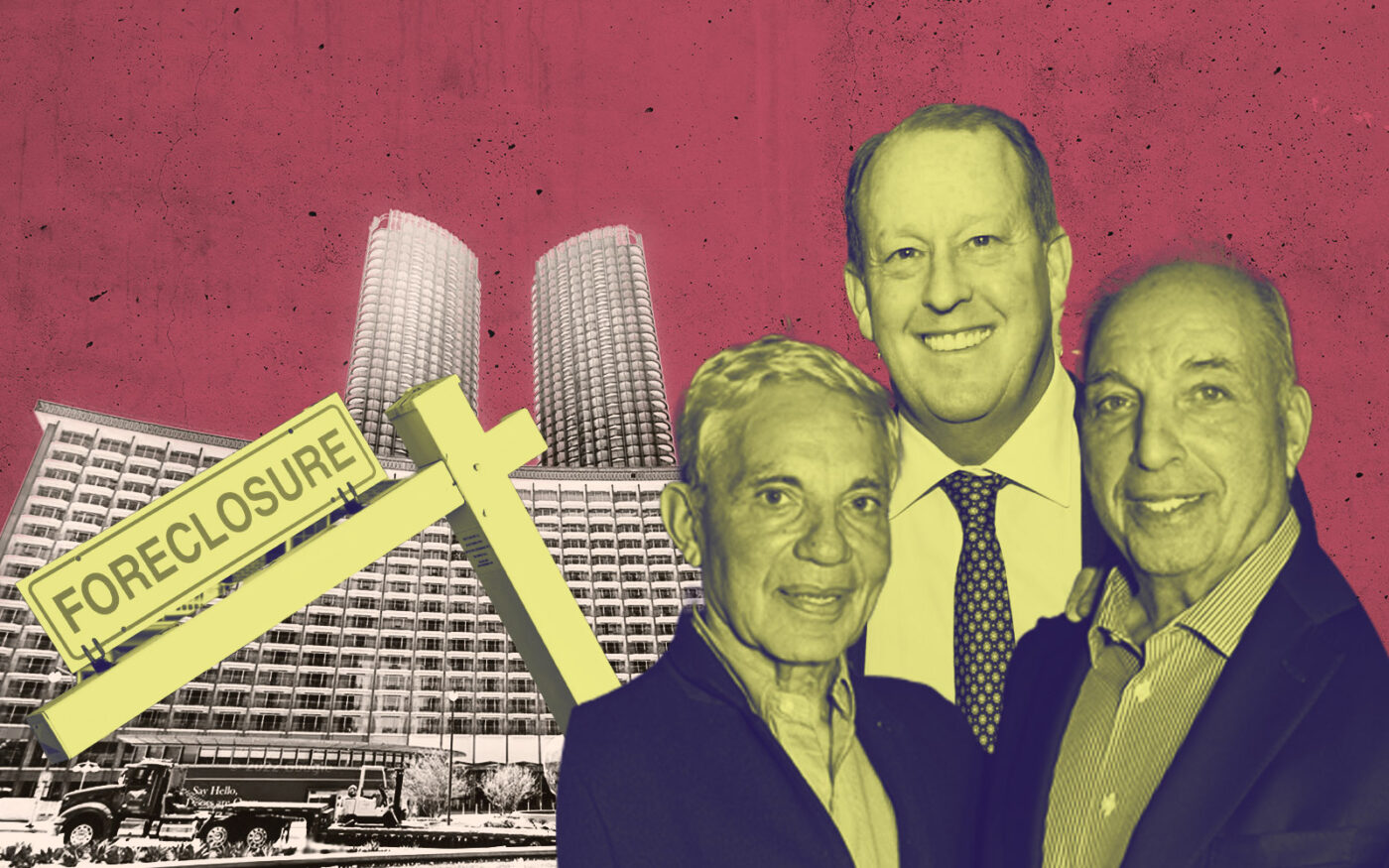

The door is open for the Reuben brothers to foreclose on Century Plaza.

After a group of EB-5 investors failed to post a $100 million bond, a California court allowed the Reuben brothers and their investment vehicle, Motcomb Estates, to pursue a foreclosure on the $2.5 billion development at 2025 Avenue of the Stars in Century City, according to a source familiar with the matter and court documents.

David and Simon Reuben have been in a legal battle with a group of EB-5 lenders since October of last year, after the 900 foreign investors claimed the Reubens and Motcomb reshuffled the debt stack on the property, allegedly whittling away the rights of more junior lenders to reclaim loan payments.

L.A. County Superior Court judge Mark Epstein ordered the EB-5 investor group to post a $100 million bond by 11:59 PM on Thursday, he said during a court hearing on Monday. If they didn’t, the Reubens could proceed with a UCC foreclosure.

The EB-5 investors had argued they were never aware of a mezzanine loan agreement between Michael Rosenfeld — the developer of the project — and the Reuben brothers, signed in 2020.

But, the U.K.-based investor brothers introduced evidence that showed attorneys for the EB-5 investors were included on an email with the attached agreement. The evidence was discovered by attorneys for the EB-5 investors, but was never brought up to the court.

“CMB’s false claim that it was misled by Reuben Brothers in connection with the Century Plaza loans blew up in its face,” Matthew Parrott, a real estate attorney at Fried Frank who is representing the Reubens, said in an emailed statement.

“You were told that that was the plan,” Judge Epstein told Matthew Taggart, an attorney for the EB-5 investors, during the Monday court hearing. “It undercuts the very heart of the argument you were making to me.”

“I am a little bit disturbed that we went all this way without anyone even mentioning the fact that aspects of the evil plan apparently were disclosed,” he added.

Parrott did not respond to a request for comment.

Judge Epstein then said the EB-5 investors could continue their arguments and keep a pause on the foreclosure for at least another 30 days if they posted the $100 million bond — but that was a tall ask for the investor group.

In a letter to a court in New York — where the group is also suing the Reubens — an attorney for the EB-5 investors said the consortium “will not be able to post such a bond in so short a time period.”

“It is simply not possible,” Jonathan Preziosi said in the letter.

Transfer tax troubles

Though the Reuben brothers are able to proceed with a foreclosure, they will not be able to close before the city of L.A.’s new transfer taxes go into effect.

The Reubens had pushed both the California and New York courts to allow a foreclosure to occur before April 1, when the city will introduce a 5.5 percent transfer tax on all sales over $10 million.

However, on March 1, New York state court blocked the foreclosure, allowing arguments to proceed.

Attorneys are still unclear whether the new transfer taxes will apply to foreclosures. Currently, L.A. County documentary transfer taxes do not apply to foreclosures, which provides precedent, but it’s unclear how the new taxes will be administered.

Generally, any change in control — including a shift in underlying LLC ownership — will trigger the tax, with a custom that the seller pays, attorneys have previously told The Real Deal.

“If the property were valued at $2 billion, that would be a $110 million tax loss that we wouldn’t otherwise incur,” Parrott said during a Feb. 10 court hearing in New York. “It appears very possible, indeed likely, that that law would apply to foreclosure transfers.”

Even though the EB-5 investors failed to post the bond by Thursday morning, foreclosure sales cannot go through on March 31, given it’s a California state holiday — César Chávez Day.

This means the earliest the sale can go through is April 3 — two days after the tax goes into effect.

Either way, Rosenfeld is finally set to lose control of the property, after defaulting on almost $1.8 billion in loans connected to the redevelopment in July 2021.

The Reubens held off on pursuing a UCC foreclosure until the investors were sued by an entity of DigitalBridge — formerly known as Colony Capital — which also holds a mezzanine stake. DigitalBridge settled its lawsuit against the Reubens earlier this year.

Read more