From the summer of 2017 to early 2021, a real estate investment firm in Orange County coaxed potential investors with a pitch that sought to capitalize on Southern California’s red-hot housing market.

The firm would use investors’ funds, which it claimed were secured, to issue short term loans to developers, including house flippers. It promised to use the interest and fees it received from those loans to pay annual returns ranging between 6% and 9% on their investments to investors, according to a legal complaint filed on Thursday by the SEC.

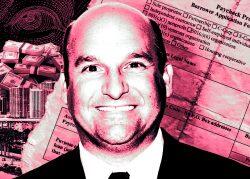

Over three and a half years, the firm–called Secured Income Group (SIG) and run by CEO Max McDermott–raised just shy of $100 million. But its secured loan scheme amounted to fraud, the SEC alleges.

“In reality,” the complaint states, “SIG and McDermott…dramatically departed from this purported business model, and in doing so misrepresented material aspects of the investment to prospective investors.”

The complaint named SIG, McDermott as the firm’s founder and owner, and its investor relations representative Stacey Porter.

Through a representative, McDermott referred TRD to his lawyer, who did not immediately respond.

McDermott, who lives in Newport Beach, founded Tustin-based SIG in 1996, according to the firm’s website. Since then SIG — which calls itself a speciality finance company and uses the motto “simple terms, strong returns” — has produced $2.1 billion in originations, according to its website, which also says it has nearly 300 active loans in four states.

But the SEC now alleges that a major component of the firm’s operation was corrupt.

The charges revolve around the firm’s offering of “Secured Debentures” — investments that would be safe, it promised, because the loans SIG issued to real estate developers with investors’ money would be secured by first lien positions on the properties being developed.

“SIG and McDermott marketed the debenture investment as safe and secure, comparing it to a CD, but with a higher yield,” the complaint states.

SIG also promised to hold the loans it issued.

Porter, who for years received commissions, took the lead on soliciting investors and leaned heavily on the “secured” promise in her pitch, according to the complaint, while McDermott oversaw the lending operation and also led the firm’s online marketing push. McDermott also talked to investors directly, “where he reiterated that SIG would use investor money to fund real estate loans secured by first trust deeds,” the complaint says.

But while SIG took in about $100 million from investors, the firm, rather than holding the loans it issued to developers and collecting interest, sold tens of millions of dollars of notes to third parties at face value, the SEC alleges, which jeopardized what it had promised were secure investments.

“SIG’s selling off its loans without repaying debenture investments led to a predictable result,” the complaint states — a growing disparity between the value of SIG’s outstanding loans and the amount it owed its own investors. By late 2020, the firm owed its debenture investors nearly $87 million but had only $23 million in its loan portfolio.

Eventually the disparity led numerous investors to question the firm’s underlying loans. The suit alleges that SIG at one point issued a portfolio summary that exaggerated its principal amounts by $45 million, and also mischaracterized loans it had already foreclosed upon as “performing.” That deception led some investors to pump even more money into the company, the SEC alleges.

The firm stopped accepting new debenture investment money in January 2021, according to the complaint, and McDermott did use “at least some of the proceeds from loan sales, as well as transfers from his other companies and sales of other assets” to pay down the liability to investors; as of earlier this month the firm owed 14 investors approximately $17.5 million.

The SEC is seeking unspecified civil penalties, while the firm’s website also notes it is “not accepting new or additional investments at this time.”

Read more