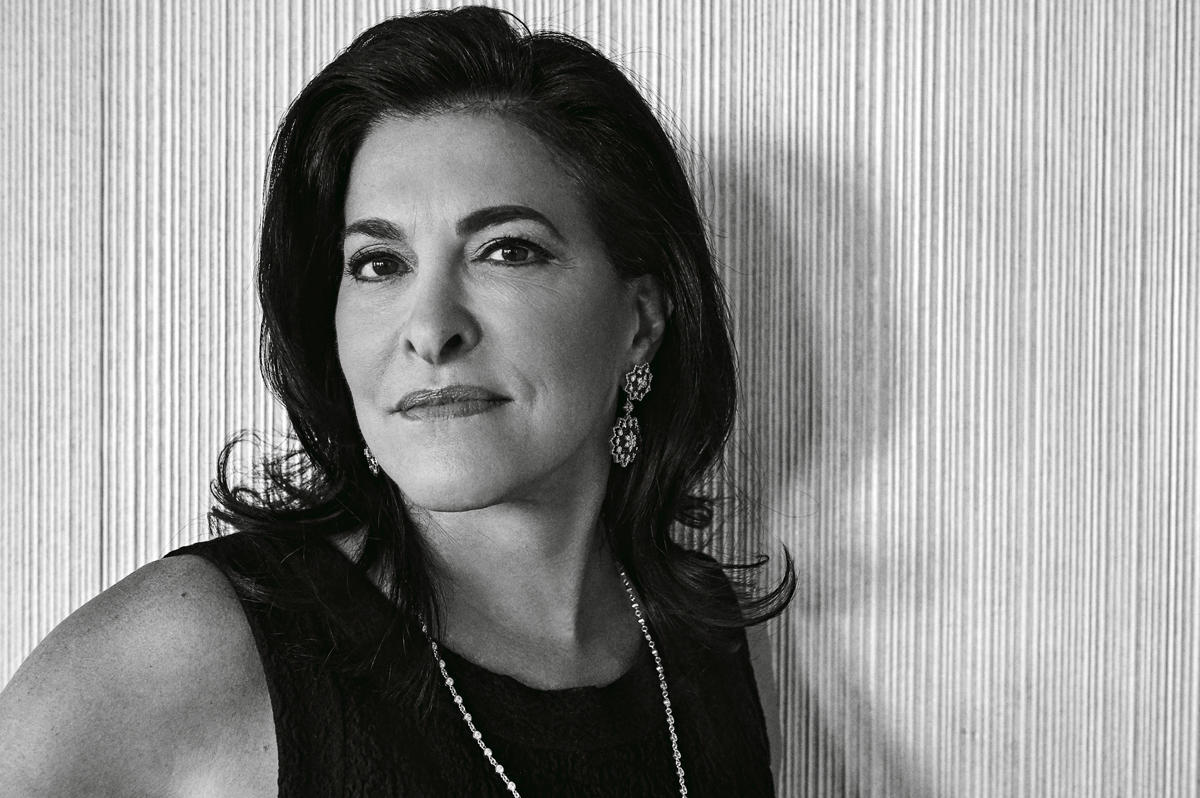

Wendy Silverstein’s career has been all about getting her hands dirty. The 17-year veteran of Vornado Realty Trust helped grow the company from a $3 billion owner of New Jersey strip malls to a more than $30 billion investment giant, as of 2015, and went on to liquidate New York REIT’s 4.4 million feet of commercial assets. Silverstein then spent a tumultuous year co-leading WeWork’s real estate investment fund before the co-working giant ditched its IPO. Approached by Meridian Capital Group to build a debt restructuring business earlier this year, Silverstein decided instead to be her own boss. The former Citibank executive teamed up with her old colleague and Deutsche Bank alum Ed Adler this fall to launch Silver Eagle Advisory Group, a loan workout firm that will target mounting distress across the real estate industry. Silverstein now splits her time between homes in Tribeca and Short Hills, N.J. Though she has periodically considered retiring — after Vorndao and again after WeWork — she’s been drawn back into the real estate industry by new challenges.

At WeWork and New York REIT, you started at a tumultuous time for these companies — either in the midst or on the verge of crisis. Have you always gravitated to that kind of challenge? Some people are motivated by power. Some people are motivated by money. For me, it was always about intellectual stimulation. I started my career in the mid ‘80s, in the leveraged buyout business, which was really in its infancy at that time. I found it super interesting. Then, truthfully, it went to what I found not to be intellectually interesting because the role that you were supposed to play was to basically say “yes” to every deal, even though the market was starting to turn. Even to a young person, it was obvious that it was turning. I wanted to learn the bankruptcy and workout business. At Citibank, there was $27 billion of bad loans in real estate, and I said, “Ah, I’m going to go there.” It was the draw of the challenge and the intellectual stimulation of taking a really broken situation and trying to fix it and make it better.

There are multiple books coming out about WeWork, along with a television series. Do you think this amount of attention is warranted? WeWork was a phenomenon. And I think that it is a story, to some extent, worth telling. I would say from my own perspective, what Adam Neumann did with both his energy and charisma, and the money that was given to him, was he grew a global real estate company and branded the office business for the first time, I think, ever. By the same token, I think it was confusing to myself and most other real estate people, as to how could this fairly basic concept of renting office space, fixing it up and re-renting it, how does that get to trade as a multiple that makes office ownership look like a dumb business because it trades at a fraction of the value?

To a lot of people, myself included, that just didn’t make any sense. It was one of the reasons why I wanted to get inside the company and say, “OK, if the world has changed this much, what am I missing?” I think the short answer is we weren’t missing anything. I don’t want to call it smoke and mirrors, but it wasn’t necessarily what it was purported to be, i.e., a technology company.

Do you think the company had a lasting impact on the industry? It wasn’t just the branding. WeWork created the availability of offering Class A office space, and sometimes not Class A, on flexible lease terms. That has nothing to do with co-working, but that really caught on. When they went after the Fortune 500 companies and offered them shorter, flexible lease terms for which those customers were willing to pay a premium, that had a lasting impact on the real estate market and landlords across the country, certainly in major cities and elsewhere in the world. And of course the landlords that own the space are in the best position to offer that to their clients. Not that they necessarily want to, but it’s established that there’s real demand for it, a willingness to pay a premium. That’s part of the WeWork legacy.

Do you think the company had a lasting impact on the industry? It wasn’t just the branding. WeWork created the availability of offering Class A office space, and sometimes not Class A, on flexible lease terms. That has nothing to do with co-working, but that really caught on. When they went after the Fortune 500 companies and offered them shorter, flexible lease terms for which those customers were willing to pay a premium, that had a lasting impact on the real estate market and landlords across the country, certainly in major cities and elsewhere in the world. And of course the landlords that own the space are in the best position to offer that to their clients. Not that they necessarily want to, but it’s established that there’s real demand for it, a willingness to pay a premium. That’s part of the WeWork legacy.

So, given Adam’s tendency toward being very public and being somewhat flashy, people like to focus on the person who had it all and then lost it. It was a spectacular rise. It was a relatively spectacular fall. The fall should have been predictable. Most people didn’t see it coming.

Are you glad you decided to investigate for yourself? I thought I knew the answer. Then I thought maybe I was wrong. And at the end of the day, the real estate people, myself included, said, “What the heck is going on here? This thing looks and walks like a real estate company. It is a real estate company!” It was an interesting 14 months experience, let’s put it that way.

How does the current crisis compare to what you saw in the 90s at Citibank? The difference this go-around is that there isn’t financial distress at the banking level. My expectation is that banks may in fact be more difficult to deal with. And it’s going to be very interesting to see how it plays out, because by the same token, excess in the financial system is not really what drove this recession. A lot of what we’re seeing, whether it’s street retail, certainly hotels, even some cases of multifamily, is clearly caused by the pandemic.

And so I think the banks have to weigh their tolerance for giving forbearance and giving discounts, to the extent things don’t make economic sense for borrowers to continue to pour money into, or if they simply don’t have the money. It’s not as if somebody did something wrong and somebody else, a banker or another buyer, can take it over and do any better. I think it does make the workout atmosphere a lot different.

How dire are things right now for investors and landlords? I think it’s very asset-specific. If you own warehouses right now, your business is booming. If you own a hotel, your occupancy has gone from whatever it was to effectively zero in April. And today it may be 30 percent. But assets like hotels, that have literally daily occupancy and daily mark-to-market, have taken an exogenous shock that’s almost never existed. Because when have any of us ever seen entire economies shut down?

What about office owners? It won’t be as bad as some people say, but it’s clearly not going to bounce back to normal in some V-shaped recovery. Offices, of course, don’t have a daily mark. They have very long-term five- to 10-year leases. So the story’s going to take a longer period of time to unfold. But I think it’s hard to be so bullish to believe that the value of office in major cities and rent won’t go down. As you see maturities and major lease rollovers, I think you’re going to see more distress in the office space as well. It’s really going to be asset class-specific and location-specific. Obviously the denser cities such as New York or San Francisco are going to be more impacted than some places that are less dense.

What about office owners? It won’t be as bad as some people say, but it’s clearly not going to bounce back to normal in some V-shaped recovery. Offices, of course, don’t have a daily mark. They have very long-term five- to 10-year leases. So the story’s going to take a longer period of time to unfold. But I think it’s hard to be so bullish to believe that the value of office in major cities and rent won’t go down. As you see maturities and major lease rollovers, I think you’re going to see more distress in the office space as well. It’s really going to be asset class-specific and location-specific. Obviously the denser cities such as New York or San Francisco are going to be more impacted than some places that are less dense.

Where does Silver Eagle fit into all this? We’re a pretty unique combination of two people with 30 years of experience on both sides of the table. Myself — as an owner and borrower up and down the capital structure for both investment grade companies and private equity companies — I’ve seen all sorts of distress. Ed, of course, originated billions of dollars of loans in multiple industries. We’re going to take that combined experience and bring both sides of the table to analyzing just about any situation out there. And I think one of the keys to doing a workout well is to be able to understand what both sides of the table are experiencing, whether you’re the borrower or the lender.

You are one of the only female senior executives in commercial real estate. Have you seen the industry change over the years? I would say that I have seen it change, and I’ve seen it change for the better. But I call it a very slow grind, and it’s still got a ways to go. We have women representation at senior levels in the industry, but the industry is super underrepresented with people of color. We better start making some progress, and the only way that’s going to happen is if people start really making it top of mind and putting it into action. If I have the opportunity to hire a woman, I’m going to work awfully hard to make sure I can get a woman of color or some other background.

Your first husband died just before you started at Vornado. Are there ways that time period influenced you? It wasn’t a revelation that I wanted to work, but it did change my reality in that quitting was no longer an option. Having to work to support a family may seem like a burden, but it can also be a gift.

Are either of your two kids following in your footsteps, career-wise? My son, Zach, did choose to go into real estate. He’s working with me now at Silver Eagle. Ed has known Zach since he was born. It makes us feel old, but it all comes full circle.

What do you miss the most about life before the pandemic? The ability to socialize with friends with ease. But one of the great sides of this was making up for years of family dinners. I think we packed them all into seven months. My daughter just got married. Their original wedding date was Oct. 3. We rescheduled to May 2021. Then they decided to get legally married. We just had a judge on the roof in Tribeca, and immediate family over for dinner. We still hope to have the big New York City wedding.

What do you do to unwind during the pandemic? You up your exercise and your wine.

This interview has been edited and condensed for clarity.