Leo Nordine has stopped searching for multifamily properties in unincorporated Los Angeles County.

The Sotheby’s International agent and multifamily investor deleted his MLS alerts for investment properties in this vast swath of L.A. County — an area that covers 65 percent of the county — because the main investment appeal is gone.

“A lot of people who focused on buying apartments in unincorporated L.A. County did so specifically because there was no rent control,” Nordine said. “I was one of them.”

In November, the Los Angeles County Board of Supervisors approved a temporary rent control ordinance for 120 unincorporated areas of L.A. County. The measure made tenant protections there stronger in some ways than other cities with such price controls, such as Santa Monica, West Hollywood, and the City of L.A.

The ordinance, which is in effect for six months, will ease pressure on renters in the short-term. But a permanent ordinance without measures to promote development could drive away investors like Nordine and do more harm than good, critics of the measure said.

The measure was conceived and drafted in the lead-up to the statewide vote on Proposition 10, which would have allowed local governments to place price controls on rental housing built after 1995. Prop 10 failed, garnering the support of just 38 percent of voters statewide and 47 percent of L.A. County voters.

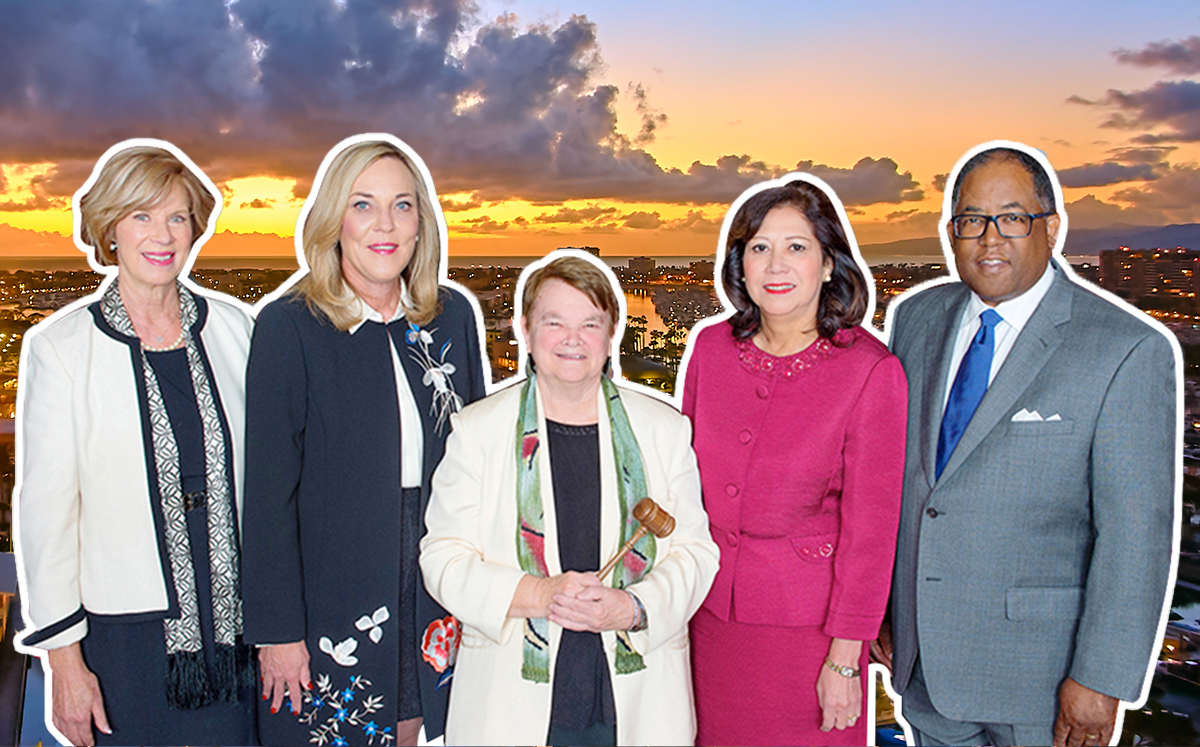

Despite its unpopularity, the board’s 4-1 vote in favor of the rent stabilization ordinance is a clear indication that substantial support exists for rental-price controls among the supervisors’ constituents. The temporary measure covers an estimated 200,000 renters around the county, many of which have experienced years of seemingly never-ending rent hikes.

Following the November vote, County Supervisor Sheila Kuehl, who spearheaded the measure, said in a statement that rent control “thoughtfully adopted with other market regulation measures” could protect at-risk tenants with minimal effects on the market. She did not elaborate on those other measures.

But some economists argue that more is needed.

“If you just do a rent control ordinance, without a set of ordinances to allow more supply and to lower the costs of building and rehabs… then you can actually end up in a situation where you aren’t actually improving the housing market for unincorporated L.A. County,” said Gary Painter, an economics professor and director of USC’s Price Center for Social Innovation.

Other critics say the Board of Supervisors is playing politics. Beverly Kenworthy, Executive Director of the California Apartment Association’s L.A. Division, which represents owners and operators of around 65,000 rentals in the Greater L.A. area, accused the Board of Supervisors of catering to a small group of vocal proponents of rent control.

“This is an emotional issue,” Kenworthy said. “People don’t see or acknowledge the long-term effects.”

Kitty Wallace, an executive vice president with Colliers International, said the measure was meant to drum up support ahead of the Prop 10 vote.

It “was to let everyone know that if Prop 10 passed, they were in support of a three percent cap,” she said.

Wallace said there were few parts of unincorporated L.A. County that saw rent hikes in excess of 3 percent annually this year, or on average over the last five years. Those that did included Ladera Heights, Marina del Rey, and East L.A.

Kenworthy said the current measure leaves something to be desired. One glaring issue with the ordinance is that it did not allow landlords to bring their properties up to market rate rents before restricting them to the 3 percent increase cap, she said. That leaves them in a hole they can’t get out of.

If a permanent measure caps hikes at 3 percent, Kenworthy believes renters should expect consistent 3-percent hikes each year as landlords look to stockpile cash to pay for future maintenance costs.

“Even if they hadn’t raised rents in the past, now they have to,” she said. “They are not going to have the flexibility to project what kind of future maintenance costs they could incur.”

Economists generally oppose rent control. But Painter cautioned that rent control with measures to mitigate negative impacts on the market is a viable policy in markets where landlords have significant market power over renters. That’s the case in unincorporated L.A. County, which is why he supported Prop 10.

But as far as investors go, many like Nordine don’t want to take the risk in unincorporated L.A. County.

The agent said he’s now putting more of his resources towards the “beach cities,” particularly Redondo Beach, where there’s no rent control.

“Rent control ices the market,” Nordine said. “ It scares off investors.”