to notify” HCD that it defaulted on the loans.

The development firm was founded by the late Hollywood producer Steve Bing, who had inherited a real estate fortune from his grandfather, New York developer Leo Bing.

Meyers has previously laid blame on the state for the defaults, arguing that officials failed to sign regulatory agreements for the deals, which were required by lenders.

Without signed regulatory agreements, Shangri-La has had to pay property taxes and for “multiple refinancings,” Meyers said in a phone interview last month, adding that HCD had not responded to his requests to work out issues.

The attorney general has asked the court to order that the regulatory agreements with the state take priority over any other lender agreement, which would prevent a lender from foreclosing the assets.

Read more