UPDATED, Aug. 16, 2023, 10:29 a.m.: Unibail-Rodamco-Westfield is close to a deal to refinance a $925 million loan on its Westfield Century City mall in Los Angeles, The Real Deal has learned.

Morgan Stanley will fund the two-year, floating-rate loan, which will be pooled into a commercial mortgage-backed securities offering, according to a release from Fitch Ratings, a KBRA report and data from Trepp. The deal is expected to close Aug. 29.

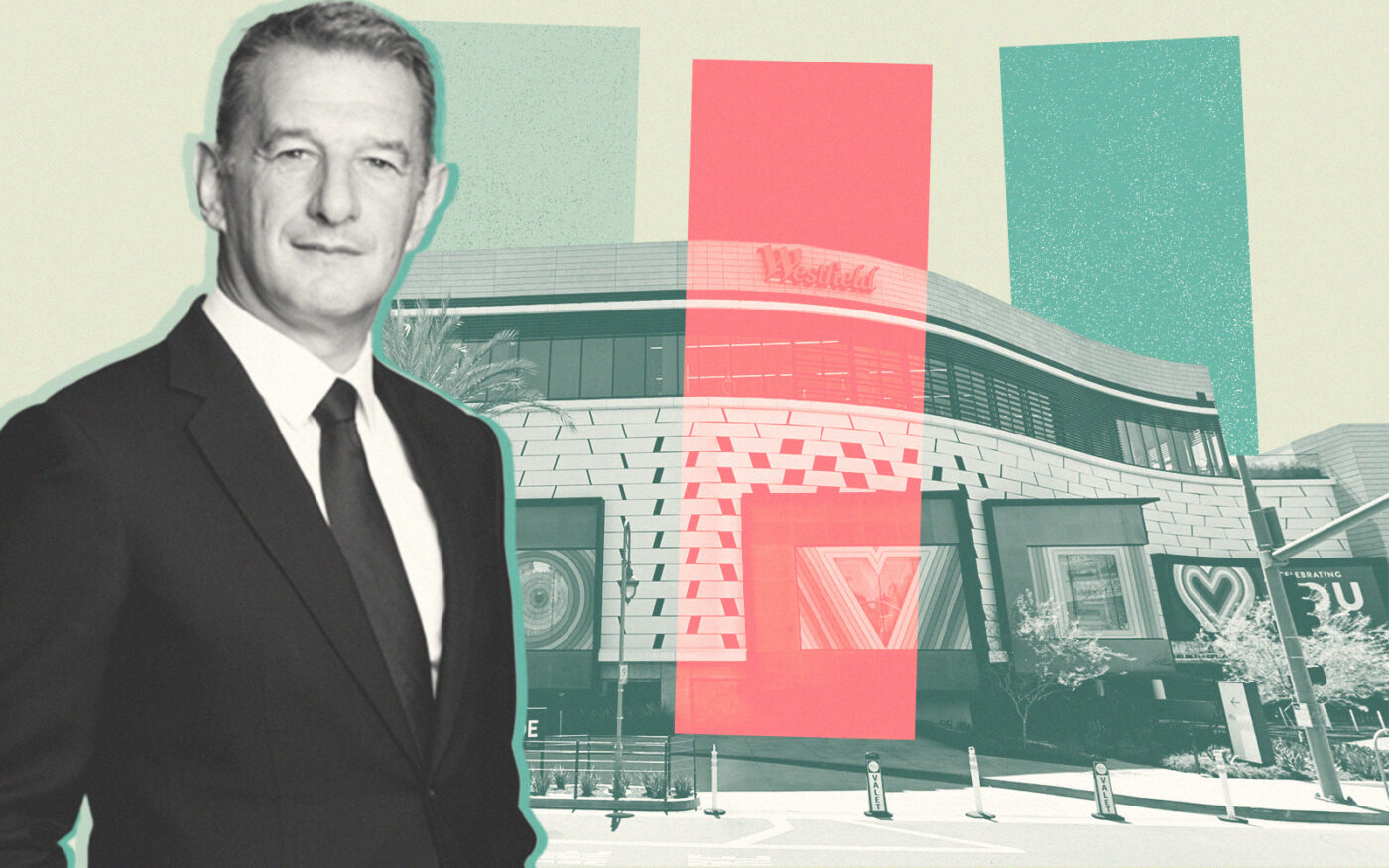

The Westfield mall, a 1.4-million-square-foot shopping center at 10250 Santa Monica Boulevard, is one of the anchors of Century City, which has become an office and retail hub for the Westside. On a weekend, the open-air mall teems with people. Taiwanese hotspot Din Tai Fung, the younger millennial-loved Aritzia and Zara, Italian grocery chain Eataly, Tesla and Apple all occupy spaces at the mall.

Three department stores anchor the property — Macy’s, Bloomingdale’s and Nordstrom — and together reeled in about $200 million in sales from March 2022 through March of this year, according to Fitch.

The mall was valued by Newmark in May at $1.94 billion, according to a Unibail-Rodamco spokesperson. In its report, KBRA gave a valuation of $1.35 billion based on stressed market conditions. Unibail declined to comment further on the deal.

Unibail will use the funds to return $909.5 million in equity back to the company and pay closing costs of $18.5 million, according to Fitch.

The deal has an interest rate of the secured overnight financing rate plus 2.92 percent — a tighter spread compared to other recent CMBS deals to close, according to a report from ratings agency KBRA. A recent floating-rate CMBS deal for two hotels in Dallas was priced at the secured overnight financing rate plus 3.15 percent.

Unibail-Rodamco will be required to buy a rate cap — a limit on how high the interest rate on a floating-rate loan can get — of 6 percent, according to the KBRA report.

However, the Westfield mall refi is one of the largest CMBS deals to close this year, for any asset class — and the largest tied to a property in Los Angeles. In July, Rick Caruso scored a $450 million CMBS loan with a fixed rate of 7.1 percent to refinance his Americana at Brand mall in Glendale.

Westfield, the Australian company acquired by Unibail-Rodamco in 2018, has owned the property since 2002. In 2017, the firm finished a $1 billion renovation of the mall.

“The property is considered one of the top malls on the West Coast,” Fitch said in its report.

For the last two years, Unibail has planned to sell its malls in the U.S. And it’s willing to stop making debt payments on them, too.

In June, the firm and Brookfield Properties ceased making payments on a $558 million loan tied to the Westfield San Francisco Centre mall, after Nordstrom announced it would exit the property. The companies plan to hand the keys to the lender.

This story has been updated to reflect a May valuation of the property and KBRA’s stressed valuation.