Foreign buyers acquired just under $8 billion worth of commercial property in the five boroughs in 2017 and $9.5 billion last year, down from about $20.2 billion in 2015 and $15.8 billion in 2016, according to Real Capital Analytics.

As Chinese capital continues to recede, though, a new foreign investment landscape has emerged with a diverse mix of other cross-border players.

Related: NYC’s new global investment fix

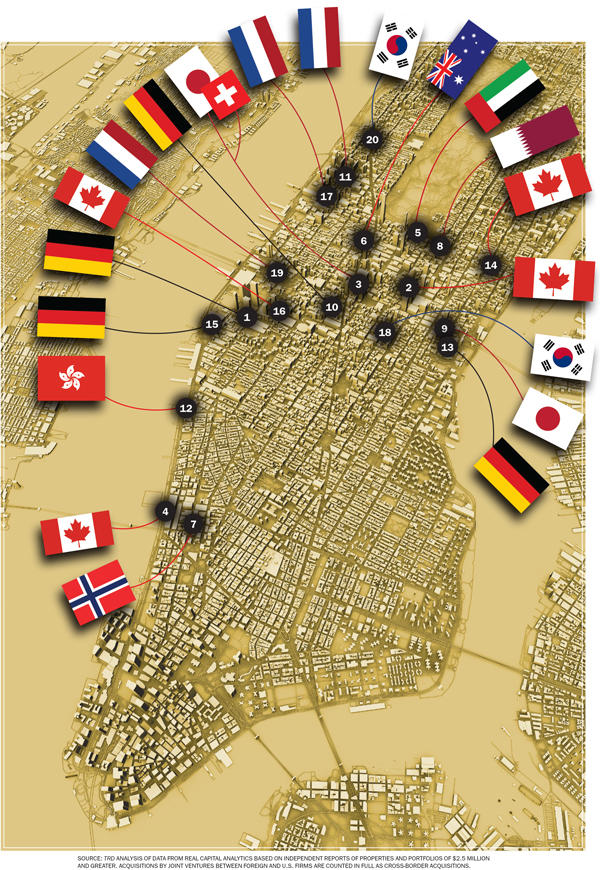

Here are the top 20 commercial acquisitions in Manhattan involving foreign buyers between July 2017 and June 2019, according to an analysis of RCA data by The Real Deal.

“The Canadians and the Germans are really the two groups that are most active in the [New York City] market. And really it’s Allianz that’s a big deal for the Germans,” said veteran investment sales broker Bill Shanahan of CBRE.

1. 30 Hudson Yards (commercial condo)

VALUE: $2.2 billion

BUYER: Allianz, Arizona State Retirement System, Related Companies

COUNTRY: Germany

2. 666 Fifth Avenue (ground lease)

VALUE: $1.29 billion

BUYER: Brookfield AM

COUNTRY: Canada

3. TSX Broadway (additional equity)

VALUE: $719 million

BUYER: UBS, SoftBank Group and partners

COUNTRY: Switzerland, Japan

4. St. John’s Terminal

VALUE: $700 million

BUYER: OMERS, CPP Investment Board

COUNTRY: Canada

5. Park Lane Hotel (increased stake)

VALUE: $654.5 million

BUYER: Mubadala

COUNTRY: UAE

6. Random House Tower

VALUE: $633 million

BUYER: QSuper

COUNTRY: Australia

7. Saatchi & Saatchi Building

VALUE: $615 million

BUYER: NBIM, Trinity Real Estate, Hines

COUNTRY: Norway

8. Plaza Hotel

VALUE: $600 million

BUYER(S): QIA

COUNTRY: Qatar

9. 685 Third Ave.

VALUE: $467.5 million

BUYER: Unizo Holdings

COUNTRY: Japan

10. 1515 Broadway (43% stake)

VALUE: $460 million

BUYER: Allianz

COUNTRY: Germany

11. 101 West End Ave.

VALUE: $416 million

BUYER: PGGM (NL), Dermot Company

COUNTRY: Netherlands

12. Standard Hotel

VALUE: $340 million

BUYER: Gaw Capital

COUNTRY: Hong Kong

13. 222 East 41st St.

VALUE: $332.5 million

BUYER: Commerz Real

COUNTRY: Germany

14. 1065 Second Ave.

VALUE: $277.5 million

BUYER: OMERS

COUNTRY: Canada

15. Terminal Stores (30% stake)

VALUE: ~$270 million

BUYER: Allianz

COUNTRY: Germany

16. 333 West 34th St.

VALUE: $255 million

BUYER: Brookfield AM

COUNTRY: Canada

17. 21 West End Ave. (30% stake)

VALUE: $195 million

BUYER: PGGM (NL)

COUNTRY: Netherlands

18. 400 Madison Ave.

VALUE: $194.5 million

BUYER: Daishin Securities

COUNTRY: South Korea

19. The Helux/The Landon

VALUE: $193 million

BUYER: PGGM (NL), Dermot Company, USAA

COUNTRY: Netherlands

20. West End Collegiate Church Development Site

VALUE: $158 million

BUYER: Daishin Securities, Alchemy Properties

COUNTRY: South Korea