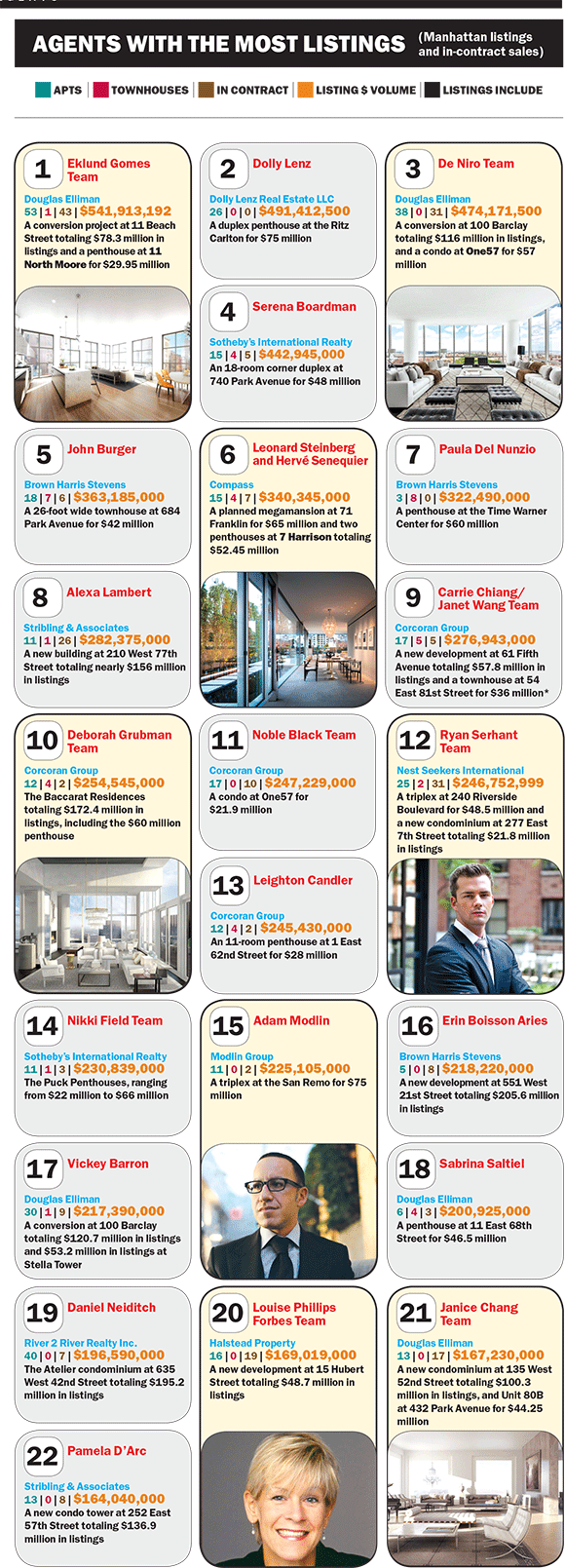

In the high-stakes world of Manhattan real estate, agents tend to fall into two camps — those brokering sales in glitzy new condo buildings and those dealing in resale units, including the trophy pads that trade for top dollar.

As in the past few years, agents who’ve associated themselves with new developments made clear gains on The Real Deal’s annual ranking of Manhattan’s Top 75 residential listing agents. But in the ever-competitive residential market, the upper echelon of the ranking saw a considerable reshuffling.

Of course, the emphasis on new development is not new, nor is it a surprise given the recent condo boom — 2015 has been called the year of the condo, after all. And there is still plenty of money to be made selling new condos for the foreseeable future, with some 6,500 new condos expected to hit the market in Manhattan this year alone, compared with about 2,500 last year.

TRD’s ranking — which is based on listings culled from the listings portal On-Line Residential on May 31 — includes exclusives and properties that went into contract on or after January 1. Needless to say, the ranking is not designed to capture every facet of an agent’s business — closed deals and buy-side transactions, for example, are not part of this tally. Instead it is meant to be an across-the-board snapshot of who is marketing what.

For the second year in a row, Douglas Elliman’s Fredrik Eklund and John Gomes dominated the ranking, buoyed by their new development prowess and Eklund’s star power, courtesy of his role on Bravo’s reality real estate TV show “Million Dollar Listing New York.” Their team, which moved to Elliman from CORE in 2010, racked up an impressive $542 million in listings this year, up from $535.5 million last year and $92 million in 2013. And their dominance illustrates a larger trend.

“Multi-agent teams again dominated the list of the top-producing agents in Manhattan,” said Jonathan Greenspan, president of OLR. “Most of these teams gross the bulk of their income from new developments.”

Not missing a beat

In the No. 2 spot, power broker Dolly Lenz, who left Elliman in 2013 to start her own firm, had more than $491 million in listings, up from last year’s $476 million, according to OLR. She did not respond to a request for comment, but in the past she’s contented that her numbers are low because she does not input data into OLR.

Still, her current listings include the Dome Penthouse at the Ritz-Carlton, asking $75 million, as well as a six-unit new development at 22 Bond Street, where prices range from $9.8 million to $19.9 million.

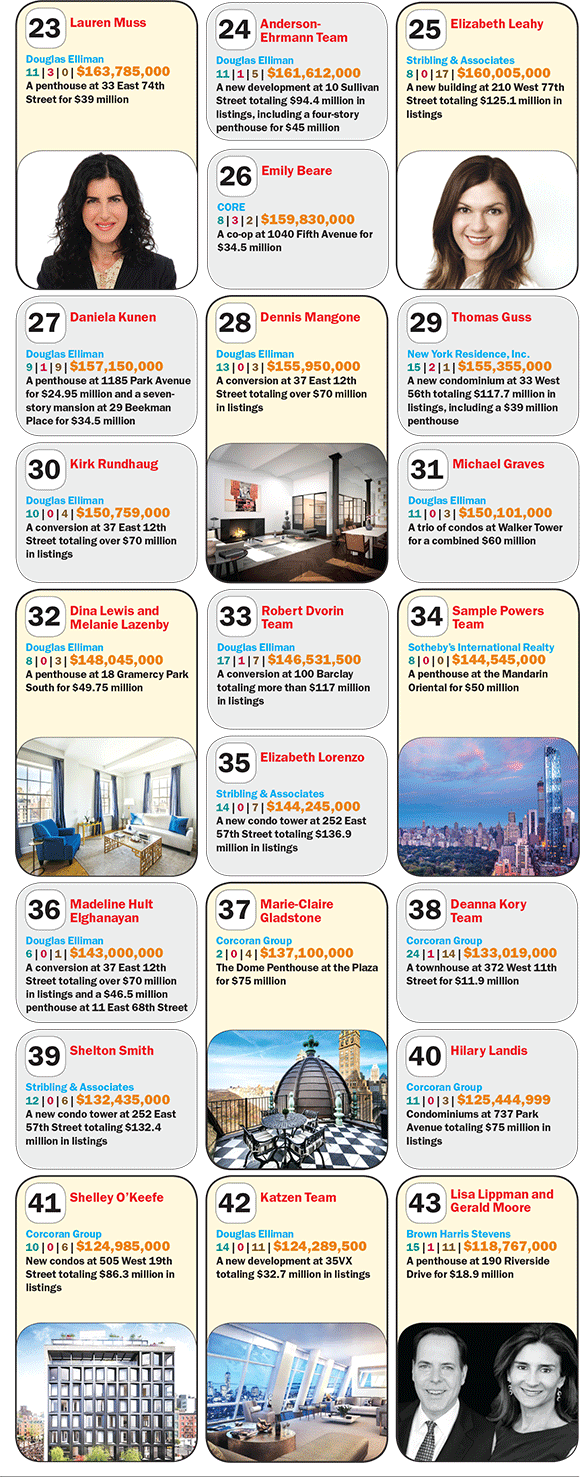

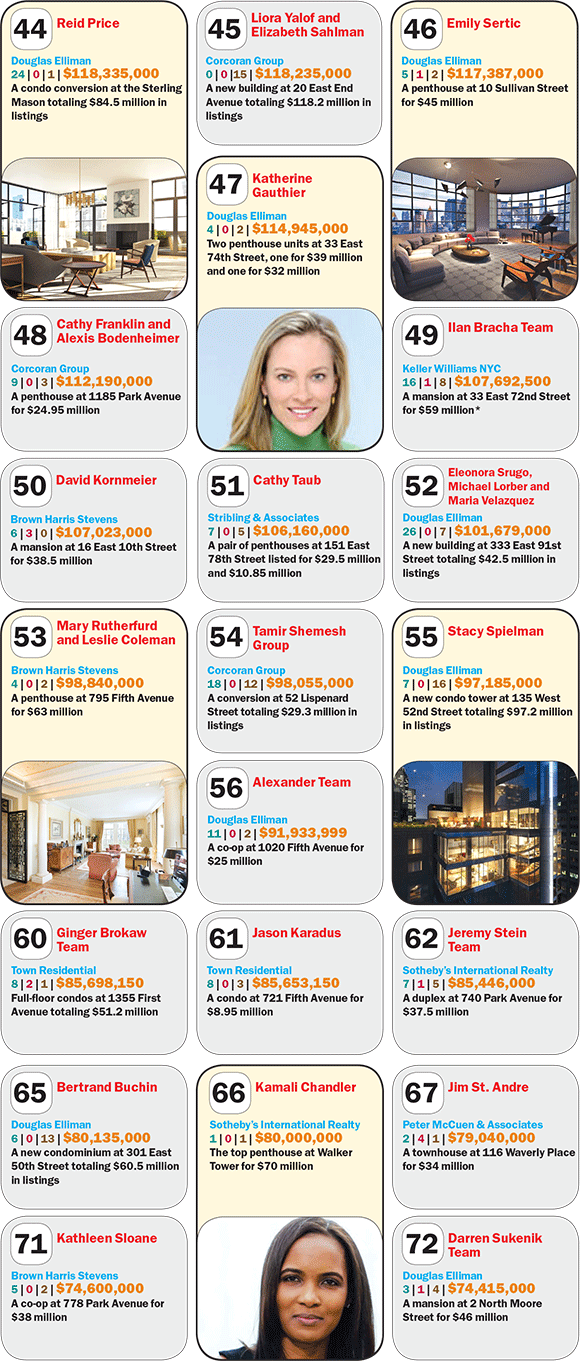

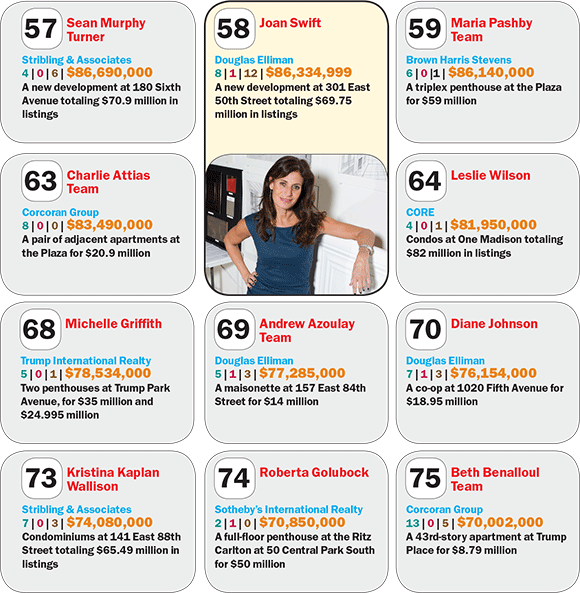

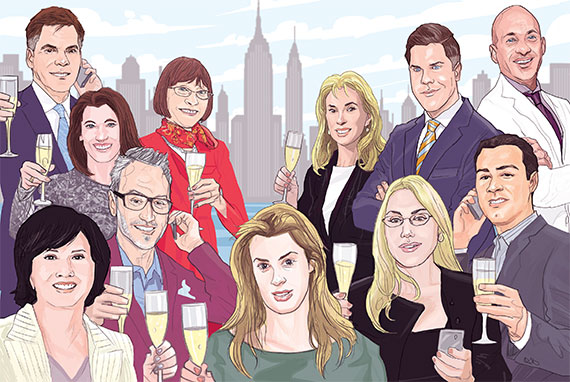

The rest of the top 10 on the ranking are: Elliman’s Raphael De Niro; Sotheby’s International Realty’s Serena Boardman and Brown Harris Stevens’ John Burger. They were followed by Compass President Leonard Steinberg and business partner Hervé Senequier at No. 6; BHS’ Paula Del Nunzio at No. 7; Stribling’s Alexa Lambert at No. 8, and Corcoran Group agents Carrie Chiang and Deborah Grubman at No. 9, and No. 10, respectively.

Overall, the number of listings represented by the Top 75 agents inched up marginally this year, though the dollar value of the listings made bigger gains. Collectively, the top agents had 1,386 listings, up 4.8 percent from 1,322 last year. The value of those listings, however, was $12.26 billion — a 13 percent increase from last year.

In addition, Elliman agents had the biggest presence on the list with 26 brokers making the cut with a combined $4.1 billion in listings. Corcoran had the second highest tally with 13 agents and $2 billion, followed by Stribling with eight agents and $1.2 billion.

Interestingly, despite their June 2014 jump to Compass from Elliman, Steinberg and Senequier did not miss a beat. That move seems to illustrate the importance of an agent’s own brand over that of their firm. At Compass, the pair racked up an impressive $340 million in listings, compared with nearly $332 million last year. Steinberg estimated that he left about $1 billion worth of new development work at Elliman.

“It’s the price you pay when you make a break,” he admitted. But, he said, his business quickly recovered. “Dollar-wise, we’ve recouped that and then some.”

Rising fortunes

For agents landing new development deals, it’s not just the astronomical price tags for new condos that are boosting their fortunes; it’s also their cachet.

Eklund and Gomes apparently have a lot of that cachet.

They are currently marketing HFZ Capital’s 11 Beach Street, a 27-unit building with a sellout total of $228.5 million, and they have more than 1,000 new units in the development pipeline, Eklund said.

Meanwhile, Elliman’s De Niro jumped to No. 3 (from No. 8) with $474.2 million in listings.

He’s currently marketing the Ralph Walker Tribeca, a condo conversion by Magnum Real Estate and CIM Group at 100 Barclay Street, where he has more than $116 million in listings.

“We’re in a new development boom right now. All the top agents are experiencing the same thing,” De Niro said.

Nest Seekers International’s Ryan Serhant, Eklund’s co-star on MDLNY, also shot up on the ranking, catapulting to No. 12 from No. 36 with $246.7 million in listings, including the Justin, a five-unit condo at 225 East 81st Street that has a $22 million sellout.

Serhant’s team is currently working on 20 new development projects, up from just two in 2013, he said. He also noted that his team sold $100 million worth of real estate — including development sites, multi-family buildings and investment properties — to developers and others.

“In this day in age, you have to be a real estate concierge. You can’t just think a developer will call you and sign you onto a project,” he said. “You have to bring the site to the developer, you have to coordinate the financing.”

He added: “It doesn’t matter what firm you’re with. There are too many real estate brokers in the city, it all comes down to your personal brand.”

Steinberg agreed. Agents today, he said, create their own brands and then affiliate with a firm that can provide the resources and tools they need.

With few exceptions, that’s certainly the case among the brokers specializing in new development. And when it comes to those assignments, just one plum job can make a huge difference in a broker’s bottom line.

Sotheby’s Nikki Field, for example, soared to No. 14 (from No. 68) with nearly $231 million in listings, up from $82 million last year. That jump was largely driven by one new development project that she’s marketing: Jared Kushner’s Puck Penthouses, which accounted for $123 million of her listings. The six penthouses atop the famed Soho building incorporate original details like barrel-vaulted ceilings with ultra high-end finishes, and prices range from $22 million to $66 million.

Meanwhile, Elliman’s Michael Graves, who did his first real estate deal in 2010, clocked in at No. 31, up from No. 71 last year. Graves, who worked for his family’s Minnesota-based hospitality business before turning to New York real estate, had more than $150 million in listings, according to OLR.

This spring, Graves listed three units on the 18th and 19th floors of Walker Tower in Chelsea that were together asking $60 million. The units are owned by developers Elliott Joseph and Kevin Maloney of Property Markets Group, who converted the building into condos with Michael Stern’s JDS Development Group. (Graves put one of those units, 18C, which was asking $10.5 million, into contract last month.)

More than half of his listings are new development condos. At Stella Tower, another PMG and JDS condominium at 425 West 50th Street, Graves has six listings worth $31.5 million.

Of course, not every new development condo lists for eight figures.

Eklund and Gomes — who have been working together for eight years and employ two drivers and two assistants for their 10-agent team — consider their bread-and-butter the $2 million to $7 million sector.

“It’s what the buyers want, and there’s a lack of inventory,” Eklund said.

The duo is also growing their resale business. “We’re trying to have a foot in each world. They are connected,” Eklund said.

Gomes added that new development buyers look to sell every few years. “We want to represent them when they sell and then help them buy in another new development,” he said.

Resale redux

Top agents with a long-term view aren’t just focusing on new development, however.

For example, Sotheby’s Boardman — No. 4 on this year’s list with nearly $443 million in properties — is mostly listing trophy resales, including the $80 million Duke Semans Mansion at 1009 Fifth. The seller, Mexican billionaire Carlos Slim, bought the Beaux Arts mansion for $44 million five years ago.

Meanwhile, BHS’ Burger clocked in at No. 5 with $363 million in listings, including a $42 million neo-Federal townhouse at 684 Park that is currently being used by the Queen Sofía Spanish Institute, but is categorized as a single-family home by OLR. He’s also marketing a pair of co-op units at the Beresford, at 211 Central Park West, for a combined $32.5 million.

Late last month Burger placed No. 2 among the top 1,000 agents nationwide on a ranking by research firm REALTrends and the Wall Street Journal with closed deals totaling $638 million in 2014. The ranking is based on surveys with brokers and backed up by data from multiple listing services and other sources.

He and other top resale brokers are clearly doing just fine.

Adam Modlin, president and founder of the Modlin Group, jumped to No. 15 with listings that topped $225 million, including the actress Demi Moore’s $75 million penthouse at the San Remo.

In the highest end of the market, which Modlin described as properties $25 million and up, he said there is little product. However, at the same time, he’s wary that too much is being built along Billionaire’s Row.

“Inevitably, it’s going to be a very competitive space to fight for those customers,” he said.

Shifting places

As in years past, several high-profile agents dropped off the list.

Top agent Kyle Blackmon, who ranked No. 14 last year with $198 million in listings, did not appear on this year’s list, for example.

Blackmon defected to Compass from BHS in late 2014. His drop-off from the ranking runs counter to the success that Steinberg and Senequier had moving between firms.

Blackmon has just three listings, according to OLR, including a five-bedroom co-op at 740 Park asking $27 million, a three-bedroom condo at 151 East 58th Street asking $9.6 million and a two-bedroom co-op at 870 Fifth asking $7.39 million.

Blackmon, through a Compass spokesperson, declined to comment.

Two heavy-hitters at Leslie J. Garfield, the boutique brokerage focusing on the townhouse market, also fell off this year’s list. President Jed Garfield and agent Matthew Pravda ranked No. 27 and No. 23 last year, respectively.

Pravda said he’s had a number of big recent sales, including a $19.3 million double-wide townhouse at 138-40 West 11th Street. “A lot of my inventory I’ve sold,” he said. “In this market, well-priced real estate flies off the shelf, period.”

Meanwhile, Corcoran’s Deborah Kern, No. 17 on last year’s list with $186 million in listings, also fell off the list. She is the senior sales director for Vornado Realty Trust’s 220 Central Park South and has “no personal sales listings at [this] particular moment,” she told TRD.

That move will likely pay off in spades. As of early May, the last time Vornado reported its earnings, it had already sold one-third of the building’s 118 units. In all, 220 CPS has a $2.8 billion sellout, with prices ranging from $12.25 million to $150 million. Already, there’s been a reported sale of two penthouses for a combined — and record-shattering — $250 million.

Keeping it quiet

Whisper listings have always played a big role in the top reaches of Manhattan’s luxury market. But several top agents said they are quietly representing more of these off-market listings as sellers increasingly seek a modicum of privacy.

BHS’ Del Nunzio — who had $322.5 million in listings this year, compared to $503 million last year — has several mega listings in her official tally. They include a $60 million penthouse at the Time Warner Center and the $48 million Charles Ogden mansion at 12 East 79th Street.

But Del Nunzio said she has another $178 million worth of off-market exclusives. “They can be an important part of my business,” she said, noting that in 2014, one of her off-market listings, a brick-and-limestone home at 113-115 East 70th Street, sold for $51 million. The seller was fashion designer Reed Krakoff.

Meanwhile, Modlin is also quietly marketing a townhouse off of Fifth Avenue. He said off-market sellers are typically motivated more by the desire to stay anonymous than by fetching the highest price.

“If you’re doing something quietly, you may not attract the biggest net of buyers, you may not get the highest bidder,” he said. “But you preserve your privacy.”

Foreign connection

While TRD does not tally buy-side deals into its totals for this ranking, they are an increasingly important part of many brokers’ business models. That’s especially true given the force that foreign buyers have become.

Sotheby’s Field, for one, has been riding the wave of Chinese buyers. Field said her business is “consultant-centric,” meaning she is spending time advising clients on their global residential portfolios.

“As more high-net-worth and ultra-high-net-worth individuals continue to diversify their liquid assets, I am advising my clients on focused and targeted worldwide residential purchases,” she said.

Field said teammate Kevin Brown has locked in 13 contracts at the Baccarat and the Four Seasons — all from foreign buyers. “The brand, New York City, is number one on every international buyer’s wish list,” Field said.

Janet Wang, who works with Corcoran’s Carrie Chiang, is also a go-to broker for Chinese buyers. Chiang’s team ranked No. 9 on TRD’s list this year, with nearly $277 million in listings, including a limestone mansion at 54 East 81st Street that hit the market at $36 million, but has since been reduced to $32 million.

Meanwhile, Elliman’s Graves said he’s traveled to Shanghai, Hong Kong, Taiwan, Barcelona and London in the last five months alone. Overall, he closed upwards of $85 million in buy-side business last year, he said.

“It’s very important for someone selling luxury properties to have connections that are international,” he said. He said international buyers see New York as a bargain compared to London and Hong Kong.

Sotheby’s Elizabeth Sample and Brenda Powers, whose team ranked No. 34 with $144.5 million in listings, said they are also continuing to see interest from overseas.

“There is a tremendous amount of wealth in the world that is seeking a solid investment like New York City,” they told TRD in an email.