The year started off with some sizable multifamily investments in Los Angeles, including one sale that topped the most-expensive sale of 2018.

The top five multifamily sales in January include locations throughout the region, from El Monte to Long Beach. They combined for $390.9 million – nearly double the sum of the top five sales in December.

1. 1231 S. Hill Street | $180.1M

Mack Real Estate Group purchased the mixed-use building at 1231 S. Hill Street from the Los Angeles County Employees Retirement Association for $180.1 million on January 8. Later in the month, the association announced it would invest $250 million into the international real estate market this year in hopes of getting higher returns.

2. The Landing at Long Beach | $72M

Friendly Franchisees Corp. acquired the 206-unit apartment complex at 1613 Ximeo Avenue in Long Beach for $72 million. The property includes 18 two-story buildings and spans about nine acres. The firm secured a $43.1 million loan for the purchase.

The seller of the Landing at Long Beach was Western National Group, an Irvine firm that paid $46 million for the complex in 2012.

3. 269 S. La Fayette Park Place | $71.6M

On the last day of January, Blackstone Group sold its property at 269 S. La Fayette Park Place in Rampart Village for $71.56 million. The buyer was Roberts Companies.

The 147-unit building was completed in 1970 and includes 123,500 square feet of space.

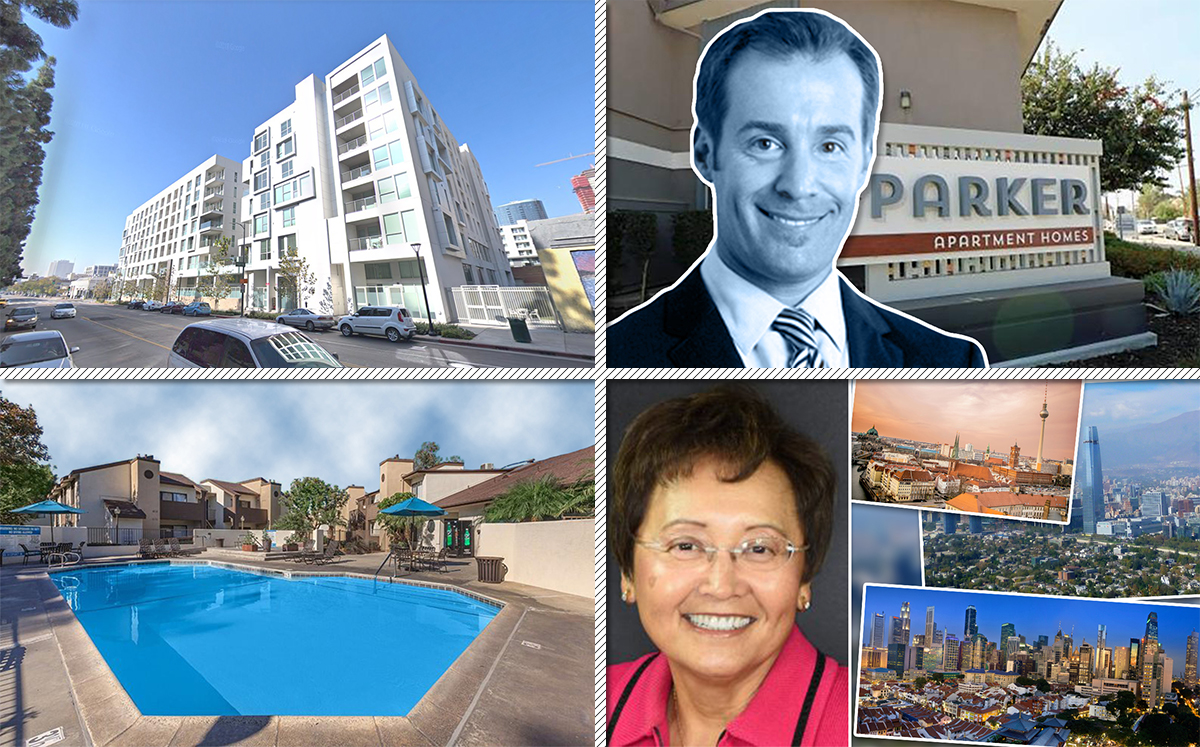

4. The Parker | $40.5M

Uhon, Inc., a private equity firm tied to Chinese developer Shenzhen Yuhong, paid $40.5 million for a 177-unit apartment building at 4608 Arden Way in El Monte. The seller was Benedict Canyon Equities.

It is one of the only multifamily properties of its size in the area. The apartments sit across from the 1.2 million square-foot industrial redevelopment site for the Goodman Logistics Center.

5. Villa Elaine Apartments | $26.7M

Slate Property Group, a New York City-based real estate investment and development firm, paid $39 million to acquire two multifamily properties in Hollywood, including the 102-unit Villa Elaine Apartments at 1245 Vine Street. The other building is located at 1665 Sycamore Avenue.

The off-market deal was Slate’s first investment in Los Angeles. The five-story Villa Elaine Apartments is one of the many historical sites in Hollywood. Built in 1925, it was once the home of Frank Sinatra, Orson Welles and Man Ray. It’s since been used as a popular filming location.

A family trust controlled by Chandler Jones sold both properties, records show. Both buildings had remained in the trust for more than 50 years.