UPDATED, Oct. 19, 9:15 a.m.: Beverly Hills, home to many of the world’s high-end fashion retailers, was also home the priciest retail investment sales in Los Angeles County last month, with two major deals.

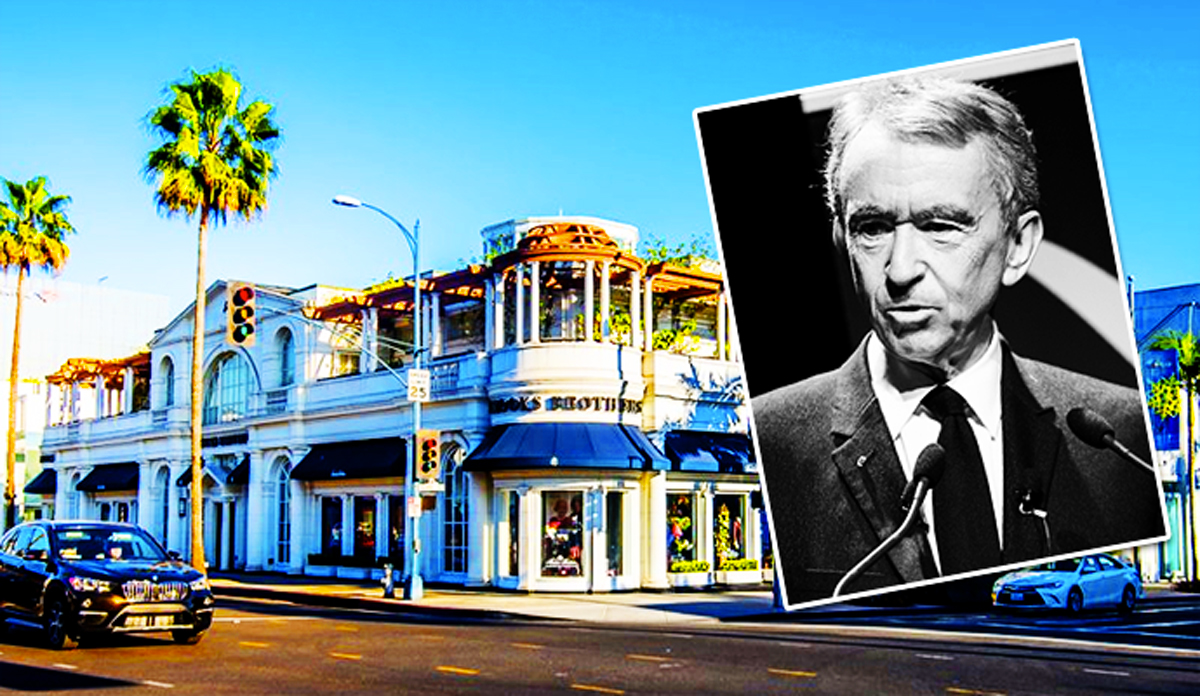

An entity tied to French billionaire Bernard Arnault claimed the top retail investment sale, paying $245 million for a double-lot property on tony Rodeo Drive. The 22,000-square-foot, two-story building was formerly leased by Brooks Brothers.

Combined, the top five retail sales for September totaled $344 million, and included an unusual retail acquisition by broker and investor Kurt Rappaport The total is a substantial increase from August, when the top five properties that changed hands combined for $57 million. That amount was also slightly more than July, which tallied just $49 million in all.

The September list was compiled from property records collected by PropertyShark.

1. 468 N. Rodeo Drive | L VMH Moet Hennessy | $245M

An LLC tied to the CEO of Louis Vuitton’s parent company, Bernard Arnault, acquired the two-story building at 468 North Rodeo Drive. The double-lot property, which spans 12,170 square feet on the ground floor, and 10,100 square feet on the second, hit the market in May for $300 million. The property had been in the hands of a family trust, tied to an individual named Robert Anderson, for over 50 years. Brooks Brothers had been leasing the property for 15 years before it vacated in August.

2. 450 N. Canon Drive | Kurt Rappaport | $35.5M

In a surprising move from his bread and butter, top broker and investor Kurt Rappaport paid $35.5 million to acquire 23,000 square feet of retail space on Canon Drive. The seller was an entity named Canon Ball LLC, which is tied to an unidentified doctor. Rappaport, co-founder of luxury brokerage Westside Estate Agency, acquired seven storefronts with plans to renovate the buildings to their “original 1930s Beverly Hills feel,” he has said. The purchase marks one of the broker’s first big moves into commercial real estate, in addition to residential real estate.

3. 1205 E. Valley Boulevard | Freddy Yang | $23.8M

An LLC named Crystal Cal No. 1 LLC, tied to real estate consultant Freddy Yang, paid $23.75 million to acquire a shopping plaza at 1205 East Valley Boulevard in Alhambra. The seller was Grace Chang, acting through an entity titled Valley Investment CO LLC. The lot, leased by several shops, spans 141,400 square feet.

4. 6900 Santa Fe Avenue | Sterling Organization | $23.8M

The Sterling Organization, based in Palm Beach, followed its purchase in August with another retail buy in September. The firm paid $23.75 million to acquire Margarita Plaza, a 76,800-square-foot shopping center at 6920 Santa Fe Avenue. It’s currently anchored by a 43,350-square-foot Food 4 Less grocery store. There is also a Little Caesar’s Pizza and Jackson Hewitt tax preparation office. The seller was MP Investors LLC, tied to individuals Gerald S. Friedkin and Stephen H. Swire, and Rubenstein Capital.

5. 7601 Melrose Avenue | Spacegrab | $8M

Spacegrab, an online marketplace for trading commercial real estate, paid $8 million to purchase a 5,400-square-foot retail site at 7601 Melrose Avenue near the Fairfax District. The seller was a partnership of Efrem and Uri Harkham of Harkham Industries, and Moshe Aflalo of Aflalo Equities, property records show. The buying entity was 7601 Melrose Avenue LLC, controlled by David Hay, founder at Spacegrab. Founded in 2016, Spacegrab allows business owners to enter and exit leases through its online platform.

6. 106 N. Topanga Canyon Boulevard | Joseph Daneshgar | $7.9M

Silver JD LLC, controlled by Joseph Daneshgar, acquired a 17,000-square-foot site at 106 North Topanga Canyon Boulevard in Topanga. The seller was Steven Carlson, records show. Business registration records link Silver JD to Langdon Street Capital, a real estate investment firm controlled by a relative, Adam Daneshgar. Langdon, though not involved in this purchase, is best known for purchasing the Grand Central Market in Downtown L.A. Langdon is planning a series of cosmetic improvements to the iconic food hall.