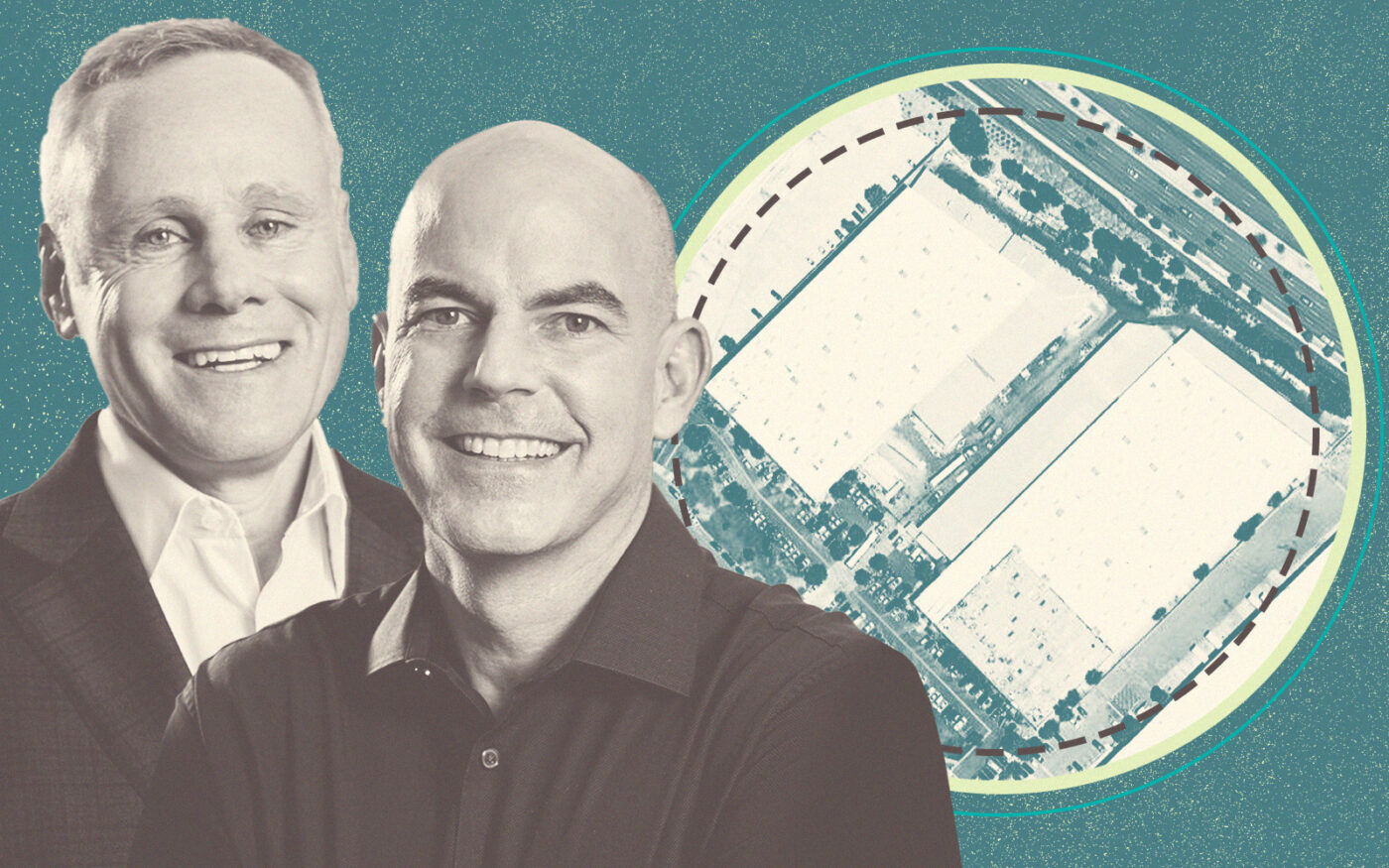

Rexford Industrial Realty has picked up two warehouses in Santa Clarita for $38 million.

The Sawtelle-based real estate investment trust bought the industrial buildings at 27756 and 27712 Avenue Mentry, in Valencia, the Commercial Observer reported. The seller was tenant Forrest Machining, suggesting a leaseback deal.

The price for the 230,538-square-foot industrial properties on more than 9 acres works out to $165 per square foot. In comparison, premium office buildings in Downtown Los Angeles are struggling to fetch $175 per square foot.

One building at 27756 Avenue Mentry contains 86,700 square feet, according to Loopnet. The building at 27712 Avenue Mentry contains 143,850 square feet. The two properties sit next to three others already owned by Rexford.

Brokers Matt Dierckman, David Harding, Greg Geraci and Billy Walk of Colliers represented both the buyer and seller.

Los Angeles County has one of the strongest industrial real estate markets in the nation, according to the Observer.

New leases signed in the last 12 months averaged $19.92 per square foot, $7.20 more than in-place rents, according to a report from CommercialEdge.

The county held the nation’s second-highest average sales price, at $344 per square foot, during the first half of the year. The national average was $129 per square foot.

But total sales volume in the first half of the year for L.A. County was $1.2 billion, compared to $2.3 billion during the same period last year.

As of June, Rexford managed 364 properties with 44 million rentable square feet.The landlord’s assets have an occupancy rate of nearly 98 percent, according to the Observer.

The industrial REIT reported $58 million in net income in the first quarter, up 32 percent from the same period last year, according to The Real Deal. Revenues were $186 million, compared to $141 million the prior year — also a 32 percent increase.

Last year, Rexford spent $2.4 billion buying industrial properties, compared to $971 million in 2019, when it reported a yearly net income of $50.5 million — what the firm now makes in one quarter.

— Dana Bartholomew

Read more