A new real estate transfer tax in Los Angeles was supposed to give the city an average of $56 million a month in its first year. In its first month, the Measure ULA tax took in $3.6 million.

For transactions closing in April, the city received the revenue from five deals that were subject to the new tax, Bisnow reported.

The so-called “mansion tax,” which went into effect April 1, adds a 4 percent tax on real estate transactions of more than $5 million and a 5.5 percent tax on transactions over $10 million.

It was expected to generate $672 million in its first year, at a needed pace of $56 million a month, to support affordable housing and homeless programs.

Supporters of the new tax weren’t surprised the first month’s receipts weren’t tracking with annual estimates.

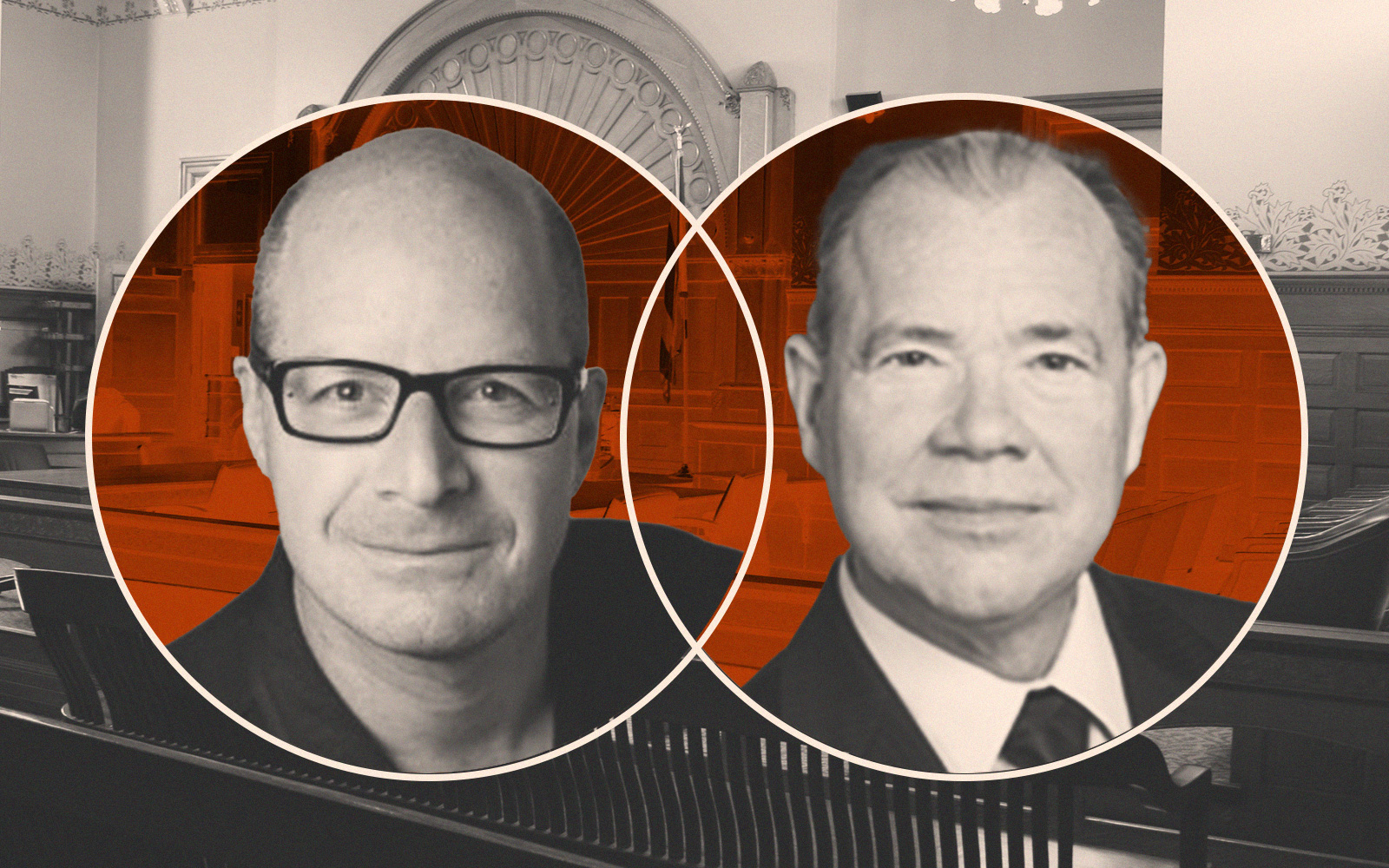

Eli Lipmen, executive director of Move L.A. , said its supporters expected to see a rush to close deals before the tax launched, followed by an expected lull. He said its backers were “in this for the long haul.”

Read more

Since it was proposed, Measure ULA received pushback from the real estate industry, which mounted legal challenges and a state ballot measure that aims to invalidate the tax. The legal and legislative challenges have put up hurdles to spending the money that Measure ULA takes in.

In this year’s city budget, Mayor Karen Bass proposed spending $150 million from the new tax on programs to combat housing insecurity. That includes $62 million to buy and renovate homes, $25 million to help rent-burdened seniors and people with disabilities and $25 million for eviction defense services.

If the legal challenges to Measure ULA were successful, Bass proposed using $150 million in federal funds the city expects to receive to offset any reimbursements.

— Dana Bartholomew