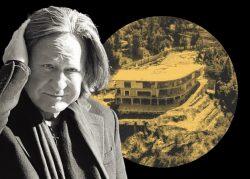

A federal bankruptcy judge effectively sidelined Mohamed Hadid by ordering the appointment of a Chapter 11 trustee — a neutral party — in the ongoing case of the controversial Franklin Canyon land where the high-profile spec developer dreamed of building megamansions.

The court’s order is the latest turn in a years-long battle for control of the choice hilltop parcels and–in a more recent development–their potential pending sale to a Ventura County construction firm.

The two entities that own the land, Coldwater Development LLC and Lydda Lud LLC, filed for bankruptcy protection in January but had remained managed by Hadid. At last week’s hearing the judge, Sheri Bluebond, also ordered that assets related to the cases be transferred immediately from the entities’ control into a trust account controlled by lawyers.

“No matter how your spin it”

“No matter how you spin it, it’s a horrible day for Hadid because the judge said she didn’t trust him to manage the company,” said Ronald Richards, an

attorney who represents Give Back, LLC, which represents unidentified private backers and has been attempting to wrest control of the properties as part of a stated aim of preserving the land as open space.

Before Coldwater and Lydda Lud declared bankruptcy, Give Back began buying the entities’ debt and became the largest creditor, with some $30 million worth of notes.

Hadid appeared to condone the order, likely because the move could ultimately help spur a sale.

“It felt like he was OK with it because he will be able to explain that there was a ‘no harm, no foul’ type of situation here,” said Aram Ordubegian, an attorney who represents Coldwater Development and Lydda Lud, referring to Hadid’s actions that prompted the trusteeship. “And also it allows the current potential buyer … to have more opportunity, or more time, to do their due diligence.”

Missing $1.5M

The potential for harm and a foul apparently grew after Hadid drained an escrow account attached to the case.

In May, with the bankrupt properties on the market, a mysterious potential buyer surfaced, in the form of an LLC that was purportedly connected to the Saudi royal family. That potential buyer deposited $1.5 million into an escrow account, but the money disappeared within weeks. A subsequent court filing revealed that Hadid had directed the money out of the account without the court’s or even his own lawyers’ “consent or knowledge.”

In a legal filing, Ordubegian and his team offered seven paragraphs of “context” on Hadid’s money shifting. The filing contends that Hadid wired the money back to the potential Saudi buyer, who demanded the return because a non-disclosure agreement to maintain the anonymity of the buyer’s high-profile family had been breached.

Hadid has replaced $1.1 million of the fund. The missing $400,000, the filing said, was used by Hadid “to continue to secure and maintain the property” on the authorization of the potential Saudi buyer.

“This individual became increasingly insistent,” the filing said, “and Mr. Hadid at some point relented, directing the escrow officer to return the funds to the [Saudi buyer]. Mr. Hadid then secured replacement funds in the amount of $1.1M.”

Richards had a different take.

“What he did … was reprehensible,” the attorney said in an interview last week. “He ordered money that everybody thought was in an escrow account and had it returned to somebody in a foreign country, and then he replaced it with somebody else’s money.”

In an interview, Ordubegian added that the judge’s order was not solely related to Hadid’s escrow draining, but also the fact that his replacement of the funds had created a conflict of interest.

Working the System?

Hadid’s opponents have expressed doubts that there was ever a legitimate potential buyer at all. Some contend that the spec developer’s escrow maneuver amounted to more evidence of his real strategy: creatively working the legal system to stall for time.

But that time could be drawing shorter. On Tuesday Judge Bluebond gave the latest potential buyer, Sahara Construction Company, a deadline of today to make an additional $1.5 million refundable deposit to demonstrate proof of funds on a $37 million bid for the land.

Sahara, based in Moorpark in Ventura County, also has been attempting to buy another highly controversial Hadid property, the doomed Strada Vecchia mansion.

In late October, seemingly out of nowhere, the firm expressed interest in the Franklin Canyon land just as the court-ordered auction for the property was ending. Sahara did not make a qualified bid but hinted at the $37 million offer and requested more time for due diligence, which the court granted. The firm also said it is seeking to finance, rather than use its own funds, for the potential offer.

The trustee could decide to look for a higher bid even if Sahara makes an offer, perhaps putting the property back on the market and delaying the saga for months. Richards, meanwhile, has also proposed another option, in which Give Back would assume control of the land by paying off the other creditors in the case, who are owed a total of $2.6 million.

Read more