Los Angeles County’s top four retail investment sales of March totaled around $316 million and include some high profile names and properties. The top sale of the month saw the parent company of fashion house Louis Vuitton more than double its real estate on tony Rodeo Drive in Beverly Hills. A less glamorous power center in Cerritos also accounted for a top sale.

The numbers were compiled from property records by Real Capital Analytics.

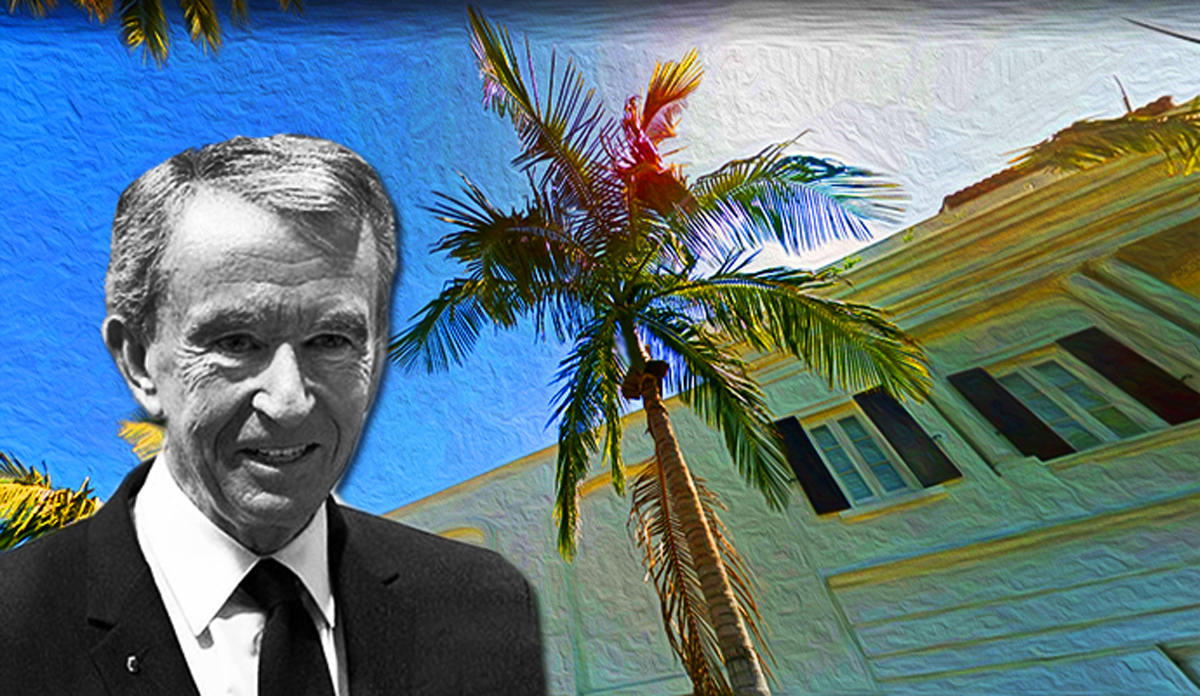

1. 456 N. Rodeo Drive — Louis Vuitton Moet Hennessy | $110 million

This 6,200-square-foot storefront might have enormous price-per-square-foot numbers, but that’s just par for the course on the famed Rodeo Drive corridor. The sale is was second only to Louis Vuitton Moet Hennessy’s other nine-digit acquisition on Rodeo Drive. That was the record-breaking $19,405-per-square-foot sale of the iconic yellow building at 420 North Rodeo Drive in 2016. The seller in the March deal was the Palm Beach, Florida-based Sterling Organization, which acquired the property for $55 million from the Karl B. Shurz Trust earlier in the month, and quickly flipped it to LVMH. Sterling had previously signed a 30-year lease for the building and exercised its right to purchase the property when Shurz died.

2. Cerritos Towne Center — Utah State Retirement System | $97 million

The second highest purchase is the Cerritos Towne Center in Cerritos. This retail center is over half a million square feet and 99 percent leased to tenants including Walmart, Petsmart and Kohls. The seller was Gerrity Group, based in Solana Beach near San Diego. The firm paid $87.5 million for the property in 2011. The buyer took out a first mortgage for just under $40 million with SunTrust for the purchase.

3. Gateway Towne Center — Clarion Partners | $85.5 million

New York’s Clarion Partners picked up this nearly 30-acre Compton power center from Costa Mesa-based Prism Realty. The sale comes out to around $304 per square foot for 282,000 square feet of rentable space between two buildings currently occupied by retailers including Home Depot, Best Buy, and Target. Clarion adds the property to a portfolio worth around $33 billion.

4. 8420 Melrose Avenue — L3 Capital and Guggenheim Partners | $23 million

It’s hard to compete with Rodeo Drive, but Melrose Avenue is commanding some steep prices for retail spaces, too. This sale for an 11,300 square foot space on the popular corridor came out to $2,029 per square foot. The property is 100 percent occupied by popular fashion brands including Theory, Serena & Lily, and the Kardashian-owned Dash. Malibu-based American Commercial Equities sold the property at a loss 10 years after paying nearly $26 million for it in late 2007. Guggenheim is the subject of a Securities and Exchange Commission investigation into three residential deals in L.A., including chief executive Mark Walter’s $85 million purchase of a Malibu mansion from record label owner David Geffen.