Commercial sales may be slipping in the U.S., but L.A. has no shortage of big, glossy deals. In the first quarter of 2016 alone, there were seven commercial properties that traded for over $100 million.

Read on for the priciest 10 of the first quarter, compiled by TRData.

Westwood Office Portfolio — $1.3 billion

In the largest sale of the year by a landslide, Douglas Emmett and the Qatar Investment Authority acquired four office buildings plus a parking garage in Westwood for a whopping $1.34 billion, or about $777 per square foot. The portfolio measures a total of 1.73 million square feet. Located on the 10800-10900 block of Wilshire Boulevard, the multi-story structures were purchased from Blackstone Group. The tallest of the four has 24 stories.

Douglas Emmett now controls nearly three-quarters of the Westwood/Wilshire office corridor.

Runway Playa Vista — $475 million

Though significantly cheaper than the Westwood sale, the price tag of Playa Vista’s premier neighborhood center, the Runway, is nothing to sneeze at. Invesco Real Estate bought the mixed-use plaza or $475 million from Lincoln Property Company and its partners back in February.

Runway includes six properties on Jefferson Boulevard and Millennium Drive, totaling 217,000 square feet of retail space, 420 apartments and 33,000 square feet of office space. Current retail tenants include a Cinemark Cinema, Whole Foods and a wide range of restaurants.

Pasadena Towers — $256 million.

Next up, there’s the duo of Pasadena Towers at 55 South Lake Avenue and 800 East Colorado Boulevard. CBRE Global Investors purchased the 477,501-square-foot office campus for $256 million from Beacon Capital Partners. At the time the deal closed in late March, the complex was 96 percent leased.

One Colorado — $201 million

The One Colorado shopping center comprises 12 adjoining structures surrounding a courtyard in downtown Pasadena, including a parking garage. Excel Trust, a San Diego-based firm which was acquired by Blackstone last year, purchased the holdings for $201 million from the Trident Group. The historic structures total 259,402 square feet of ground-floor retail space and offices in some upper levels.

Paseo Colorado — $132 million

Dallas-based Cypress Equities purchased three retail centers and a multifamily residential complex million earlier this month for $132 million. Dubbed Paseo Colorado, the four-structure portfolio in downtown Pasadena was previously owned by DDR Corp.

Altogether, the properties at East Colorado Boulevard and South Marengo Avenue measure 382,000 square feet. According to Cypress’ website, the firm will be converting an already-demolished Macy’s store into a 179-room Hyatt Place hotel, additional retail storefronts and 78 condominium units.

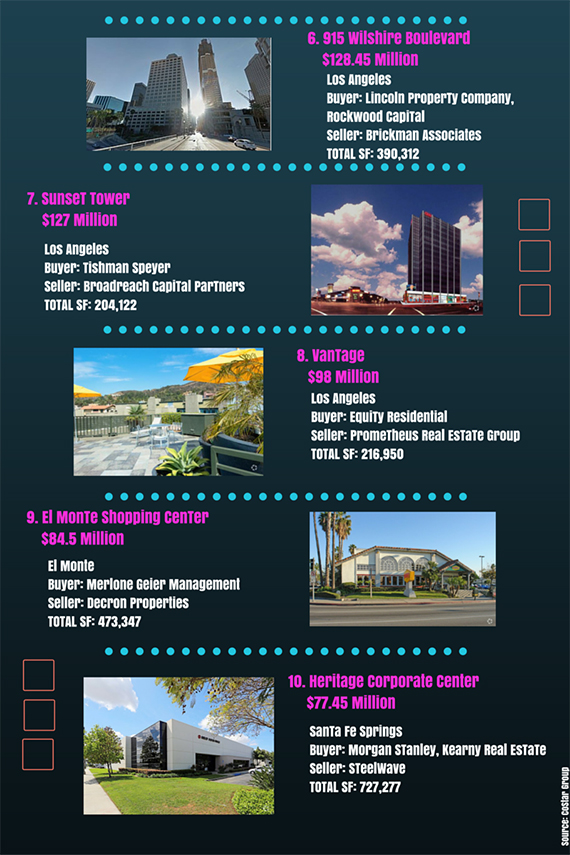

915 Wilshire Boulevard — $128.5 million

Just a month after it sold Runway Playa Vista, Lincoln Property Company made a big buy. Lincoln partnered with Rockwood Capital in its purchase of 915 Wilshire Boulevard, a 22-story office tower in Downtown Los Angeles, for $128.5 million. The building is currently 88 percent leased.

Lincoln, which is hyper-active in Los Angeles, has plans to remodel the interiors. Here’s what makes the deal interesting: Lincoln had owned 915 Wilshire before. The firm sold it to Brickman Associates in 2007 but had stayed on as a property manager and leasing agent even after the sale.

Sunset Tower (CNN Building) — $127 million

Developer Tishman Speyer acquired the Sunset Tower at 6430 Sunset Boulevard in Hollywood for $127 million in February. The 14-story building, known as the CNN tower for bearing the news network’s logo, was previously owned by Broadreach Capital Partners.

John Miller, Tishman’s senior managing director, said in a statement that the company has plans to modernize the 204,000-square-foot office property to fit “today’s workstyle.” It’s currently 86 percent leased with tenants that include CNN-parent Turner Broadcasting and BLT Communications.

Vantage — $98 million

Chicago-based investment trust Equity Residential acquired the 298-unit apartment complex at 1710 North Fuller Avenue in Hollywood for $98 million, or $328,859 per unit, in late March. The seller was Prometheus Real Estate Group.

Under Prometheus, the 164,056-square-foot property, dubbed Vantage, underwent interior renovations. At the time of Equity’s purchase, 95 percent of Vantage was leased.

El Monte Shopping Center — $84.5 million

In January, developer Merlone Geier Partners purchased a shopping center in El Monte for $84.5 million. The seller was Decron Properties. Totaling 473,347 square feet, the property includes seven storefronts on the 3500 block of Peck Avenue.

The center is anchored by Longo Lexus, a car dealership.

Heritage Corporate Center — $77.5 million

Last but not least, Kearny Real Estate and Morgan Stanley bought a set of 23 industrial properties in Santa Fe Springs last month for $77.5 million from seller SteelWave. The structures — located on Mora Drive, Telegraph Road, Slusher Drive and Heritage Park Drive — are 94 percent leased, brokerage CBRE confirmed.

The portfolio totals 727, 277 square feet.