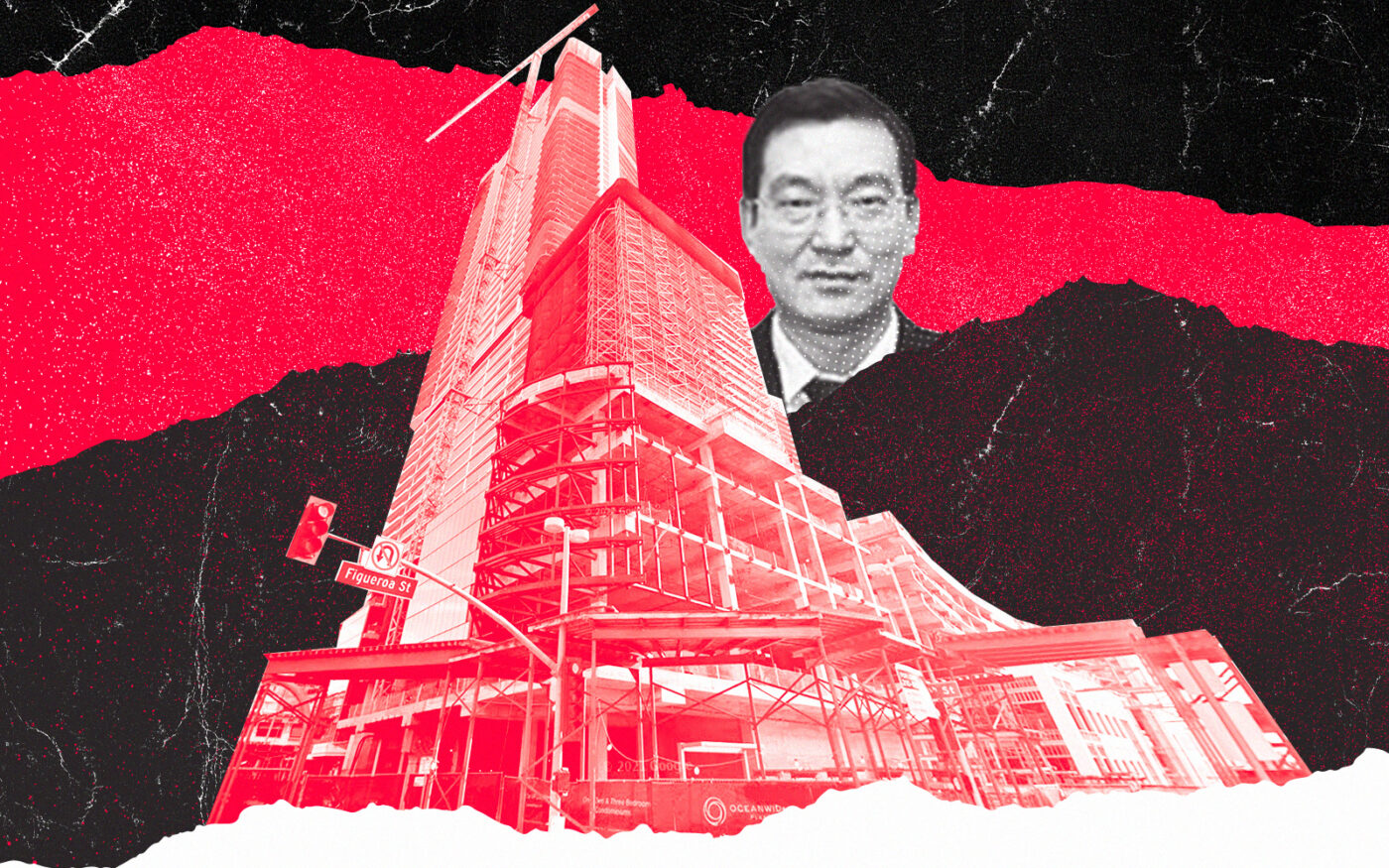

China Oceanwide Holdings, the Beijing-based developer behind Oceanwide Plaza, one of the largest unfinished projects in Downtown L.A., has defaulted on an EB-5 loan tied to the development, The Real Deal has learned.

The company owed $157.4 million to a group of EB-5 lenders as of January, according to a notice of default filed with L.A. County. A sale of Oceanwide Plaza can be scheduled after Aug. 8, according to the notice.

Oceanwide Plaza, which is the only U.S. asset Oceanwide has left, has sat unfinished since 2019. In filings with the Hong Kong Stock Exchange, the firm said it would need more than $1.2 billion to finish construction, in addition to the $1.1 billion it has already spent.

Across two towers, Oceanwide had planned to build a Park Hyatt hotel and 500 condominiums.

Oceanwide has “failed to complete construction of the project in accordance with the loan agreement,” and failed to obtain a senior construction loan, according to the notice.

The firm has also allowed mechanic’s liens to be filed against the project — violating the loan agreement — and failed to keep all risk insurance on the development.

The EB-5 investors — together with a limited partnership named L.A. Downtown Investment — also said Oceanwide has failed to pay at least $11.8 million in interest payments and $56 million in principal.

The EB-5 group recorded a loan with L.A. County for $325 million in 2015. However, in court records, contractors for Oceanwide have claimed the EB-5 lenders were only able to raise $138 million for the project.

In February, an L.A. Superior Court judge ruled that the EB-5 lenders held a more senior position in the debt stack than unpaid contractors, meaning the lenders would get paid out first in the event of a default.

Oceanwide has also disclosed that it has signed a letter of intent to sell Oceanwide Plaza to a “potential buyer,” but has not provided further details.

Read more