Updated 1:15 p.m., May 31, 2016: Overseas investors and developers have been rushing in to fund the revitalization of Downtown Los Angeles, in addition to buying assets in other locations throughout the county. It’s gotten to the point where local players have complained that it’s becoming hard to compete with their cold hard cash offers.

But who are these investors and where is their money coming from?

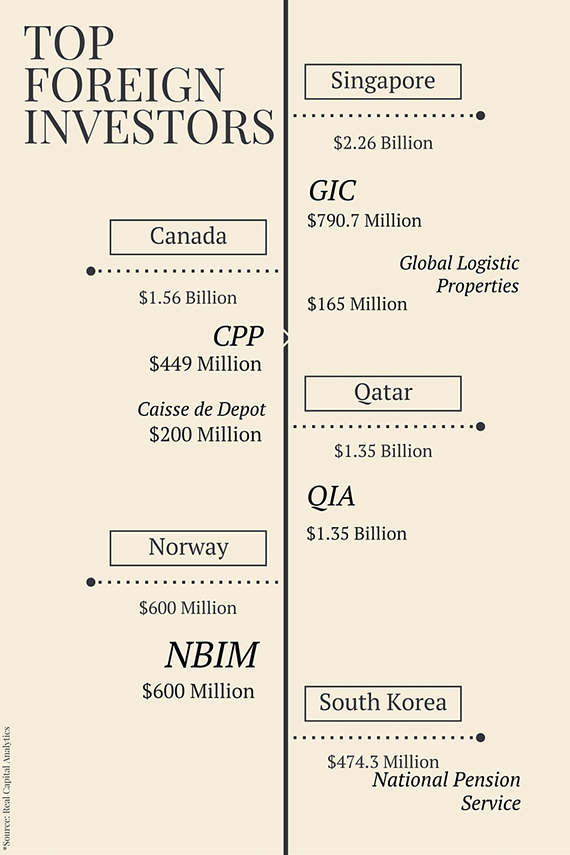

Some of the biggest sources of foreign capital come from oil-rich countries such as Qatar as well as some of the U.S.’s closest neighbors, such as Canada. In a bid to determine which countries have the most skin in the L.A. real estate game, TRD analysed the sales of properties bought by foreign-based companies between May 1, 2015 and April 30, 2016, using data from Real Capital Analytics.

TRD then ranked countries based on the total dollar value of the L.A. holdings they’re invested in, but was not always able to establish the specific value of their respective stakes in those properties. Read on for a closer look:

1. Singapore — $2.26B

Investors from Asia were some of the most active cross-border investors in the U.S. last year, according to NAIOP, the Commercial Real Estate Development Association. A large part of that investment came from Singapore, capital from which flowed into industrial and retail assets at a fast clip.

Among the biggest transactions of the past year was Singapore sovereign wealth fund GIC’s acquisition of a 40 percent interest in five U.S. retail properties, including the Lakewood Centre in Lakewood, for $790.7 million.

Global Logistic Properties, a warehouse owner whose parent company is Singapore’s sovereign-wealth fund, also acquired several L.A.-based warehouses, including the Sorenson Industrial Distribution center for $43 million, and Bell Gardens Industrial Park for $37.1 million.

2. Canada — $1.56B

Canada has long been considered one of the top sources of global investment in U.S. commercial real estate — and the past year has been no different.

Some of the country’s largest institutions, including Brookfield, the Canada Pension Plan Investment Board and Caisse de Depot poured money into the L.A. market via several high-profile deals over the past 12 months.

CPP’s biggest investment was the $449 million acquisition last year of a portfolio of California medical office buildings in partnership with Health Care REIT Inc. CPPIB reportedly holds a 45 percent stake in the joint venture and a 50.5 percent interest in the portfolio, which includes several buildings along North Bedford Drive in Beverly Hills.

Ivanhoé Cambridge, a real estate arm of Caisse de Depot, also made headlines when it bought DTLA’s PacMutual office complex for approximately $200 million last September in partnership with Callahan Capital Properties.

Meanwhile, Brookfield purchased the former Los Angeles Daily News headquarters in Warner Center, which has been cleared to make way for development, for $184.1 million last August. The landlord is now considered one of the largest commercial landlords in the Downtown L.A. after a major push into that market over the past couple of years.

3. Qatar – $1.35B

The Qataris have made some of their biggest investments in L.A. over the last quarter, thanks largely to the Qatar Investment Authority, a fund which helps to manage much of the country’s energy-generated wealth. The QIA, which recently set up a New York office to funnel money into U.S. investments, reportedly controls more than $300 billion in capital.

The QIA’s largest L.A. deals include its acquisition of a $1.34 billion, 1.7 million-square-foot office portfolio in Santa Monica from the Blackstone Group in February. The deal was done in partnership with Santa Monica-based REIT Douglas Emmett. The deal valued the four Westwood office buildings at 10960, 10940 and 10880 Wilshire Boulevard and 1100 Glendon Avenue, at $777 a square foot.

The Qataris’ exact stake in the deal is unclear, but Douglas Emmett is reportedly retaining 20 to 30 percent of the equity in the joint venture.

4. Norway — $600M

The Norwegian Norges Bank, or NBIM, was responsible for entirety of its country’s investments in L.A. This past year, it invested a sliver below $600 million on 19 properties, the biggest of which were mostly industrial. The top transaction was Garfield Industrial Park, a warehouse at 6100 Garfield Avenue the bank purchased last May for $87 million.

The 19 properties were part of a expansive national portfolio of more than 300 holdings. The acquisition was in partnership with San Francisco-based developer Prologis, and cost NBIM a total of $2.3 billion. The bank will retain 45 percent in the portfolio valued at $5.9 billion. The seller was KTR Capital.

Norway only recently began investing in global real estate, The Real Deal reported earlier this year. Using funding from Norway’s oil reserves, Norges is a wealth fund worth over $1 trillion. It wasn’t until 2010 that the government decided to move up to 5 percent of its portfolio into real estate outside of Europe.

5. South Korea — $474.3M

South Korea, as it turns out, has a huge stake in Playa Vista — a stake worth $474.3 million to be exact. Under its National Pension Service, South Korea invested in three properties at the Runway Playa Vista, a 14-acre mixed-use retail community that also includes offices and an apartment building.

The primary buyer in this transaction was Invesco Real Estate, an arm of Atlanta-based investment manager Invesco. While it’s unclear how much NPS spent in the joint venture, the overall deal, with six properties in total, cost $475 million. The brand new complex includes 217,000 square feet of retail space, 33,000 square feet of offices and 420 apartment units.

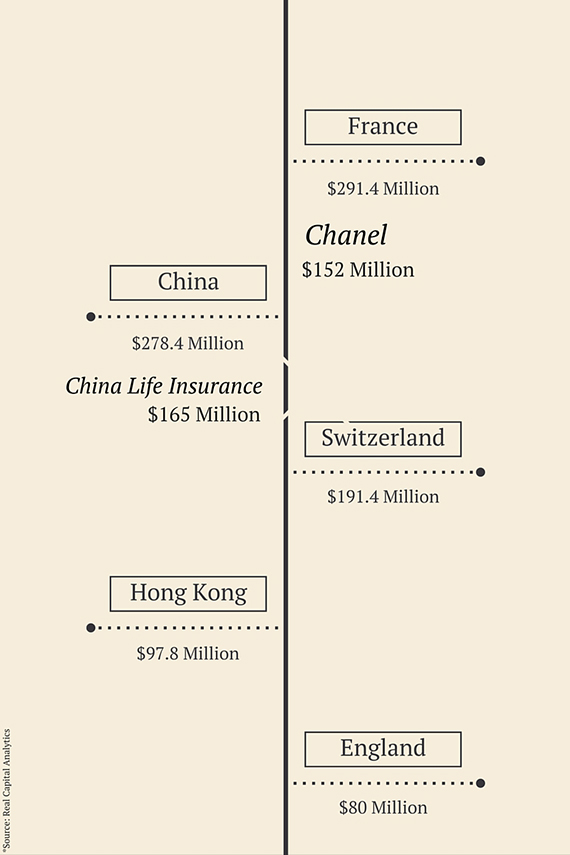

For $13,217 a square foot, luxury retailer Chanel made waves late last year when it purchased its Rodeo Drive storefront in a record-breaking deal. The fashion house paid a total of $152 million for the coveted shopping spot. This transaction accounts for more than half of France’s total investments in L.A.

Chanel followed the footsteps of fellow French retailer Hermes, who upgraded its location to a Rodeo Drive store in the last three years. Chanel also owns the property next door to its new acquisition. According to CBRE first vice president Nima Bararsani, the iconic brand plans to intertwine the two structures in order to create a “larger footprint” on Rodeo Drive.

The seller was a partnership of two families, a long-time owner of the property. Chanel had been leasing it before the purchase. It was “a unique situation of a tenant that wanted to be an owner,” Bararsani told the L.A. Times.

7. China — $278.4M

China may not have the priciest holdings in Los Angeles, but its presence is certainly felt. While other top foreign players have one or two major firms doing their bidding in the Golden State, China has several.

Its largest, the state-run China Life Insurance, was involved in deals worth $165 million combined. Among them, the purchase of Sorenson Industrial Distribution, a warehouse in Santa Fe Springs, was the biggest acquisition at just under $43 million.

Chinese real estate developer Gemdale Corporation was also involved in a hefty deal. With headquarters in L.A. already, it made its first big investment in the city last September: a $125 million mixed-use project in Hollywood, in partnership with L.A. developer LaTerra. The 4-acre site is located at 1350 North Western Avenue.

Other notable Chinese buyers include JE Group and Singpoli.

Correction: An earlier version of this story mistakenly identified Nima Bararsani as a lawyer involved in the Chanel Rodeo Drive transaction.