International tourists buying up trendy handbags and other bling are not the only ones dialed into the ramped-up retail offerings on prime Fifth Avenue in Midtown. The city’s Department of Finance has also taken note of how rent rates on the most expensive shopping strip in the world are going gangbusters. And the agency’s response has been to slap some high-profile properties with higher tax assessments.

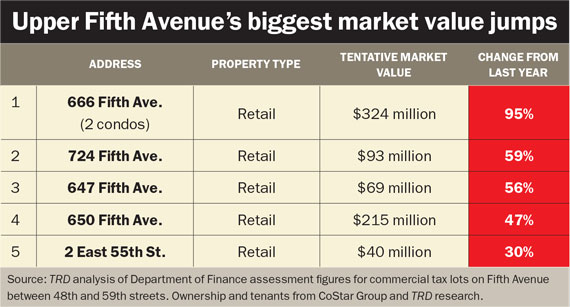

In the top case, the agency — which released its tentative assessment rolls for the 2016-2017 tax year last month — jacked up values at two retail condos in the same building by a staggering 95 percent.

Tax attorney Glenn Borin said he’s been fielding phone calls about new assessments, which were calculated using 2014 income and expenses.

“Some buildings have been particularly hard hit. Retail has seen some big increases,” said Borin, a special counsel at the law firm Stroock & Stroock & Lavan.

“If it’s off [budget] by 30 to 40 percent, that can be kind of disastrous,” he said, explaining that the steep increases may be the result of slightly lower capitalization rates that the Department of Finance used for retail assets in the latest roll.

The total market value of NYC’s real estate surpassed the $1 trillion mark for the first time — up 10.6 percent from last year. It’s worth noting, however, that market value assigned to each property by the city does not actually reflect the price a site would fetch on the open market. In fact, the market value is generally about half or a third of an estimated sale price. It does, however, determine how much each property owner is required to pay in taxes.

In addition, according to an analysis of the data by The Real Deal, not all properties along the flashy Fifth Avenue stretch between 48th and 59th streets saw hikes. In fact, the city cut valuations for some properties — but they were primarily office, not retail.

Still, the buildings that got hit, got hit really hard.

The two biggest increases were for 666 Fifth’s two retail condos, according to TRD’s analysis. The two units — one of which is owned by the clothing chain Zara and the other by Vornado Realty Trust — saw their values jump by 95 percent, to a combined $323.5 million after several years of annual increases closer to 10 percent.

The retail condo at 724 Fifth Avenue, which saw its assessment jump 59 percent to $93 million, logged the next highest increase. The landlords — SL Green Realty and investor Jeff Sutton — renewed a lease with fashion designer Prada in 2013 for 15 years, for about $19 million per year, insiders said.

Vornado was also sacked with the third highest assessment jump. Along with its partner Crown Acquisitions, it saw 647 Fifth Avenue jump 56 percent in value to $69 million. The two partners acquired the small building in 2014, as part of a $700 million purchase that included 2 East 55th Street. The firms inked a lease last year with the Swatch Group for the adjacent retail sites worth approximately $35 million per year, according to sources.

Thankfully for the landlords, these assessments are preliminary figures, which building owners have the chance to appeal. And, not surprisingly, they almost always do appeal.

Vornado will not have to worry about its tax assessment at the office condo at 666 Fifth. The value of the REIT’s office space dropped in value (at least in the city’s eyes) by 4 percent. Other office condos, such as 724 Fifth Avenue, meanwhile, also saw their values drop.

And a few retail spaces on the stretch of Fifth saw assessments fall sharply. But they were exceptional cases.

For example, the city took pity on some out-of-commission retail buildings, including the Cartier building at 649 Fifth Avenue, which is undergoing a renovation that will cost at least $25 million, according to city filings. The market value of that property was slashed by 21 percent — the biggest drop on the stretch.

Insiders say the city is closely eyeing retail assets because of the surge in rentals.

Of course, an unexpected rise in market value, and hence taxes, is a direct hit to the building’s bottom line and value.

Typically, the tenant pays for all, or most, of the increases in taxes from the time the lease is signed, and the landlord pays the taxes that existed before that signing, said Garry Steinberg, a retail broker and principal with Lee & Associates NYC. But in some cases, the tenant’s increase is capped so the landlord ends up footing the bill.

Either way, neither the tenant nor landlord wants to see a sharp rise in taxes. “Everybody cares because if you have a retail lease, you want the tenants to do well,” Steinberg said.

And once a retailer’s lease expires and a new tenant is signed, the landlord is on the hook.

“When the tenant leaves or vacates — and when rents fall — those assessments are stuck,” said Peter Hauspurg, CEO of commercial brokerage Eastern Consolidated.