West Hollywood’s office market is off to a rocky start in 2016.

WeHo saw its office vacancy rise and its rents drop in the first quarter, according to a report by NGKF.

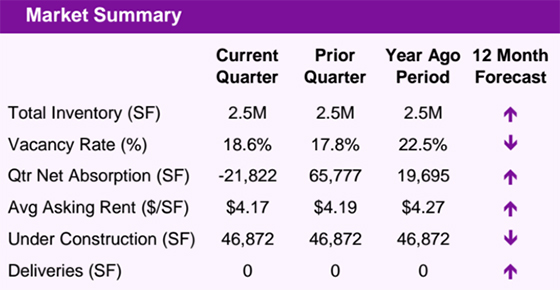

While the Westside as a whole saw its asking rents rise, rents in WeHo for full service gross leases declined two cents from the previous quarter to $4.17 a square foot a month. Asking rents have declined 10 cents in WeHo over the last four quarters.

High vacancy at Class A properties, which constitute most of WeHo’s office supply, are to blame. Vacancy at Class A reached a whopping 20.9 percent in the first quarter, and that pulled down the average Class A asking rent to $4.22 a square foot a month, down 11 cents from the same quarter a year earlier.

Average asking rent at Class B properties was actually up 22 cents during the same period, and closed first-quarter 2016 at $2.79 a square foot a month. However, the Class B market is relatively small in West Hollywood, representing only 12.8 percent of the 2.5 million square feet of inventory. Those few Class B properties saw a low vacancy rate of 4.6 percent in the first quarter, so those landlords had the leverage to push rents higher.

The overall vacancy rate, including all building classes, increased 80 basis points to close first-quarter 2016 at 18.6 percent, up from 17.8 percent in the previous quarter. The first-quarter vacancy rate remained well below the 22.5 percent recorded at the same time last year.

Net absorption totaled negative 21,822 square feet in the first quarter. It was WeHo’s first time seeing negative net absorption in the last eight quarters.

There was 46,872 square feet under construction in the first quarter, which is an amount that has remained unchanged from the same quarter a year earlier. The project that continues to be under construction is 46,872-square-foot creative office building at 925 North La Brea Avenue. It is expected to deliver next quarter.

Notable transactions in the first quarter included the sale of Beverly Hills Spinal Surgery’s building at 8436 West 3rd Street for $632 a square foot. On the investment sales front, the biggest deal was Continental Development’s acquisition of 8075 West 3rd Street for $556 a square foot. VE Equities also completed its acquisition of the Hustler store at 8920 West Sunset Boulevard in the first quarter for $892 a square foot.

VE plans to redevelop the site into a mixed-use property as part of a joint-venture project with London & Regional Properties and Arts Club of London. Gwyneth Paltrow is a minority partner in Arts Club and will be involved in the private club planned for the site.