With a long history as a refuge of tolerance, West Hollywood has battled back in recent months against what it views as profiteering landlords trying to use rent-controlled apartments for short-term rentals.

It has been a delicate balancing act. Earlier this year, the city council banned landlords from making money from short-term apartment stays, a move taken in part to protect the city’s hotel revenue.

But West Hollywood’s lawmakers are nervous that the current hotel development boom could oversaturate the market. Last year, then-Mayor Lauren Meister proposed halting hotel projects until the city could study how all the developments in its pipeline would affect vacancy rates and taxes generated for the city.

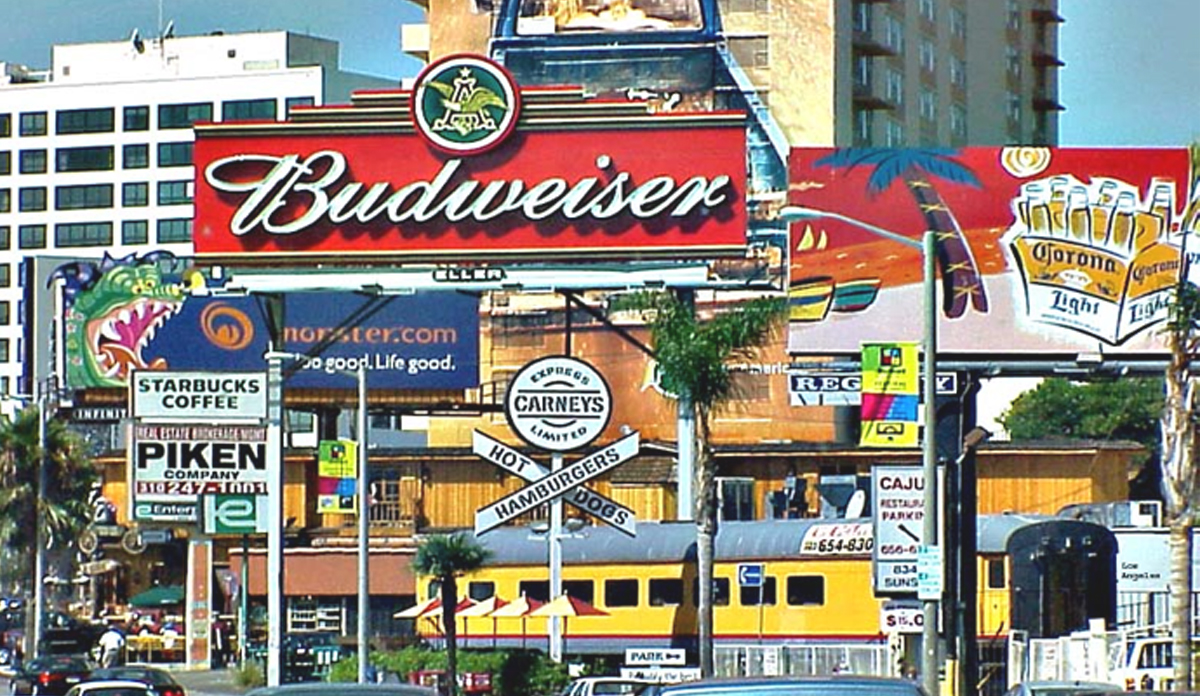

At less than two square miles, the city of West Hollywood has some of the most enduring tourist destinations in the country. That has created opportunities for hotel real estate investors. But it has also created challenges, such as dealing with ever-growing online rental platforms like Airbnb.

Starting in the prohibition era, the area that is West Hollywood became a hotspot for visitors when it was an unincorporated section of L.A. County. Gambling was illegal in the city of Los Angeles, but not the county, and the Sunset Strip was lined with casinos and speakeasies that were out of the jurisdiction of the Los Angeles Police Department.

Tourism continued to energize West Hollywood during the 1960s with the success of rock ‘n’ roll clubs and the Hyatt “Riot House” Hotel, which have hosted global music legends.

Residential and office space

As dependent as the city is on tourism, West Hollywood was incorporated largely to protect its residents. When it was established in 1984 some 85 percent of it residents were renters. Lawmakers quickly enacted one of the strongest municipal rent control laws in the nation.

Rent protections and pioneering laws against discrimination also made West Hollywood a magnet for people throughout the country living in less tolerant places.

Commercial Draw

The city also has created substantial commercial real estate opportunities. The Pacific Design Center, which opened in 1975 with its “blue whale,” was followed by Center Green in 1988 and Center Red in 2011. They now amount to 1.6 million square feet of space.

In September, film and television production company A24 signed a lease for an entire 25,000 square-foot floor in the red building. The co-working office company WeWork, which uses 70,000 square feet of space at the center, signed a deal that same month to bring film production space to the Red Building. Earlier this year, artificial intelligence firm Poletus also signed for 21,000 square feet at the Center Green.

Hospitality reigns

Two West Hollywood hotels topped the list of biggest deals in 2017 for the county, in total sale price and price per room. Starwood’s $280-million purchase of the Jeremy was the largest transaction, and Jeff Klein’s buyout of the 81-key Sunset Tower Hotel topped price-per-room figures. Klein paid $90 million, or $1.13 million per room.

New hotel projects and renovations coming in 2019 are expected to account for a 9-percent jump in inventory, including the 23-room No. 850, the 190-room EDITION, and the transformation of the Jeremy West Hollywood into the 1 West Hollywood. The city could also soon approve a project by West Hollywood-based Mani Brothers Real Estate Group to convert the 1927 Piazza del Sol into a 36-room hotel with two restaurants and a rooftop lounge.

Even with a looming overhang of hotel rooms, lawmakers are continuing to push through more development. Meister’s proposal to slow hotel growth ultimately failed. And now West Hollywood expects to see a steady flow of new hotel rooms open in the next few years that will be enough to raise inventory by 50-60 percent.

West Hollywood: By the numbers

Average residential sale price within:

Last 12 months: $851,500 – $736/sq ft

Last 2 years: $927,000 – $744/sq ft

Last 3 years: $715,000 – $660/sq ft

Average current residential listing price: $1,659,000 – $936/sq ft

Priciest residential sale: 1232 Sunset Plaza Dr – $23,980,000

Most expensive home on the market: 9255 Doheny Rd PH 1 and 2 – $48,888,888

Least expensive home on the market: 1414 North Fairfax Ave #206 – $459,900