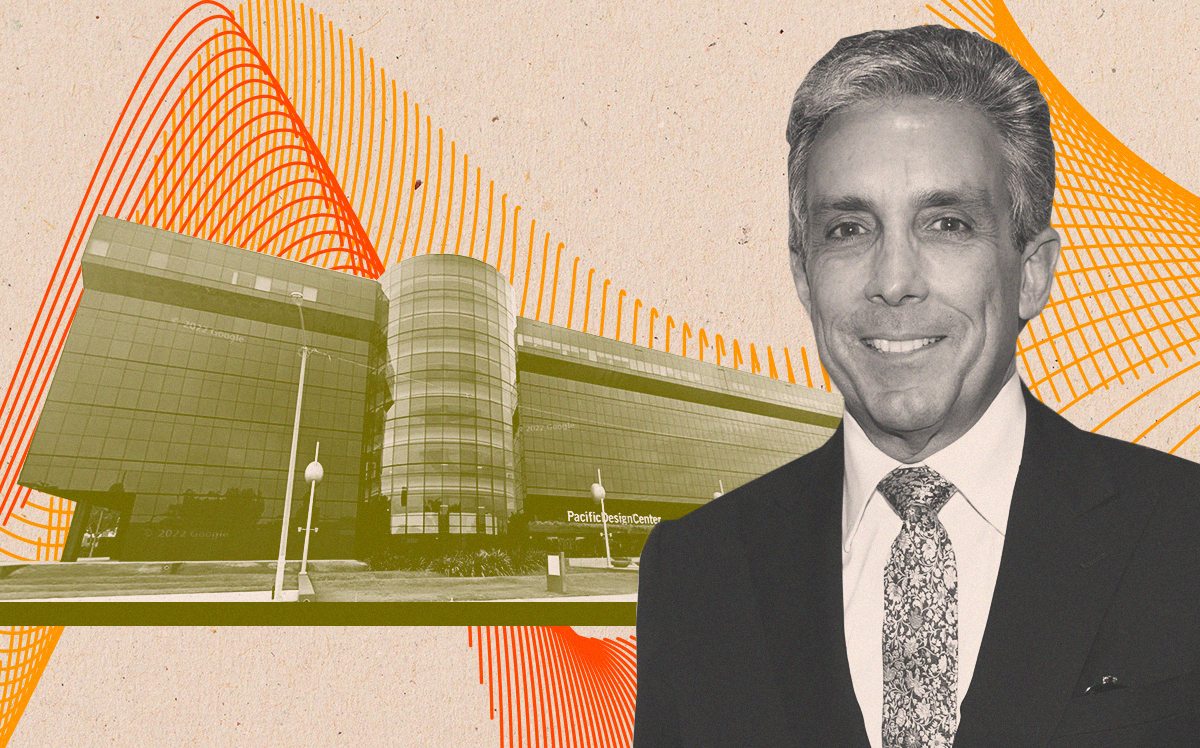

Billionaire developer Charles Cohen has scored a $265 million refinancing package on two buildings at his West Hollywood trophy asset, the Pacific Design Center, The Real Deal has learned.

Cohen Brothers Realty’s new loan from Goldman Sachs replaces a $145 million CMBS loan from Wells Fargo, records filed with L.A. County show.

Wells Fargo’s loan on the two buildings, which originated in 2014 with a fixed interest rate of 4.81 percent, was set to mature in July 2024, according to data from Morningstar.

Cohen’s new loan covers two out of the three buildings at the 8687 Melrose Avenue property — the Green and Blue buildings, which total about 1 million square feet. The Blue building is currently leased to tenants including Wolfgang Puck, Mosaic Floral Design and the Society of Interior Designers.

Cohen did not respond to a request for comment.

Refinancings have become a rarity over the last six months, as interest rates have skyrocketed. However, lenders are still expected to work with borrowers by granting modifications and extensions to “stable performing assets,” according to a Fitch Ratings report.

WeWork, Trion Properties and Cedars-Sinai are among tenants leasing space at the Green building, according to the Pacific Design Center website. WeWork also leases space at the 400,000-square-foot third property, dubbed the Red building.

As of September 2019, Cedars-Sinai was paying $3.1 million in base rent and occupied about 114,000 square feet at the Green building. WeWork was paying about $1.1 million in base rent, according to Kroll.

The property has always struggled with vacancy, even before the pandemic. In 2018, the Green and Blue buildings were only 55 percent occupied, after advertising firm IPG vacated about 21 percent of the buildings, according to DBRS Morningstar. By December 2021, occupancy jumped to 70 percent.