In a landmark redlining settlement, the Department of Justice announced Thursday that City National Bank has agreed to pay $31 million related to claims that the bank systematically discriminated against Black and Hispanic Angelenos who sought mortgages.

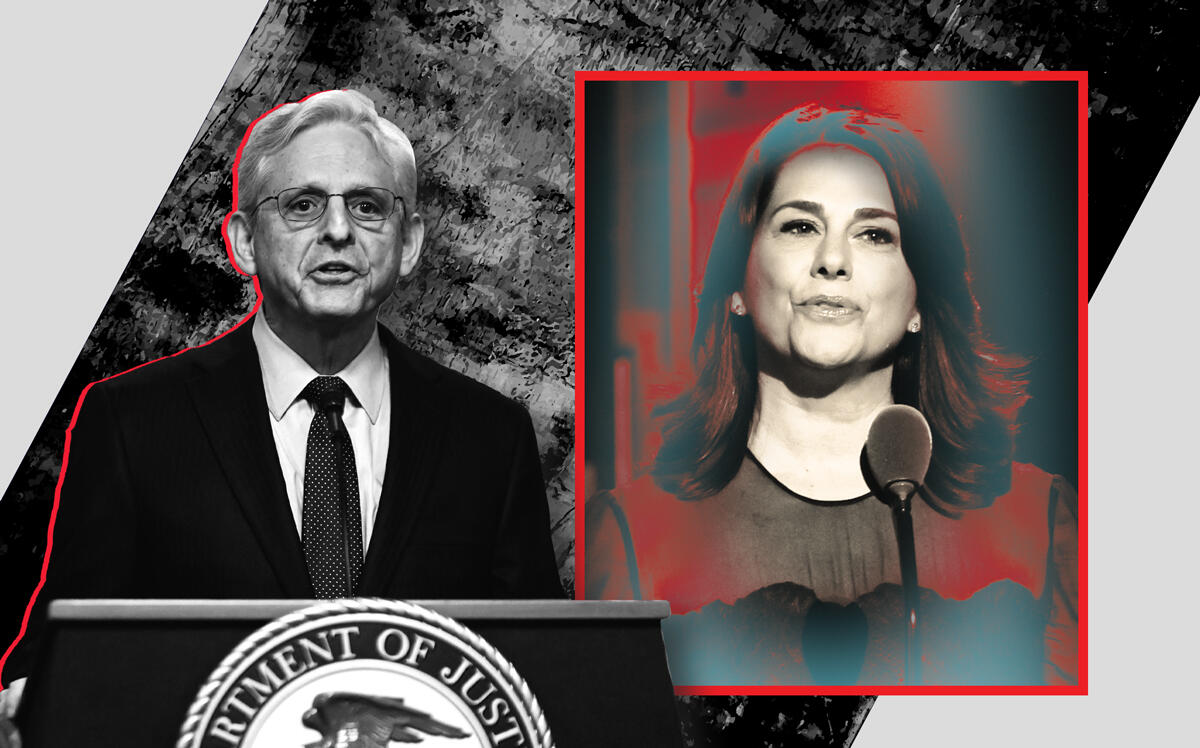

“This settlement is historic, marking the largest settlement ever secured by the Justice Department against a bank engaged in unlawful redlining,” Kristen Clarke, an official with the department’s civil rights division, said in a statement.

Attorney General Merrick Garland joined a chorus of officials claiming the settlement as a major victory in the department’s newly emboldened effort to ensure fairness in the housing market. Through its Combating Redlining Initiative, the department has so far secured more than $75 million, Garland said, making the new $31 million settlement its most significant since the department vowed a crackdown in late 2021.

The department’s case against City National, the largest bank headquartered in Los Angeles, dates back to 2017. For at least three years, the DOJ alleged, the bank “avoided providing mortgage lending services to majority-Black and Hispanic neighborhoods in Los Angeles County and discouraged residents from obtaining mortgage loans.”

Between 2017 and 2020 the bank, which has assets of around $95 billion, received more than six times fewer mortgage applications than other banks did in those neighborhoods, the DOJ alleges. It also failed to open new branches to serve Black and Hispanic customers: Of the 11 branches City National opened or acquired over the past 20 years, only one was in a Black or Hispanic neighborhood, where it did not assign an employee to generate mortgage applications.

L.A. County — which in recent years has been roiled by both a housing crisis and racial tensions, including a major scandal involving member of the L.A. City Council — is roughly half Latino and 9 percent Black.

The DOJ filed a federal complaint over the case concurrent to the settlement announcement. As part of the deal, which is still subject to court approval, City National has agreed to invest at least $29.5 million in a loan fund for residents of majority-Black and Hispanic L.A. County neighborhoods, open one new branch and assign at least four mortgage loan officers to majority-Black and Hispanic neighborhoods.

In a statement, City National said that it disagreed with the allegations “but nonetheless (supports) the DOJ in its efforts to ensure equal access to credit for all consumers, regardless of race.”

The bank also emphasized that it spends tens of millions of dollars annually on affordable housing and other community-minded programs, and that it is starting new programs that go beyond the requirements of the settlement, including lending initiatives for “entrepreneurs and potential homebuyers in underserved communities nationwide.”

City National will begin the Small Business Administration lending program in the L.A. area this year, it said, while also ramping up residential mortgage lending in California and other states.

The settlement comes amid an increased focus on systemic racism in the real estate industry, which historically played a major role in exacerbating the country’s racial wealth gap. In October the California Association of Realtors apologized for its past discriminatory practices, and last summer, in a case that took on national significance, L.A. County returned Bruce’s Beach, a valuable Manhattan Beach property, to the Black family it had seized the land from a century earlier.

Read more