With Upper Fifth Avenue snatching back from Hong Kong’s Causeway Bay the title as the world’s most expensive retail district, aggressive bets made in Manhattan by local investors seem to be on solid ground.

Yet a closer look at leasing numbers and conversations with brokers indicate there is a plateau at the very high end of the market in Manhattan.

“We are seeing a little more vacancy in the market. For those of us close to it every day, we are not seeing asking rents increase any more, and we are seeing the delta between asking and taking rents decrease,” said Chase Welles, executive vice president at SCG Retail, a store leasing brokerage. He represents major tenants like Whole Foods.

Cushman & Wakefield reported in its annual global retail survey last month that Upper Fifth Avenue rents had jumped by more than 13 percent in the past year to a record $3,500 per foot, surpassing Causeway Bay, which had been the most expensive district for the past two years. But other surveys have shown a flattening.

The Real Estate Board of New York reported in late October that asking rents on Upper Fifth Avenue and the core of Times Square had declined slightly since its previous report in May, by 4 percent. That follows a five-year stretch in which asking rents more than doubled in both of those areas.

Other areas are seeing greater availabilities. The amount of available space in Soho crept up earlier this year, data from a Cushman report in July showed. And brokers are seeing more space available as they analyze the neighborhood.

“Soho has more availabilities than I have ever seen in the past,” said retail broker Patrick Breslin, an executive managing director at Colliers International.

These changes could be natural fluctuations in the market, or could spell trouble for owners, who need to pencil in the most optimistic revenue figures when calculating their offering prices.

Nevertheless, owners who are aggressive in finding tenants can make “outsized returns” from the right retail projects, Marc Holliday, CEO of SL Green Realty, said on the firm’s most recent earnings call. Despite the fact that “there is nothing reasonable” in terms of today’s purchase prices, Holliday told investors that “pound for pound,” prime retail properties are potentially more lucrative than office buildings.

To get a sense of who has made the biggest bets on Manhattan’s retail during the frothy pricing rise of the last three years, The Real Deal reviewed hundreds of deals involving street-level retail of $10 million or more in the databases of CoStar Group and Real Capital Analytics from January 2012 through last month.

Crown Acquisitions ($2.6B)

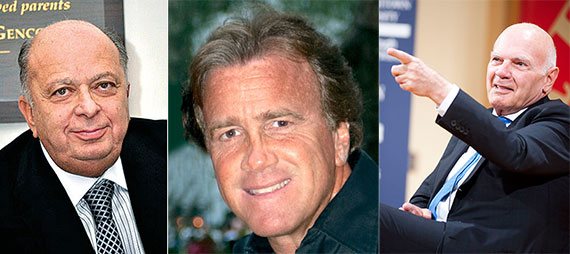

The review found that the most active buyers in that period, including Crown Acquisitions, Vornado Realty Trust and Jeff Sutton, acquired just under 100 properties valued at a total of more than $9 billion.

The results underscore the continued concentration of retail ownership within a handful of companies, both public and private. It also shows the frequent partnering among the borough’s most powerful owners.

The firm, led by Stanley Chera and his sons Haim, Isaac and Richard, has moved firmly into the upper reaches of institutional finance, including relocating its offices to one of the premier addresses of the city, the General Motors Building, from a modest space across from the Empire State Building.

| Crown Acquisitions ($2.6 B) | ||

| Submarkets | Properties | Total value |

| Fifth Avenue | 530, 645, 647, 651-653, 697 Fifth Avenue, 2 East 55th Street | $1.589B |

| Madison Avenue | 650 Madison Avenue | $517.6M |

| 34th Street | 150 West 34th Street | $252.0M |

| Others | 450 Park Avenue, 120 Prince Street | $237.9M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

In the last three years, the firm partnered with the publicly traded real estate investment trust Vornado Realty Trust, Barry Sternlicht’s private investment firm Starwood Capital and the Canadian pension fund Oxford Property Group to snap up retail assets worth approximately $2.6 billion. (Several of the acquisitions were for mixed-use properties, and in those instances TRD pro-rated the estimated value of the retail portion.)

Most of the properties it nabbed stakes in are around Upper Fifth Avenue and East 57th Street. The priciest was the store space at the base of the St. Regis, a luxury hotel at 55th Street and Fifth Avenue, where Crown partnered with Vornado to pay $700 million. Farther south down the street, it bought a portion of the retail in the Olympic Tower at 645 through 653 Fifth Avenue. A block east and a few blocks uptown, it partnered with Vornado and others to buy the office and retail building 650 Madison Avenue between 60th and 61st streets, along with 450 Park Avenue at 57th Street.

The company’s moves indicate it is focusing on the city’s prime retail corridors, although the purchase of 450 Park Avenue represents a bet that higher-priced retail will move farther east along 57th Street, drawn by the super-luxury towers rising there, including Macklowe Properties and CIM Group’s 432 Park Avenue.

At the same time, Crown stepped back from smaller deals in Manhattan, with no acquisitions in emerging neighborhoods. Overall, it has made fewer, but larger, investments in the last few years than its dealmaking rivals such as Ashkenazy Acquisition, Thor Equities and Jeff Sutton’s Wharton Properties.

Vornado Realty Trust ($2.57B)

Vornado, the large REIT led by CEO Steven Roth, acquired retail properties valued at $2.57 billion over the last three years.

The company focused on expanding its holdings along Fifth Avenue, where it was already a major landlord. To start, it paid $707 million in December 2012 for the retail at 666 Fifth Avenue, and later laid out another $1 billion for the St. Regis, 655 Fifth Avenue and 608 Fifth Avenue.

Roth sought to buy those properties, despite awareness that there is competition on the street.

“We compete with everybody … tenants almost always have multiple choices,” Roth said on the firm’s most recent earnings call. “So generally, there’s two or three spots on the street that are available, and so we enjoy competition all the time, but there’s enough for everybody.”

| Vornado Realty Trust ($2.57 B) | ||

| Submarkets | Properties | Total value |

| Fifth Avenue | 608, 655, 666 and 687 Fifth Avenue and 22 East 55th Street | $1.70B |

| Madison Avenue | 650 Madison Avenue | $517.6M |

| Times Square | 1535 Broadway | $213.2M |

| Others | 715 Lexington Avenue, 966 third Avenue, 501 Broadway and 304-306 Canal Street | $122.9M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

Insiders suspect that because it is a public company, Vornado is a bit more risk-averse than a private firm like Thor. However, the REIT has made a couple of moves that are more daring.

“No one is buying an asset to remain flat,” SCG Retail’s Welles said. He noted that firms are waiting for a vacancy or creating a vacancy. “They are not doing this to park money and get a 5 percent return.”

For instance, Vornado purchased two small vacant properties on Canal Street, including last month’s $16.4 million buy of the Pearl Paint building at 334 Canal Street, which it will redevelop, according to the REIT’s quarterly filings.

Some in the industry expect the gritty stretch of Canal to pop in the next few years.

“It used to be that the bottom of Broome [Street] marked the southernmost boundary but that pushed to Canal,” Jason Pruger, an executive managing director for retail leasing at Newmark Grubb Knight Frank, said, referring to the southern extension of Soho. He has been active on Canal Street, including last year representing the owner of the Sheraton Tribeca New York Hotel at 370 Canal Street in a lease with Planet Fitness on the lower level.

“Buyers realize that over time Canal will increase in value,” Pruger said.

More typical investments for Vornado, though, are in tourist-heavy areas like 34th Street, Times Square and Fifth Avenue.

The largest available retail Vornado is marketing is at the base of Marriott Marquis, at 1535 Broadway in Times Square, where the firm is constructing a major retail location with 45,000 square feet available. The firm purchased the site in July 2012 for $213 million.

“We expect to have very high single-digit returns on our capital investment in this asset, which means we expect to make a fair amount of money,” Roth said on the company’s latest earnings call.

Wharton Properties ($1.88B)

Jeff Sutton, through his privately held Wharton Properties, acquired a stake in 14 properties with a total value of $1.88 billion since 2012. Several of those deals were done in partnership with other players on this list, including Sitt, Aurora Capital Associates and SL Green Realty. The partnering shows the close relationship the owners have with each other, even as they vie for deals and seek out capital to “take them down,” and bringing in a rival is one way to do that.

Sutton typically purchases properties with a tenant in mind. The only store on the list of his acquisitions that is both vacant and without a lease is 650 Fifth Avenue, where he and partner SL Green bought out Juicy Couture for what city records show was $52.4 million, and has a lease being finalized with an unidentified tenant.

| Wharton Properties ($1.88 B) | ||

| Submarkets | Properties | Total value |

| Fifth Avenue | 509, 650, 717 and 724 Fifth Avenue | $956M |

| Soho | 529, 530-536 and 560 Broadway, 121 and 136 Greene Street, | $527M |

| 34th Street | 21-25 and 27-29 West 34th Street | $185M |

| Others | 1565 Broadway, 747 Madison Avenue, 21 East 62nd Street | $207.5M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

A source close to the deal said terminating the Juicy lease, “was super accretive,” using industry jargon to say it will increase the value of the deal.

Sutton has invested in a wider range of properties than Vornado and Crown. He has purchased or expanded his stakes in five properties in Soho for a total value of at least $527 million, including 529, 530 and 560 Broadway and 121 Greene Street, and has contracts out to buy two more, at 101 Wooster Street and 130 Greene Street.

Sutton partnered with SL Green Realty Corp. on the 121 Greene Street deal. He also acquired 136 Greene Street with an unidentified partner in July.

Several of his deals were buying out a portion or all of SL Green’s stake, including at 717 Fifth Avenue for $618 million.

Finally, he is a partner on a major deal to demolish, then rebuild, 529 Broadway within the landmarked district in Soho. That two-story building, acquired for $146.9 million, is now partially vacant, but the owners, which include Sitt, Aurora Capital Associates and the Adjmi family, are working on plans to demolish it and replace it with a 44,000-square-foot building that will be leased to a major athletic tenant, according to sources familiar with the matter.

While Sutton typically does not do ground-up construction, Adjmi and Aurora have long track records building new spaces.

Thor Equities ($1.47B)

Thor Equities, led by CEO Joseph Sitt, topped the list as the most active buyer of Manhattan retail real estate over the past three years, snapping up stakes in at least 20 properties worth at least $1.47 billion. While that was not the most money spent, it was the most individual assets.

Like many on this list, Thor funded a good portion of its acquisitions using outside investor money. Thor has two funds worth more than $1 billion and this year it also partnered for the first time with the publicly traded General Growth Partners to buy on Fifth Avenue. That firm, mainly known for operating malls, is led by Vornado alumnus Sandeep Mathrani.

All told, Thor’s recent purchases total several hundred thousand square feet, and about a quarter of that, The Real Deal estimates, is vacant or available for lease. That leaves it with far more available retail space than any other company on this list.

| Thor Equities ($1.47 B) | ||

| Submarkets | Properties | Total value |

| Fifth Avenue | 164, 520 and 530 Fifth Avenue | $750.0M |

| Madison Avenue | 680, 1006 and 1122 Madison Avenue | $302.7M |

| Soho | 529 and 560 Broadway, 151 Wooster Street, 57-63 and 138 Greene Street and 25-27, 115 and 155 Mercer Street | $271.6M |

| Others | 725 Eighth Avenue, 88 Greenwich Street, 70 Eighth Avenue and 38 Park Row | $144.4M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

Thor also has the most high-profile vacancies among the city’s top investors, insiders said. Some of the most visible are on a several-block stretch of lower Fifth Avenue south of 49th Street.

While that section of Fifth isn’t yet commanding the record-shattering prices seen north of that dividing line in recent years, asking rents there have surged above $1,000 per square foot, figures from the Real Estate Board of New York show.

Among the vacant spaces Thor owns is 520 Fifth Avenue, purchased in March 2012 for $120 million as a development site. Thor demolished the two pre-war structures at the corner of 43rd Street, and is now building a six-story, 77,000-square-foot building with 85 feet of frontage on the avenue. Thor is marketing the project as a flagship retail store; no tenants have yet been announced.

Thor is also marketing the retail at 530 Fifth Avenue, a 1950s mixed-use property between 44th and 45th streets, which it bought in October for $595 million, along with General Growth Properties and Scott Rechler’s RXR Realty.

In Soho, Thor made a splash with a stake in seven properties over three years. But Sitt has also has staked out locations in emerging areas, such as his $11 million purchase of a retail cooperative at 38 Park Row near City Hall.

While critics point to the risks for his investors in holding more sites vacant for longer than his rivals will typically bear, Sitt was successful in several high-profile bets over the past year. Those include the Takashimaya building at 693 Fifth Avenue, which was leased last year to Valentino for a reported annual rent of $16 million per year.

In addition, he leased up the newly constructed 837 Washington Street in the Meatpacking District, a 55,000-square foot, six-story glass building between Little West 12th and 13th streets overlooking the High Line. The building, which includes 17,500 square feet of retail, was leased to Samsung in the summer, according to CoStar.

Both of those properties were acquired before 2012.

“The key players are acquiring a lot of retail real estate. They are willing to buy and hold and wait for the right tenant, who is going to pay what they consider to be the right rent,” said Robin Abrams, an executive vice president at the brokerage Lancso. “Using that methodology, if you look at the tenants they secured and the rents they have achieved over the past year, it has been pretty meaningful.”

Behind its strategy of redeveloping prime retail sites, Thor, like many funds, makes a hefty management fee for handling properties it holds stakes in.

For example, while Thor received 1.5 percent of net investments in the $675 million Thor Urban Fund II — whose investors include the University of Notre Dame and the John D. and Catherine T. MacArthur Foundation — it also receives 4 percent of gross revenues and an additional 4 percent of total rent payments, according to a filing with the Securities and Exchange Commission from 2007, when the fund was formed.

Ashkenazy Acquisition

The most varied buyer on the list was Ashkenazy Acquisition. The firm, led by CEO Ben Ashkenazy and President Michael Alpert, bought 16 properties worth just over $1.3 billion. But the acquisitions were all over Manhattan: two in Soho, two in Midtown, and others along Madison Avenue, the Upper East Side and Lincoln Square.

The firm partnered with investors including Sutton in the $17.5 million purchase of 21 East 62nd Street, and later with General Growth Properties and Deka Immobilien Investment to buy a retail condo at 522 Fifth Avenue, at 44th Street, for $165 million.

| Ashkenazy Acquisition ($1.3 B) | ||

| Submarkets | Properties | Total value |

| Madison Avenue | 625 Madison Avenue, 711 Madison Avenue, 21 East 62nd Street | $466.5M |

| East Village | 229 Chrystie Street | $365.0M |

| Fifth Avenue | 522 Fifth Avenue (condo) | $165.0M |

| Others | 2067, 3560 and 4168 Broadway, 285 Lafayette Street, 601-611 Eighth Avenue, and six others | $311.0M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

GGP’s Mathrani said the current tenants at 522 Fifth, Camper and Orvis, are on the way out. They “will soon vacate the property and we’ll begin renovating and redeveloping the space in order to market it as a flagship location offering 7,600 square feet on the ground and 16,000 square feet on the second level,” Mathrani said in the firm’s October earnings call.

In addition, Ashkenazy snapped up a handful of assets less than $10 million that were not included on the TRD survey. While most of the investors on this list do not bother with smaller deals, Ashkenazy has shown a big appetite for them.

The company has also not shied away from deals that require patience. It bought the land under 625 Madison Avenue for $400 million. The building is owned by SL Green, which has a lease that runs until 2054 with the first reset in 2022. At that time, the rent could rise significantly, to $50 million, according to published reports.

SL Green Realty Corp.

SL Green, like Vornado, is a publicly-traded firm. Originally more focused on office assets, it has steadily moved toward retail properties as the returns have increased.

In the past three years is has acquired 10 properties in Manhattan for a total of $1.01 billion.

“[With] retail rents you can generally measure a 100 percent or more mark-to-market,” Holliday said on an earnings call. “So those are probably, on average, the highest-return deals that we’re buying today.”

| SL Green Realty ($1.01 B) | ||

| Submarkets | Properties | Total value |

| Madison Avenue | 635 and 760 Madison Avenue, 21 East 66th Street | $461.2M |

| Fifth Avenue | 650 Fifth Avenue | $256.0M |

| Soho | 115 and 131-137 Spring Street, 102 and 121 Greene Street | $233.8M |

| Others | 719 Seventh Avenue, 985-987 Third Avenue | $59.1M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

However, it has been less aggressive in retail over the past three years than Vornado.

In addition, in past years, it frequently partnered with Sutton. Recently it has moved to buy assets on its own on a deal-by-deal basis.

SL Green is also taking a strong interest in Soho, investing in three retail buildings this year to add to one it already acquired last year. It purchased those four properties for a total of $234 million since 2012.

Three of the four Soho deals were done without Sutton, although they partnered in September with him on the $27 million purchase of 121 Greene Street. They also acquired together the ground lease at 650 Fifth Avenue, which SL Green valued, in its third-quarter filings, at $256.7 million.

Aurora Capital Associates

The firm, led by Bobby Cayre, which often partners with Alex Adjmi in the city, acquired four properties valued at $456 million over the past three years, one of them in partnership with Vornado.

| Aurora Capital Associates ($456 M) | ||

| Submarkets | Properties | Total value |

| Meatpacking District | 61 Ninth Avenue, 9-19 Ninth Avenue | $240.0M |

| Soho | 114 Prince Street, 529 Broadway | $188.9M |

| Harlem | 5-15 West 125th Street | $27.1M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

The company has for years had a strong presence in Soho, the Meatpacking District and Harlem, and broadened its presence in all three. The largest purchase was the partnership with Sutton, Adjmi and Sitt for 529 Broadway in Soho. But nearby, it also paid $42 million for the retail condo at 114 Prince Street.

After a successful redevelopment of 9 Ninth Avenue, Aurora partnered with Vornado to pay about $140 million for a ground lease at 61 Ninth Avenue at 15th Street, where they plan to build an office and retail tower.

Acadia Realty Trust

The publicly traded Acadia Realty Trust has been another active buyer in the city, closing on $259 million of properties since 2012 with a focus in Soho. None of the properties are vacant.

| Acadia Realty Trust ($259 M) | ||

| Submarkets | Properties | Total value |

| Soho, Noho | 120 West Broadway, 131-135 Prince Street, 83 Spring Street, 152 Spring Street, 654 Broadway, 640 Broadway | $179.7M |

| Madison Avenue | 27 East 61st Street, 17 East 71st Street | $47.3M |

| Upper East Side | 1151 Third Avenue | $18.0M |

| Flatiron | 868 Broadway, 1151 Third Avenue | $13.5M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

Many REITs are less aggressive than Vornado and SL Green, and seek to get predictable returns on long-leased assets. Acadia tends to follow that pattern.

The firm purchased two locations just off the most expensive stretch of Madison Avenue, at 27 East 61st Street and at 17 East 71st Street for a total of $47.3 million.

“The two completed acquisitions … are part of our off Madison strategy,” company CEO Ken Bernstein said during the firm’s third quarter earnings call in October. “Today rents on Madison Avenue are generally north of a $1,000 [per] square foot, with certain front spaces commanding nearly double that. Both of our recently acquired properties are located approximately 100 feet off of Madison Avenue, providing retailers with high visibility and solid co-tenancy.”

Sitt Asset Management

| Sitt Asset Management ($245 M) | ||

| Submarkets | Properties | Total value |

| Soho | 90 and 161 Prince Street, 113, 138 and 145 Spring Street and 450 Broadway | $197.2M |

| Madison Avenue | 711 Madison Avenue | $48.0M |

| Source: The Real Deal analysis of data from CoStar Group, Real Capital Analytics and other sources. Covers Jan. 2012 to Nov. 2014. | ||

The firm, headed by brothers Eddie, Ralph and David Sitt, snapped up seven properties greater than $10 million over the past three years, with a total value of $245.2 million. The assets are concentrated in Soho: 90 and 161 Prince Street, and 113, 138 and 145 Spring Street. In addition, the company has a contract to pay about $22.5 million for 8, 10, 12 and 14 Prince Street.