As shopping malls nationwide have been battered by e-commerce, mall landlord Macerich has sought alternatives by redeveloping some of its properties into creatives office spaces.

But that didn’t solve the core problem.

Net income fell sharply for the quarter and the year.

Macerich’s net income from September through December was down 64 percent, to $11.7 million in 2018 compared to $32.7 million the year before. For the year, it plummeted 59 percent, to $60 million from $146.1 million in 2017.

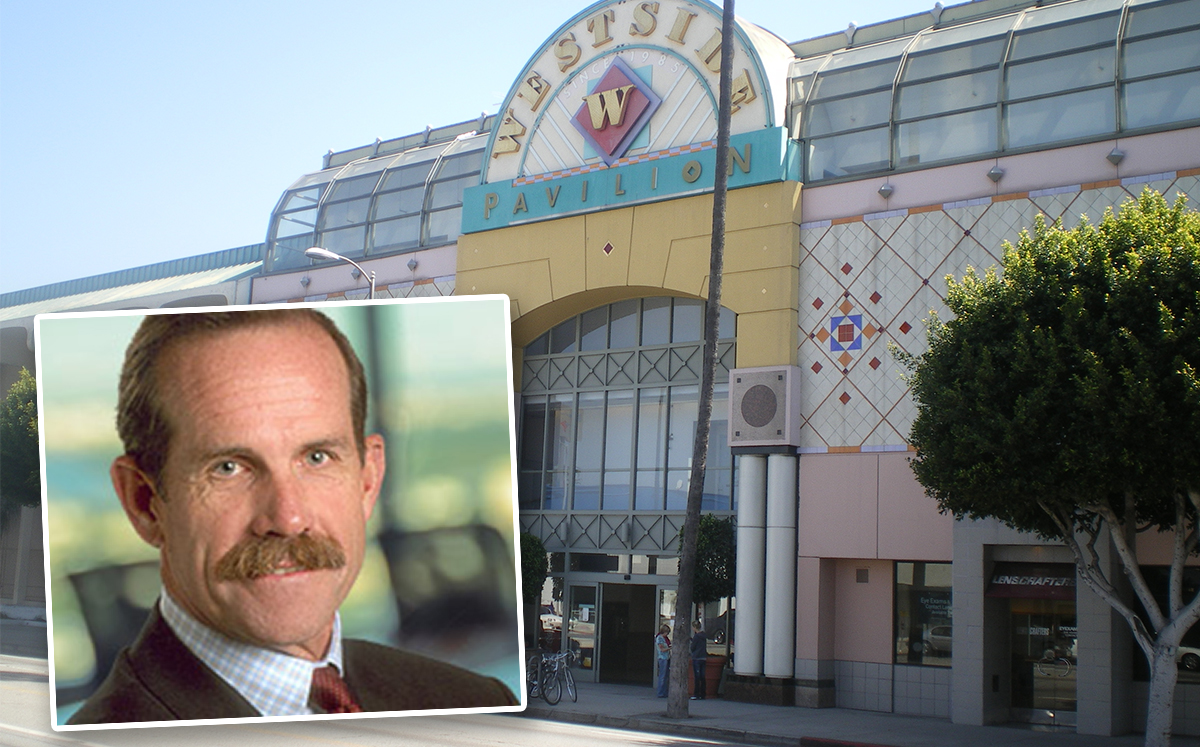

At its fourth quarter earnings call Thursday, Macerich CEO Thomas O’Hearn described the immediate issues facing the Santa Monica, California-based real estate investment trust. The firm has across its malls 90 stores whose tenants have filed for bankruptcy in the last year, he said.

O’Hearn expected the impact of tenant bankruptcies to hit Macerich hardest in the first half of this year.

“We do expect to see more” closures, O’Hearn said. “I expect it to be front-end loaded, that’s fairly typical.”

There was some good news. Occupancy, annual sales and average rent per square foot at the REIT’s 47 malls were higher during the fourth quarter of 2018 compared the same period the year before. But looking ahead, the company expects occupancy to drop 0.5 to 1 percentage point.

Sears Holdings appears to be an albatross around Macerich’s neck.

The once mighty department store is working its way through a complicated bankruptcy process. Macerich has 21 Sears stores at its malls. Most are owned in a joint venture with Sears or its real estate spinoff Seritage, others are owned wholly by Macerich.

Macerich plans to demolish or repurpose those stores once it gains full control of them. Some of them could be partially demolished to free up square footage to develop elsewhere on their properties for health clubs, hotels and possibly office space. The trust is working with co-working firm Industrious to turn unused retail space into flex office space.

Macerich has moved to redevelop some of its underperforming properties around the country, most notably the Westside Pavilion mall in Los Angeles. Macerich partnered with Hudson Pacific Properties in March to convert the mall into 584,000 square feet of creative office space.