It’s a democratic tradition like no other: California voters weighing in on crucial and complicated ballot propositions.

“It’s pretty unbelievable,” said Eric Sussman, UCLA professor of finance. “Things that ought to be passed by our legislators are relegated to completely uninformed voters. Even educated people don’t understand these initiatives.”

Ah, but such blind ballot-casting came before The Real Deal unveiled its proposition voter guide.

While we cannot help on initiatives like Prop 14 (issuing bond money for stem cell research) or Prop 23 (regulating kidney dialysis clinics), TRD will walk you through three propositions on the Nov. 3 ballot of fundamental importance to real estate.

We know they’re important because trade groups including the California Association of Realtors and companies like Blackstone are spending tens of millions of dollars to support or oppose them (voters choose “yes” or “no” on each, with a simple majority needed for approval).

Here’s what you need to know, including a detailed look at the most significant commercial real estate ballot measure in years:

Prop 15: The California Schools and Local Community Funding Act of 2020

Prop 15 is a well-funded attempt to change the third rail in California politics: the property tax freezes accomplished by 1978’s Prop 13.

Under Prop 13, properties are taxed at 1 percent of their assessed value when purchased. So, an office building valued at $1 million when bought in 1980 is still assessed at $1 million today if it hasn’t changed hands since.

Prop 15 keeps those rules in place for residential properties including single-family homes and multifamily buildings. It also does not touch agricultural property and exempts commercial real estate valued at less than $3 million.

What’s left? Commercial real estate valued at more than $3 million. That would be assessed and taxed based on its present-day value. The aforementioned office building could have an assessed value today of $50 million, leading to an exponential tax increase.

Prop 15 would generate $12 billion in additional annual revenue, according to a USC study cited in the ballot initiative. The money — and here is where the ballot measure’s name comes in — would mainly go to county education offices.

Before exploring how furious the real estate industry is (“We are all against Prop 15,” said Gary Weiss, a commercial broker at LA Realty Partners), let’s deal with something wonky. This sea change in tax law would require county assessors to visit commercial properties and determine their current market value.

How would such an enormous undertaking work? The measure’s language speaks of a “task force” the state will create, and that Prop 15 will be gradually phased in starting in 2022.

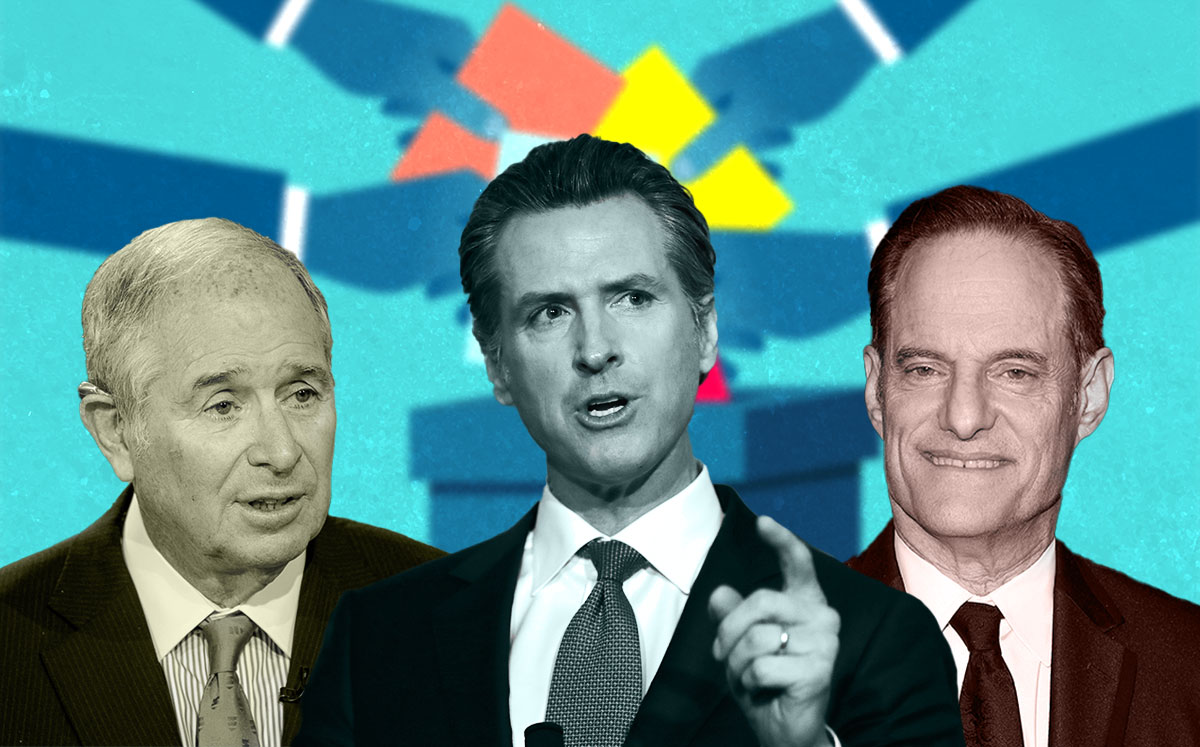

The skimpy implementation language may be because observers view approval as a long shot, even with Gov. Gavin Newsom’s endorsement.

“It’s dead on arrival,” Sussman said. “For a lot of people, they’re going to see ‘increase in taxes’ and vote ‘no’ even if the tax increase doesn’t affect them.”

Just in case, the real estate industry is spending $34.5 million to oppose the bill, according to the California secretary of state. About $25 million of that comes from the California Business Roundtable, a political action committee funded by a who’s who of real estate giants.

New York asset management company Blackstone gave $7 million to the Business Roundtable, per state records. Los Angeles developer G.H. Palmer & Associates — Geoff Palmer’s firm — gave more than $2 million, retail investor Macerich gave $1 million, and Douglas Emmett forked over $750,000.

Other contributors of note: New York’s Shorenstein Company ($500,000), and L.A. developers Kilroy Realty ($500,000) and Kennedy Wilson ($250,000).

Companies reached for comment referred questions to the Business Roundtable. The group has argued that the tax hikes will be passed on to consumers and tenants, many of whom are already squabbling over rent payments.

Prop 15 supporters have spent even more: $40.8 million so far. The biggest contributor is the California Teachers Association PAC, which has spent $12.4 million, while Service Employees International Union groups also brought in millions. The unions’ interests are clear, as the new tax revenue is earmarked to help pay public education workers.

Organized labor points out that California has one of the lowest commercial property tax rates in the country, while schools have the highest teacher-student ratio in the U.S.

A group started by Facebook CEO Mark Zuckerberg and his wife, Priscilla Chan, has raised an additional $10.9 million in support. Zuckerberg, a funder of education initiatives, stands alone among California business executives financially backing Prop 15.

Prop 19: Property Tax Transfers, Exemptions, and Revenue for Wildfire Agencies and Counties

57,463,195 to 0.

That’s not the halftime score of the Lakers’ NBA finals clinching win over Miami, but dollars spent by supporters compared to opponents of Prop 19. According to state records, $51.4 million of that money comes from the California Association of Realtors while the National Association of Realtors pitched in $4.9 million.

Under Prop 13, virtually all homes are reassessed after being purchased.

Prop 19, though, allows anyone over 55, severely disabled, or the victim of wildfires to move into a new home yet be taxed based on their old assessment.

Take a 57-year-old who bought a house in 2000 that was assessed then at $100,000. If he buys a house this year for $1 million, his tax bill will be the same as it was on the old home based on its 20-year-old assessment.

Despite such tax breaks, the measure’s supporters — including Newsom and other Democratic leaders — voice confidence that Prop 19 will yield a net gain in tax revenue, with the money going to address California’s wildfire crisis.

That’s because the initiative also “eliminates unfair tax loopholes used by East Coast investors, celebrities, wealthy non-California residents, and trust fund heirs.” Yes, that is the actual language of the ballot measure.

The “loophole” is that today, inherited homes are not reassessed. Under Prop 19, inherited homes that are not primary residences will be assessed anew.

So, why does the state’s real estate agent lobby care?

The California Association of Realtors pitch Prop 19 as addressing the wildfire problem. But the measure’s primary impact would be incentivizing home purchases for anyone over age 55.

“This is a proposal being put forth by the real estate industry in order to gin up commissions by encouraging older Californians to sell their homes,” said Daniel Yukulson, executive director of the Apartment Association of Greater Los Angeles, although his group, like much of the real estate industry, has not taken a formal position on Prop 19.

A California Association of Realtors spokesperson responded to questions by stating, “We do not discuss funding,” and adding, “The ‘Yes on 19’ campaign is focused on educating voters who will be voting on many state and local initiatives.”

Despite no money being spent against it, Prop 19’s passage is no sure thing.

“This measure is so esoteric,” Sussman noted. “I don’t see enough understanding of what this means or unhappiness with the status quo.”

Prop 21: The Rental Affordability Act

In 2018, the AIDS Healthcare Foundation shepherded onto the ballot Prop 10 in an effort to allow for more rent control. The ballot measure would have repealed California’s Costa-Hawkins law, a statute that forbids county and city governments from enacting new rent control statutes. But California voters defeated the measure, with 59 percent siding with landlords and voting “no.”

In the two years since, things have changed, as they say. For one, Newsom signed into law Assembly Bill 1482, which stops landlords from raising rents more than 5 percent plus inflation on most residential properties built before 2004.

But the AIDS Healthcare Foundation wants more, and gathered the signatures needed to put a similar Costa-Hawkins repeal on this November’s ballot.

Prop 21 would let counties and cities impose rent control on residential properties not built within the past 15 years. That includes units where the tenants change hands, though landlords could raise rents on turned-over units by at least 15 percent over three years.

The AIDS Healthcare Foundation has spent $30.6 million so far in support of Prop 21. Spending on the measure not from the L.A.-based advocacy group includes $50,000 from the California Nurses Association PAC. And that’s it.

“The Yes on 21 Campaign has been going extremely well,” said AIDS Healthcare spokesperson Ged Kensella. “We have a better campaign team in place” and “a much more sensitized electorate, given the humanitarian and economic hardships the coronavirus has visited on people.”

Landlords deride Prop 21 as a vanity project of AIDS Healthcare Foundation executive director Michael Weinstein. They have long argued that rent control only makes California’s affordable housing crisis worse because it discourages development that would increase the housing supply.

“Join us in our opposition to the [sic] Weinstein’s housing freeze,” declares the “no on 21” campaign website.

Prop 21 opponents have spent $35.6 million, with money largely from real estate investment trusts including San Mateo’s Essex Property Trust ($7.5 million), Chicago-headquartered Equity Residential ($5.6 million), Avalon Bay ($4.4 million), UDR ($2.5 million) and Prometheus Real Estate Group ($2.1 million).

Landlords are cautiously optimistic.

“Based on our polling, we believe that Prop 21 will be defeated by a similar margin to Prop 10,” Yukelson said. “My only concern is having the funding and resources to get out our messaging.”